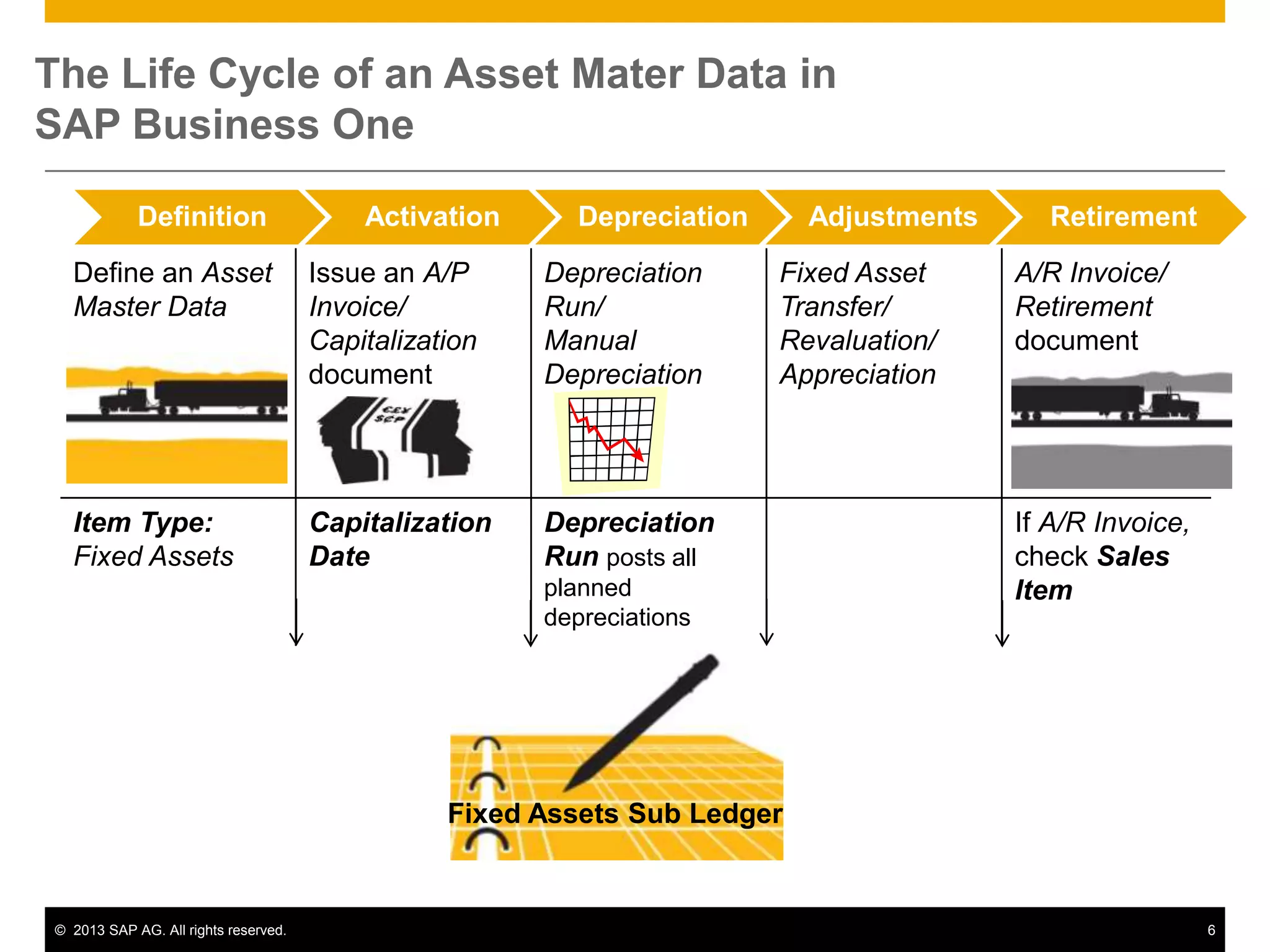

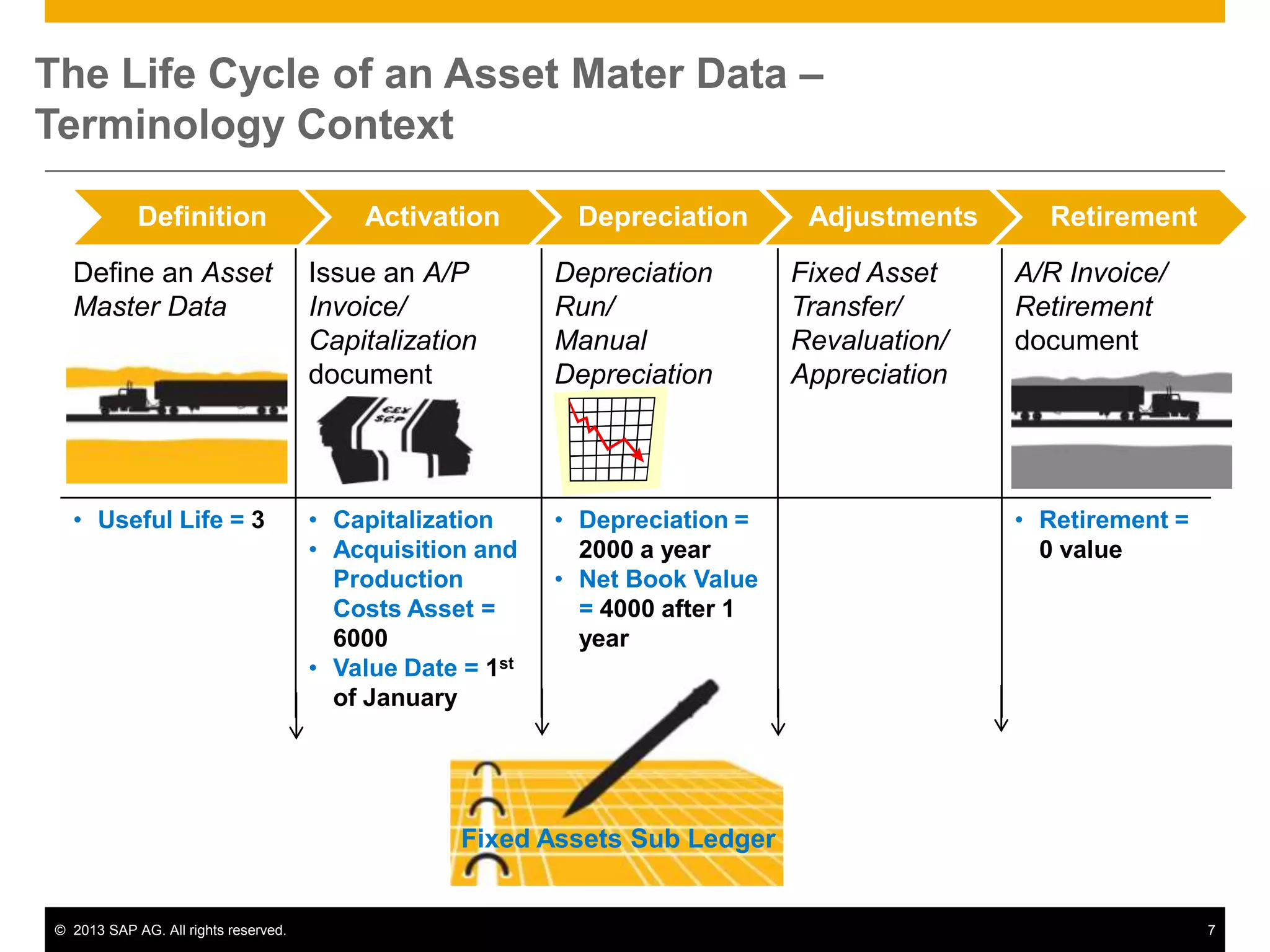

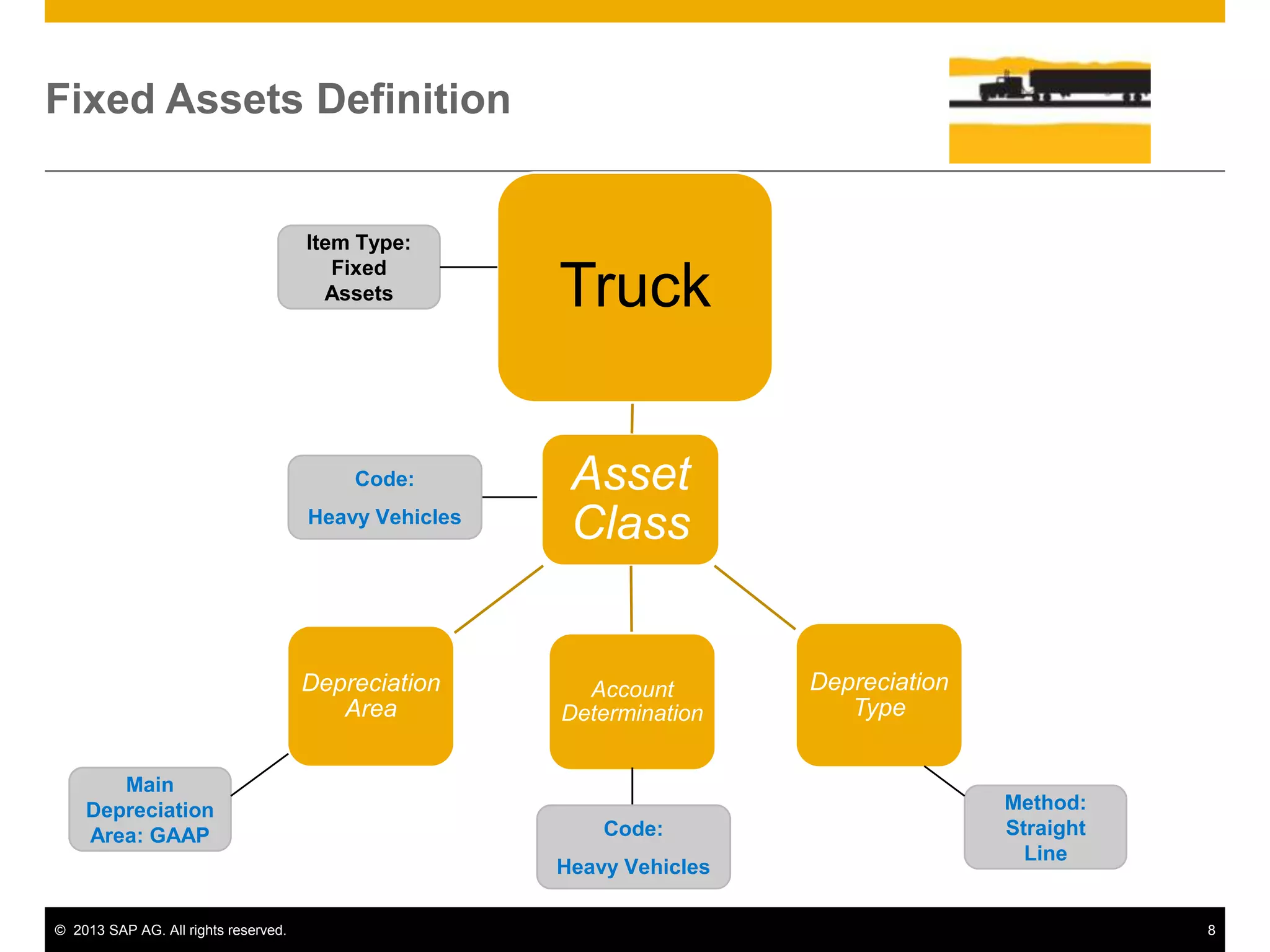

