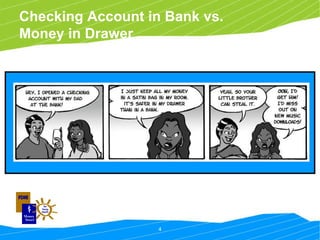

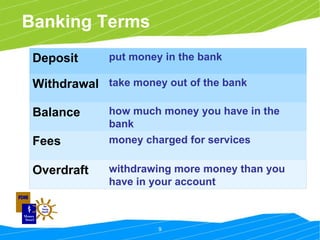

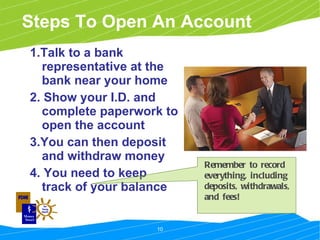

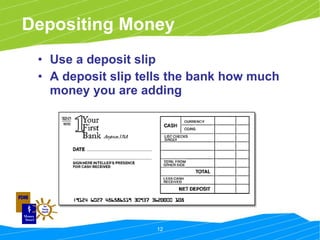

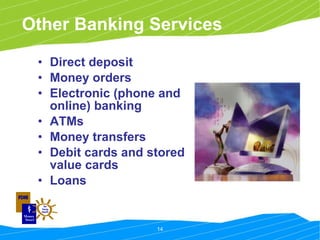

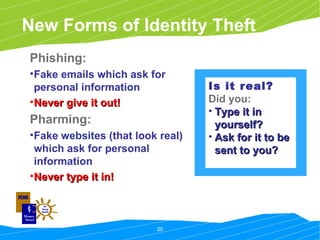

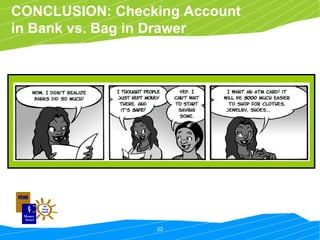

Banks offer services like deposit and loan accounts to safely store money. Some key reasons to use a bank include safety, convenience, lower costs, and building your financial future. To open an account, you will need to visit a bank, show ID, fill out paperwork, and make an initial deposit. Different bank employees, like tellers and loan officers, provide various services. It's important to protect your personal information from identity theft.