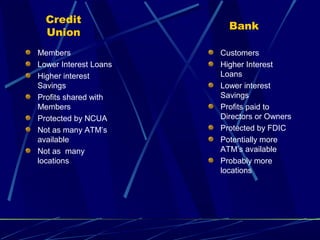

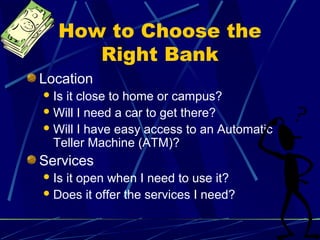

This document provides information about choosing and using bank accounts. It discusses the differences between banks and credit unions, and factors to consider when choosing a bank like location, services, and costs. It defines common banking terminology like deposits, withdrawals, interest, and fees. It describes types of accounts like checking and savings and features of checking accounts. It also outlines what is needed to open an account and important tips for using ATM/debit cards.