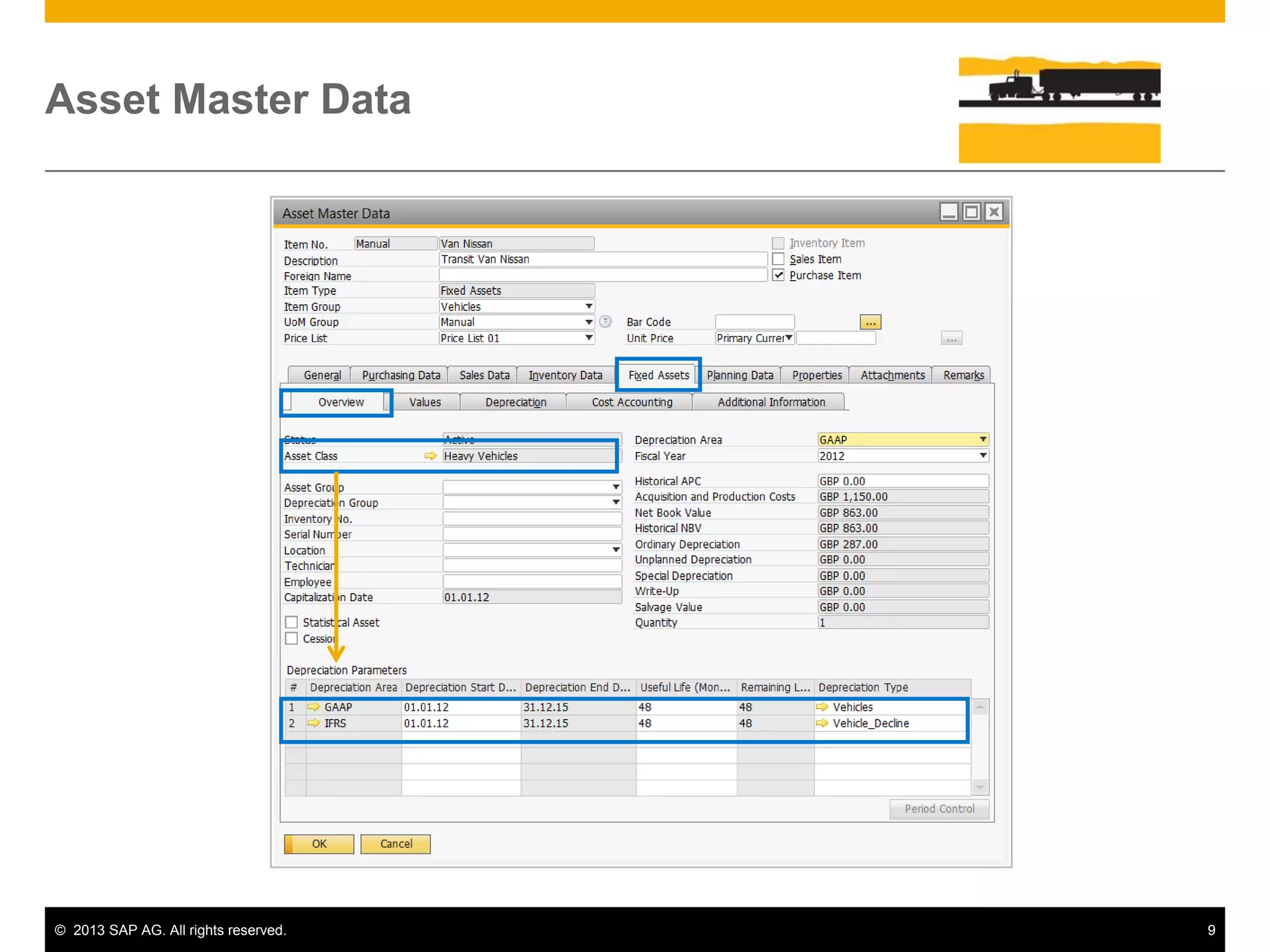

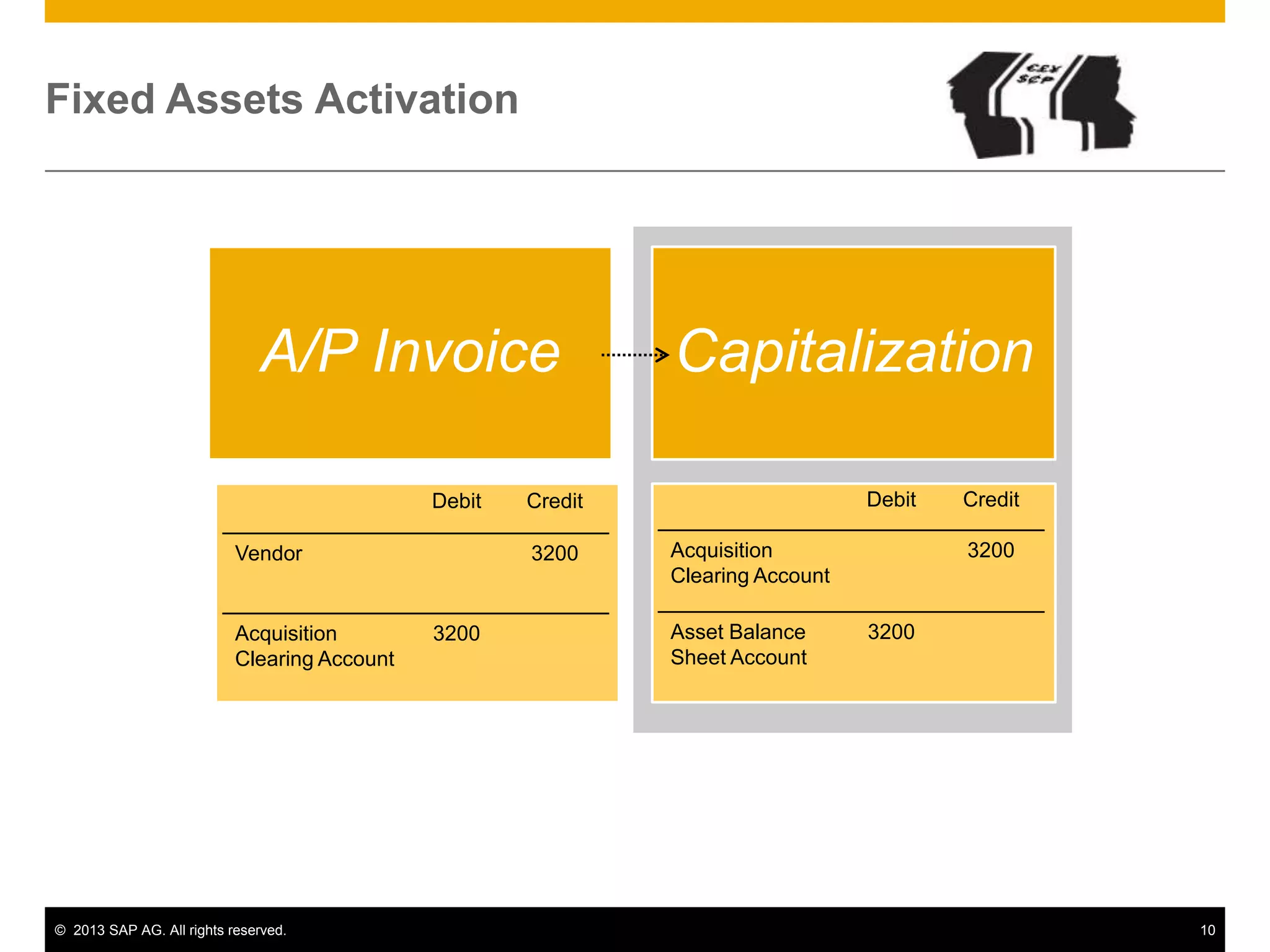

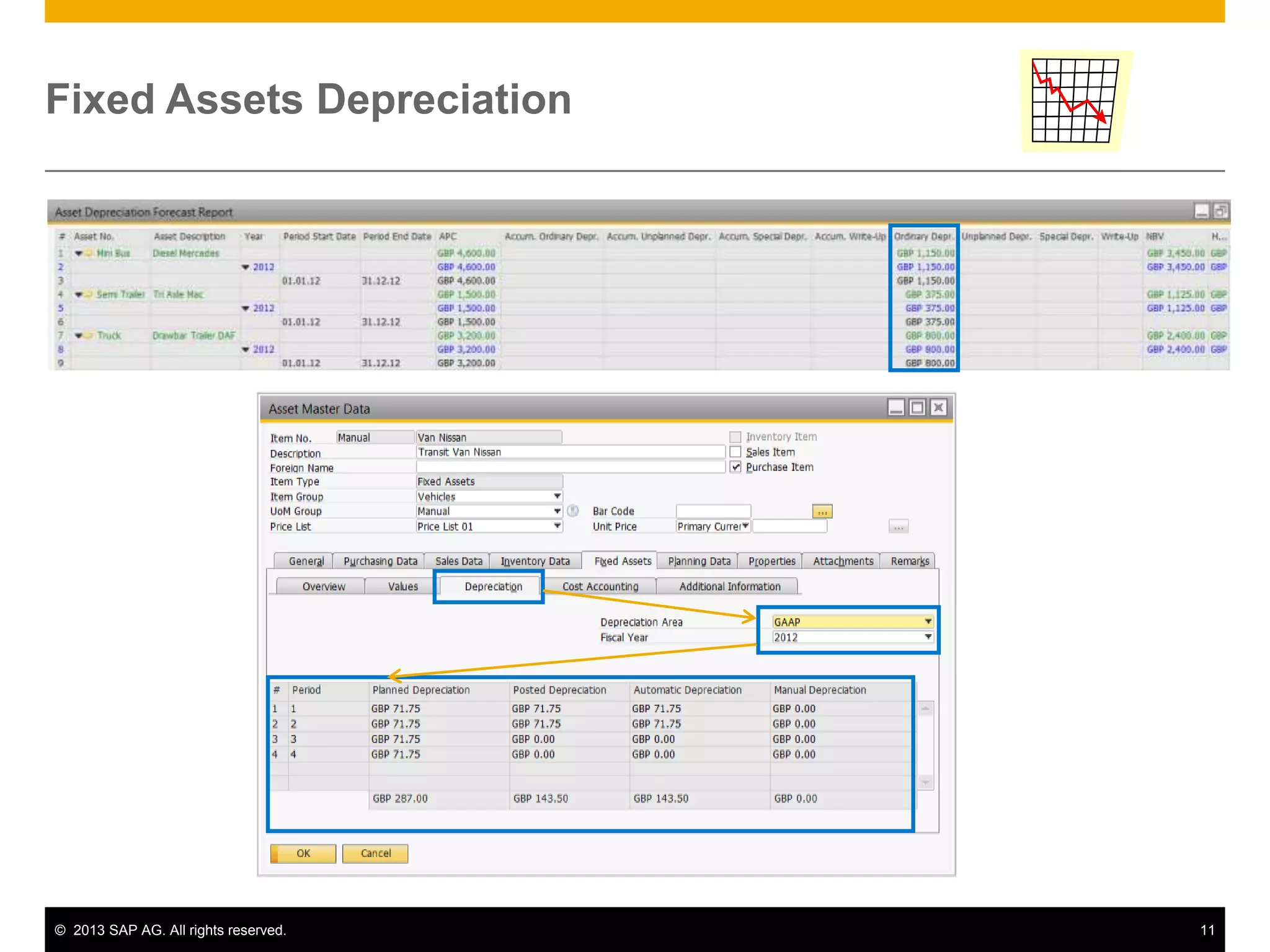

