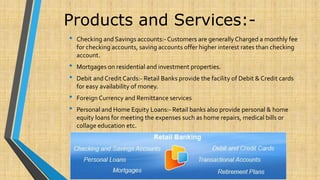

The document outlines the four main types of banking: retail, wholesale, universal, and rural banking. Retail banking focuses on direct transactions with individual consumers, offering services like credit and debit cards, loans, and accounts. Wholesale banking serves larger institutions, while universal banking combines commercial and investment services, and rural banking specifically caters to the financial needs of rural areas in India.