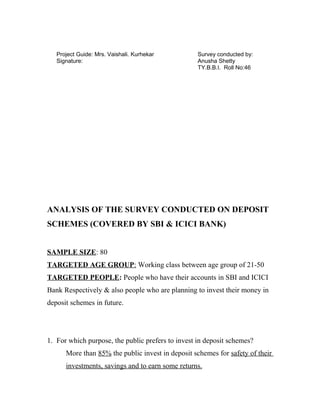

This document contains guidelines from the Reserve Bank of India (RBI) regarding know-your-customer (KYC) procedures and monitoring of cash transactions for banks in India. It outlines requirements for banks to establish customer identity and monitor suspicious transactions. Key points include obtaining proper identification for new accounts, completing KYC procedures for existing accounts, issuing demand drafts and money transfers over Rs. 50,000 only by debit to accounts, monitoring cash withdrawals and deposits over Rs. 10 lakhs, and reporting such cash transactions and suspicious activity to controlling offices. The guidelines aim to prevent money laundering and terrorist financing through strict KYC norms and monitoring of large cash transactions.