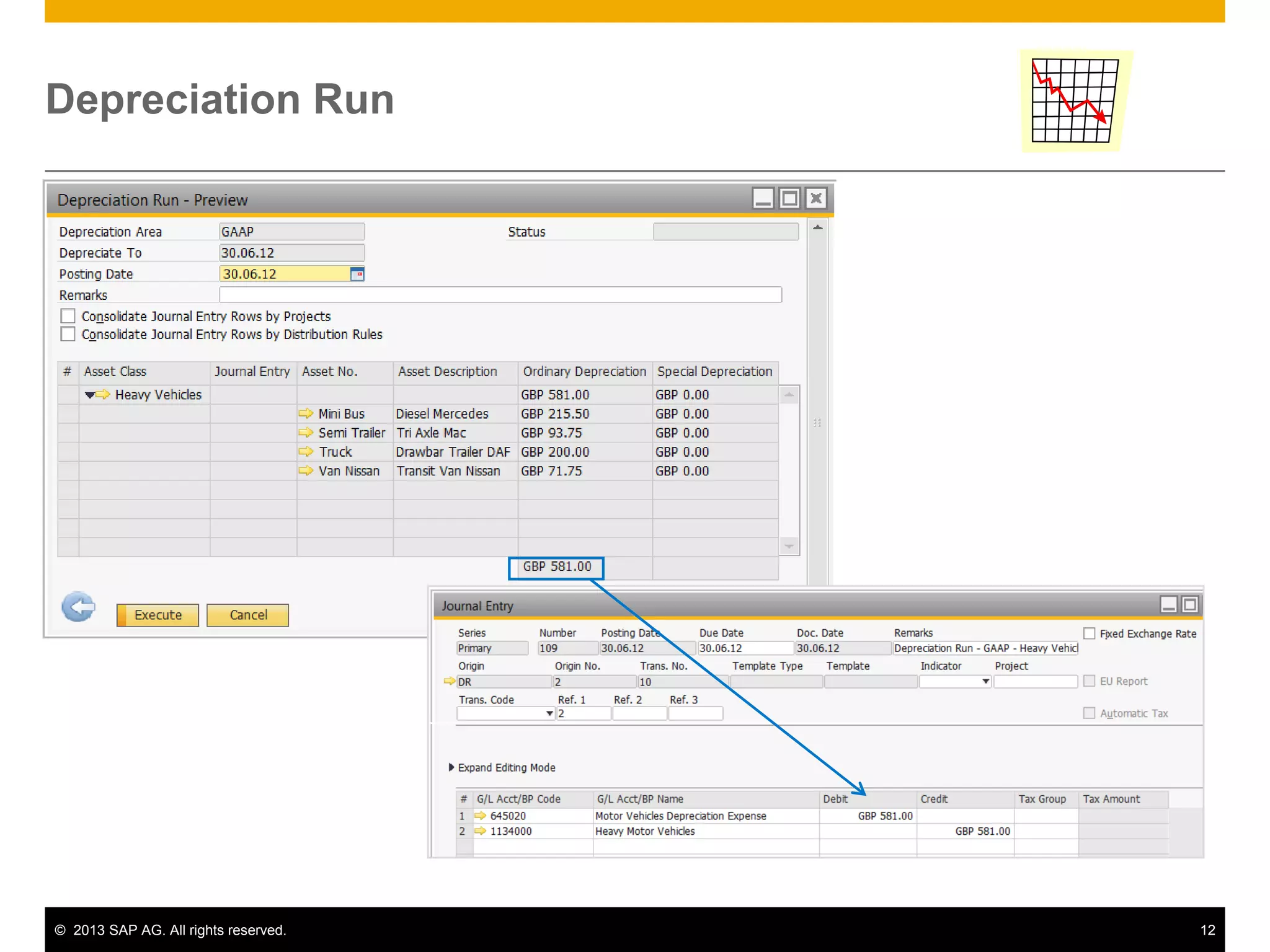

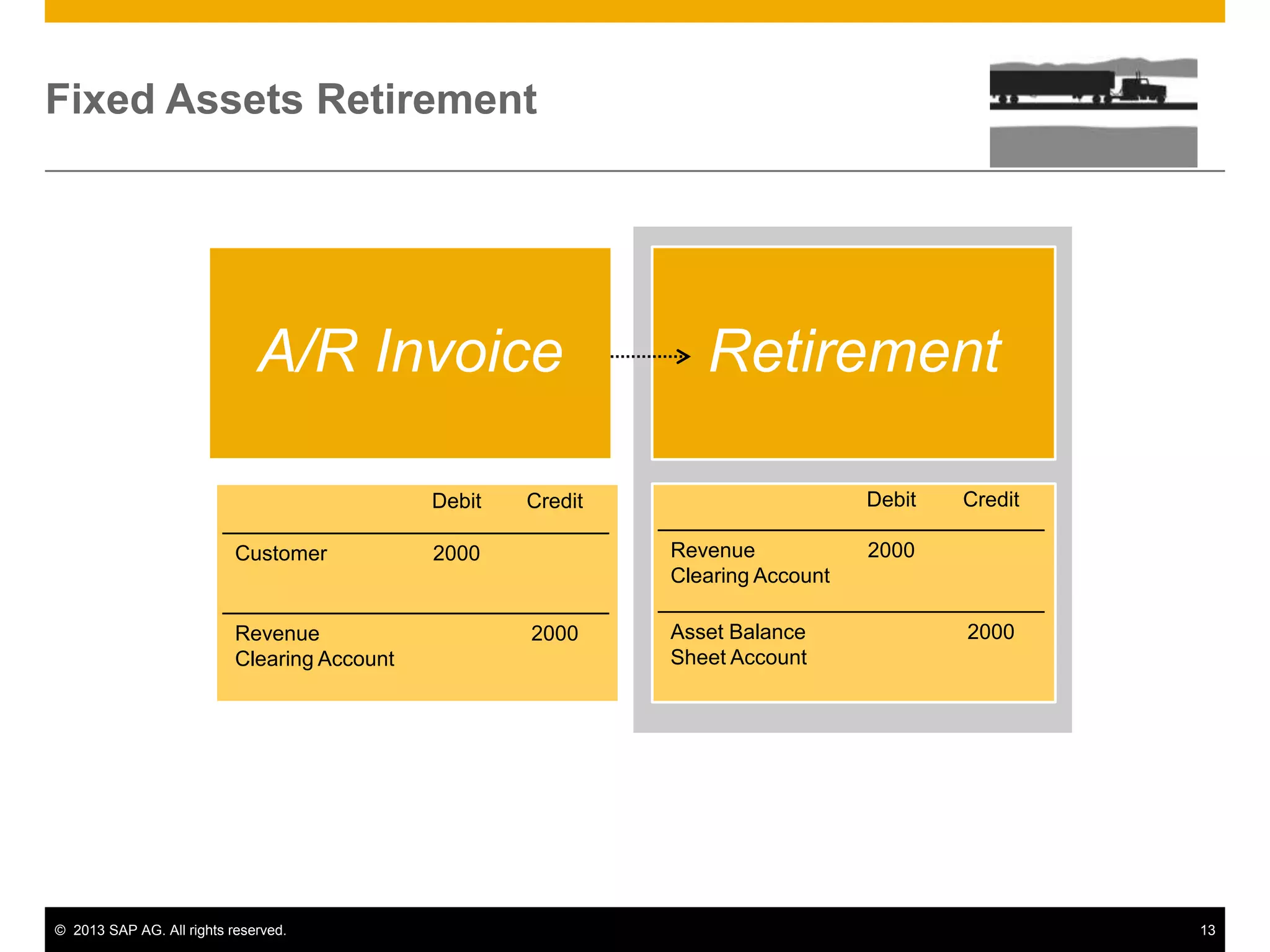

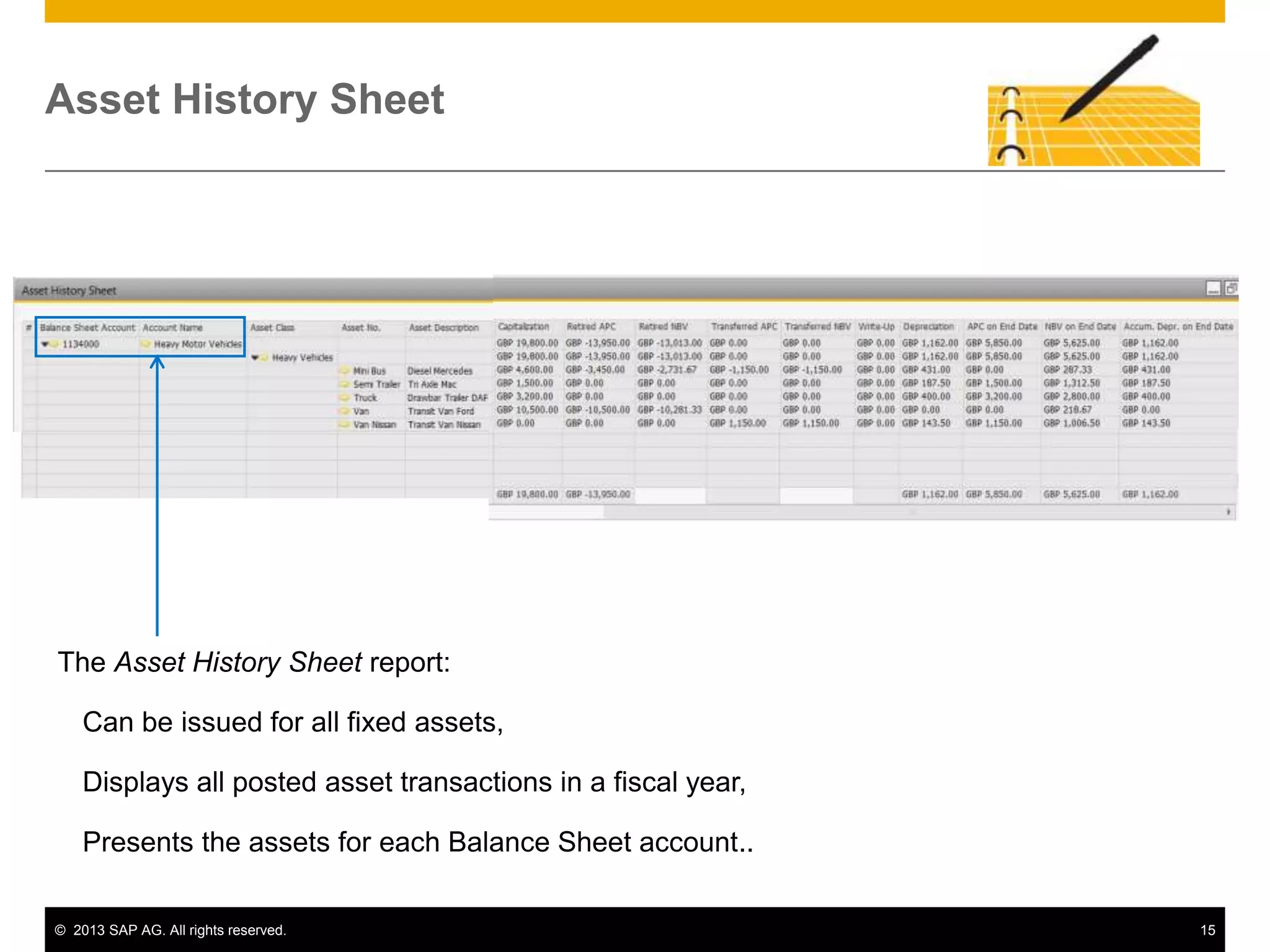

