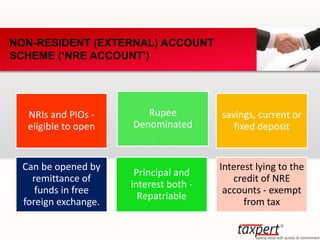

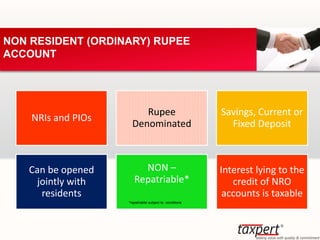

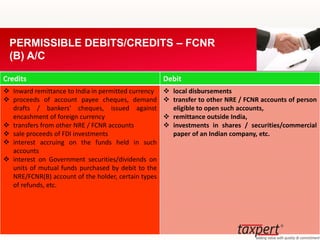

This document discusses various types of bank accounts that can be opened by resident individuals, non-resident Indians (NRIs), and other entities under India's foreign exchange regulations. It provides details on Non-Resident External (NRE) accounts, Foreign Currency Non-Resident (Bank) (FCNR-B) accounts, and Non-Resident Ordinary (NRO) accounts including eligibility, permitted credits and debits, interest rates, and loans against deposits in these accounts. The document also compares key features of NRE, FCNR-B and NRO accounts and specifies permitted purposes for loans from these accounts.

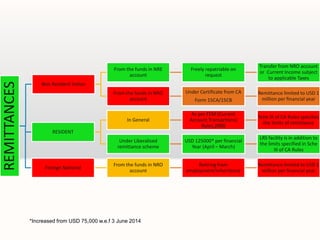

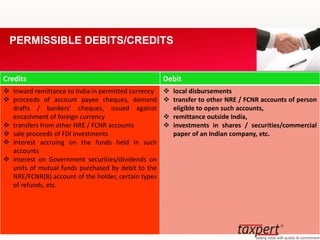

![Credits Debit

Proceeds of remittances from outside India through

normal banking channels received in any permitted

currency.

Any foreign currency, which is freely convertible,

tendered by the account holder during his temporary

visit to India.

Transfers from rupee accounts of non-resident banks.

Legitimate dues in India of the account holder. This

includes current income like rent, dividend, pension,

interest, etc.

Sale proceeds of assets including immovable property

acquired out of rupee / foreign currency funds or by way

of legacy /inheritance.

Resident individual may make a rupee gift to a NRI/PIO

who is a close relative of the resident individual [close

relative as defined in Section 6 of the Companies Act,

1956] by way of crossed cheque /electronic transfer. The

amount shall be credited to the Non-Resident (Ordinary)

Rupee Account (NRO) a/c of the NRI / PIO and credit of

such gift amount may be treated as an eligible credit to

All local payments in rupees including payments for

investments in India subject to compliance with the

relevant regulations made by the Reserve Bank.

Remittance outside India of current income like rent,

dividend, pension, interest, etc. in India of the account

holder.

Remittance up to USD one million, per financial year

(April- March), for all bona fide purposes, to the

satisfaction of the Authorised Dealer bank.

Transfer to NRE account of NRI within the overall

ceiling of USD one million per financial year subject to

payment of tax, as applicable

PERMISSIBLE DEBITS/CREDITS](https://image.slidesharecdn.com/presentationondepositsregulationsunderfema-141221223710-conversion-gate02/85/Presentation-on-Deposits-Regulations-under-FEMA-9-320.jpg)

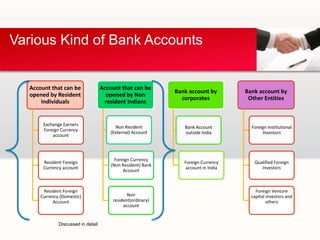

![Particulars Foreign Currency (Non-

Resident) Account (Banks)

Scheme [FCNR (B) Account]

Non-Resident (External)

Rupee Account Scheme

[NRE Account]

Non-Resident Ordinary

Rupee Account Scheme

[NRO Account]

Who can open an account NRIs (individuals/ entities of

Bangladesh/ Pakistan

nationality / ownership

require prior approval of RBI)

NRIs (individuals/ entities of

Bangladesh/Pakistan

nationality / ownership

require prior approval of RBI)

Any person resident outside

India (other than a person

resident in Nepal and

Bhutan). Individuals / entities

of Pakistan nationality /

ownership, entities of

Bangladesh2ownership

require prior approval of the

Reserve Bank.

Operations by Power of

Attorney in favour of a

resident by the non-resident

account holder

Restricted to withdrawals for

permissible local payments

or remittance to the account

holder himself through

normal banking channels.

Restricted to withdrawals for

permissible local payments

or remittance to the account

holder himself through

normal banking channels.

