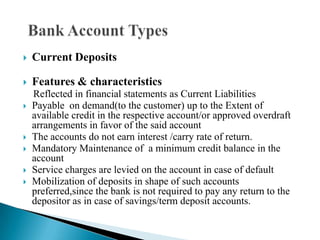

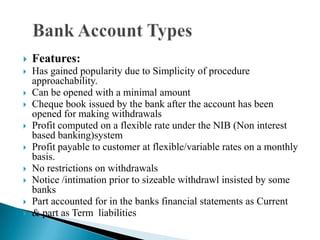

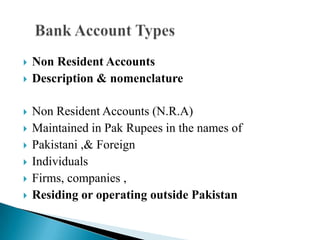

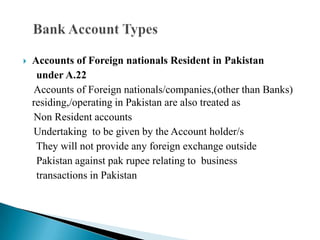

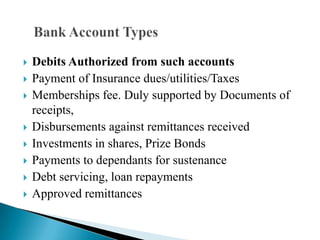

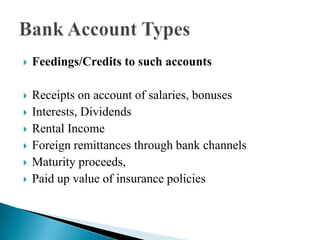

This document discusses various types of bank accounts including current accounts, savings accounts, fixed/term deposit accounts, and special purpose accounts. It provides details on the key features and characteristics of each type of account, how they are treated in financial statements, eligibility requirements, and debit and credit rules. Special purpose accounts are established to pool funds for specific public welfare projects and are exempt from certain taxes.