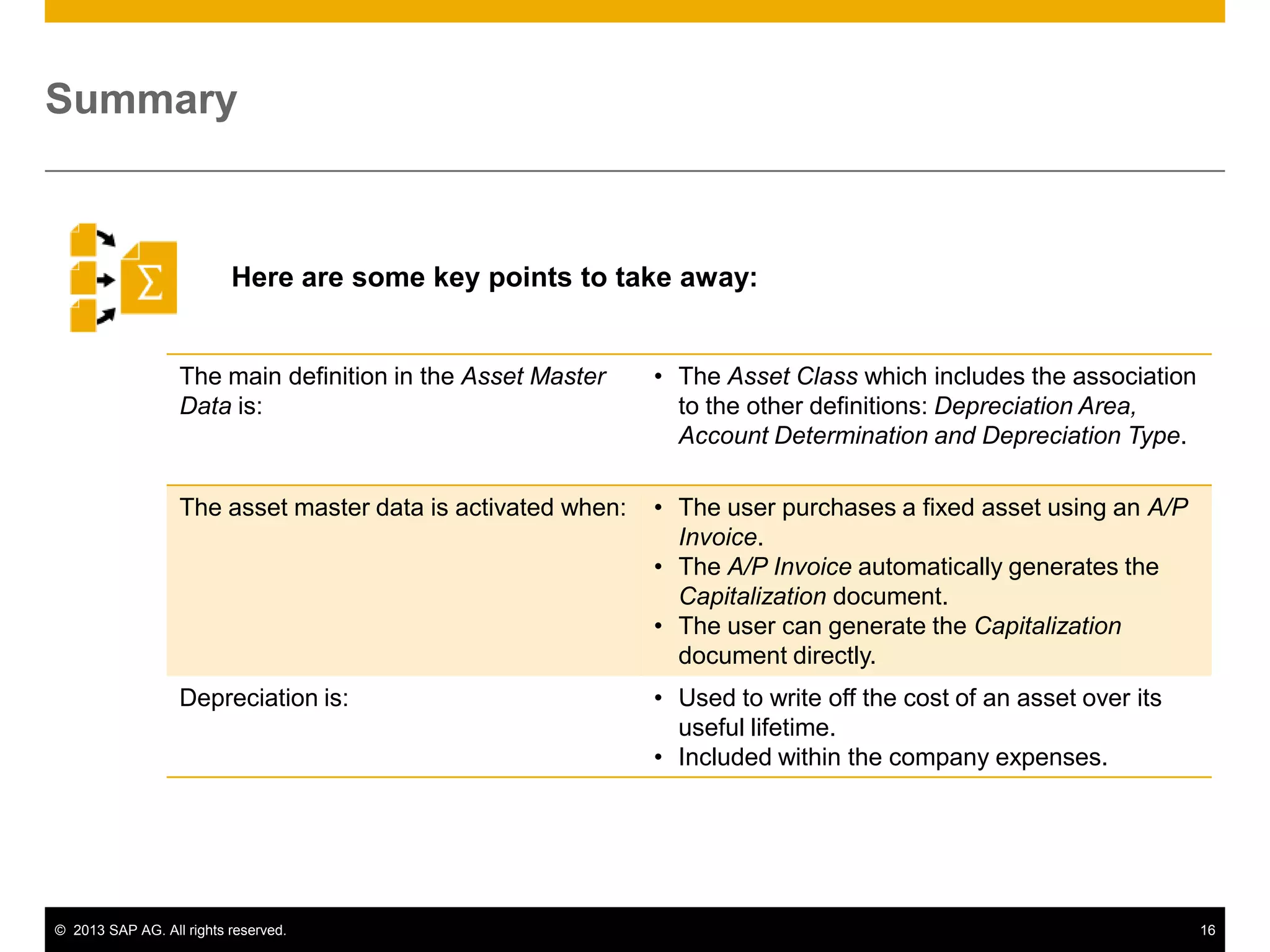

The document discusses managing fixed assets in SAP Business One. It explains the process of defining asset master data by setting properties like asset class, depreciation area, and method. Assets are activated by issuing an accounts payable invoice to capitalize the cost. Depreciation is then calculated automatically or manually over the asset's useful life. When retired, an accounts receivable invoice or retirement document is made to remove the asset from the books at net book value of zero. The asset history sheet report displays all transactions for an asset in a fiscal year.