Operations in the account in

terms of Power of Attorney is

restricted to withdrawals for

permissible local payments in

rupees, remittance of current

income to the account holder

outside India or remittance

COMPARISON](https://image.slidesharecdn.com/presentationondepositsregulationsunderfema-141221223710-conversion-gate02/85/Presentation-on-Deposits-Regulations-under-FEMA-12-320.jpg)

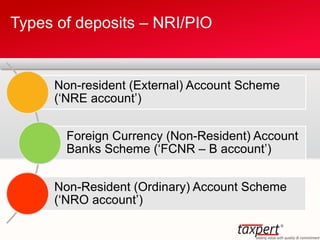

![Particulars Foreign Currency (Non-

Resident) Account (Banks)

Scheme [FCNR (B) Account]

Non-Resident (External)

Rupee Account Scheme

[NRE Account]

Non-Resident Ordinary

Rupee Account Scheme

[NRO Account]

Joint account In the names of two or more

non-resident individuals

provided all the account

holders are persons of Indian

nationality or origin;

Resident close relative

(relative as defined in Section

6 of the Companies Act,

1956) on ‘former or survivor’

basis.

In the names of two or more

non-resident individuals

provided all the account

holders are persons of Indian

nationality or origin;

Resident close relative

(relative as defined in Section

6 of the Companies Act,

1956) on ‘former or survivor’

basis.

Joint account

Nomination Permitted Permitted Permitted

COMPARISON](https://image.slidesharecdn.com/presentationondepositsregulationsunderfema-141221223710-conversion-gate02/85/Presentation-on-Deposits-Regulations-under-FEMA-13-320.jpg)

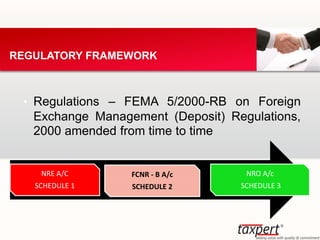

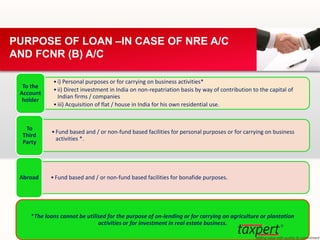

![• Personal requirement and / or

business purpose.*

To the account

holder

• Personal requirement and / or

business purpose *

To third party

Resident individual to lend to a Non-resident Indian (NRI)/ Person of Indian Origin (PIO) close relative [means

relative as defined in Section 6 of the Companies Act, 1956] by way of crossed cheque /electronic transfer.

The loan amount should be credited to the NRO a/c of the NRI /PIO. Credit of such loan amount may be

treated as an eligible credit to NRO a/c;

PURPOSE OF LOAN – NRO ACCOUNT

* The loans

cannot be

utilised for the

purpose of on-

lending or for

carrying on

agriculture or

plantation

activities or for

investment in

real estate

business.](https://image.slidesharecdn.com/presentationondepositsregulationsunderfema-141221223710-conversion-gate02/85/Presentation-on-Deposits-Regulations-under-FEMA-20-320.jpg)

![ Save as otherwise provided in the Act or rules or regulations made

thereunder, no person resident in India shall open or hold or maintain a

Foreign Currency Account:

Provided that a Foreign Currency Account held or maintained before the

commencement of these Regulations by a person resident in India with

special or general permission of the Reserve Bank, shall be deemed to be

held or maintained under these Regulations

Provided further that the Reserve Bank, may on an application made to it,

permit a person resident in India to open or hold or maintain a Foreign

Currency Account, subject to such terms and conditions as may be

considered necessary. [RBI Notification No.FEMA 10 /2000-RB dated

3rd May 2000]

REGULATION](https://image.slidesharecdn.com/presentationondepositsregulationsunderfema-141221223710-conversion-gate02/85/Presentation-on-Deposits-Regulations-under-FEMA-23-320.jpg)

![ Payment outside India towards a permissible current account transaction [in

accordance to the provisions of the Foreign Exchange Management (Current Account

Transactions) Rules, 2000]

Permissible capital account transaction [in accordance to the Foreign Exchange

Management (Permissible Capital Account Transactions) Regulations, 2000].

Payment in foreign exchange towards cost of goods purchased from a 100 percent

Export Oriented Unit or a Unit in

(a) Export Processing Zone or

(b) Software Technology Park or

(c) Electronic Hardware Technology Park

Payment of customs duty in accordance with the provisions of the Foreign Trade Policy

of the Central Government for the time being in force.

Trade related loans/advances, extended by an exporter holding such account to his

importer customer outside India, subject to compliance with the Foreign Exchange

Management (Borrowing and Lending in Foreign Exchange) Regulations, 2000.

Permissible debits](https://image.slidesharecdn.com/presentationondepositsregulationsunderfema-141221223710-conversion-gate02/85/Presentation-on-Deposits-Regulations-under-FEMA-27-320.jpg)