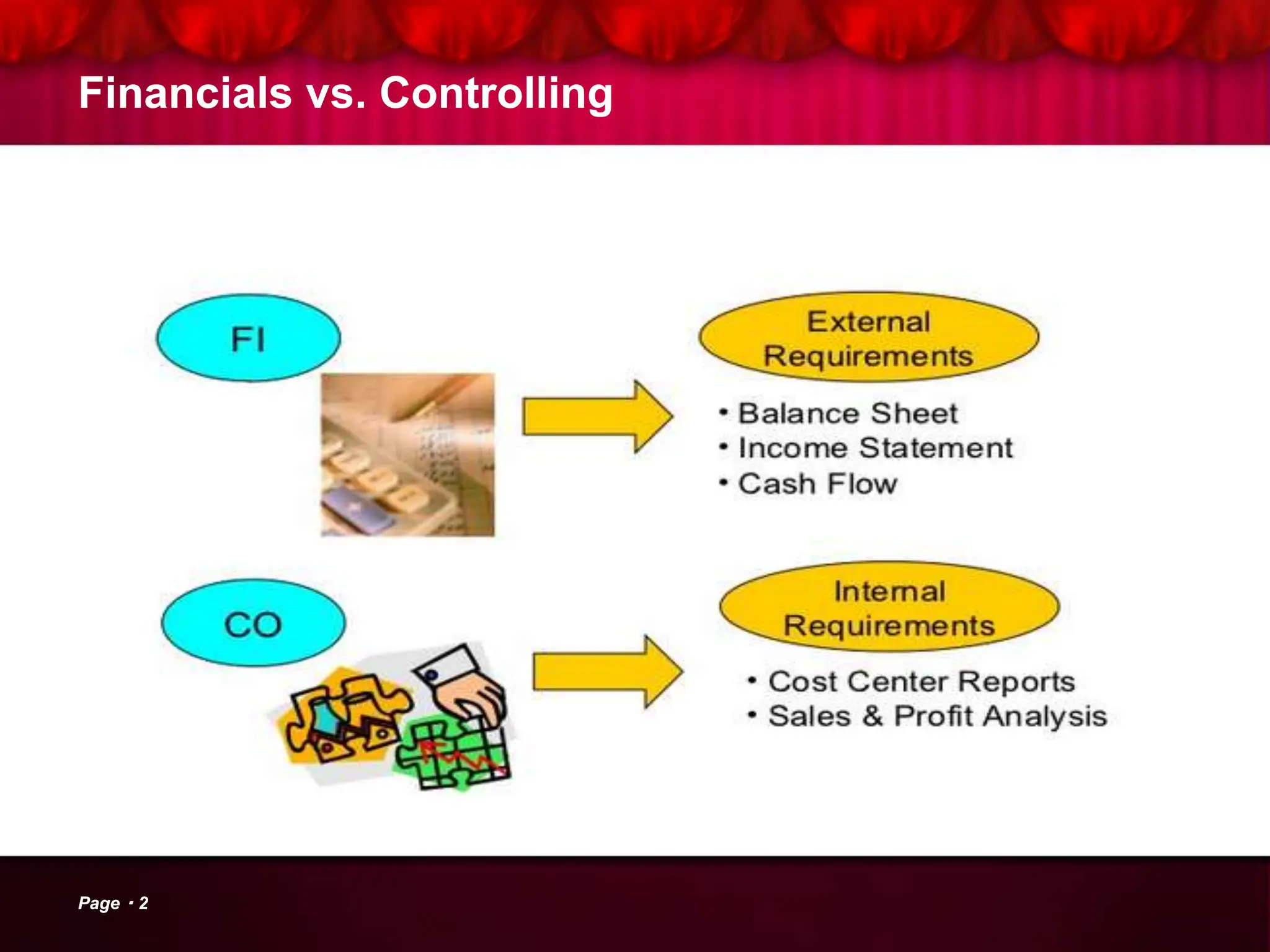

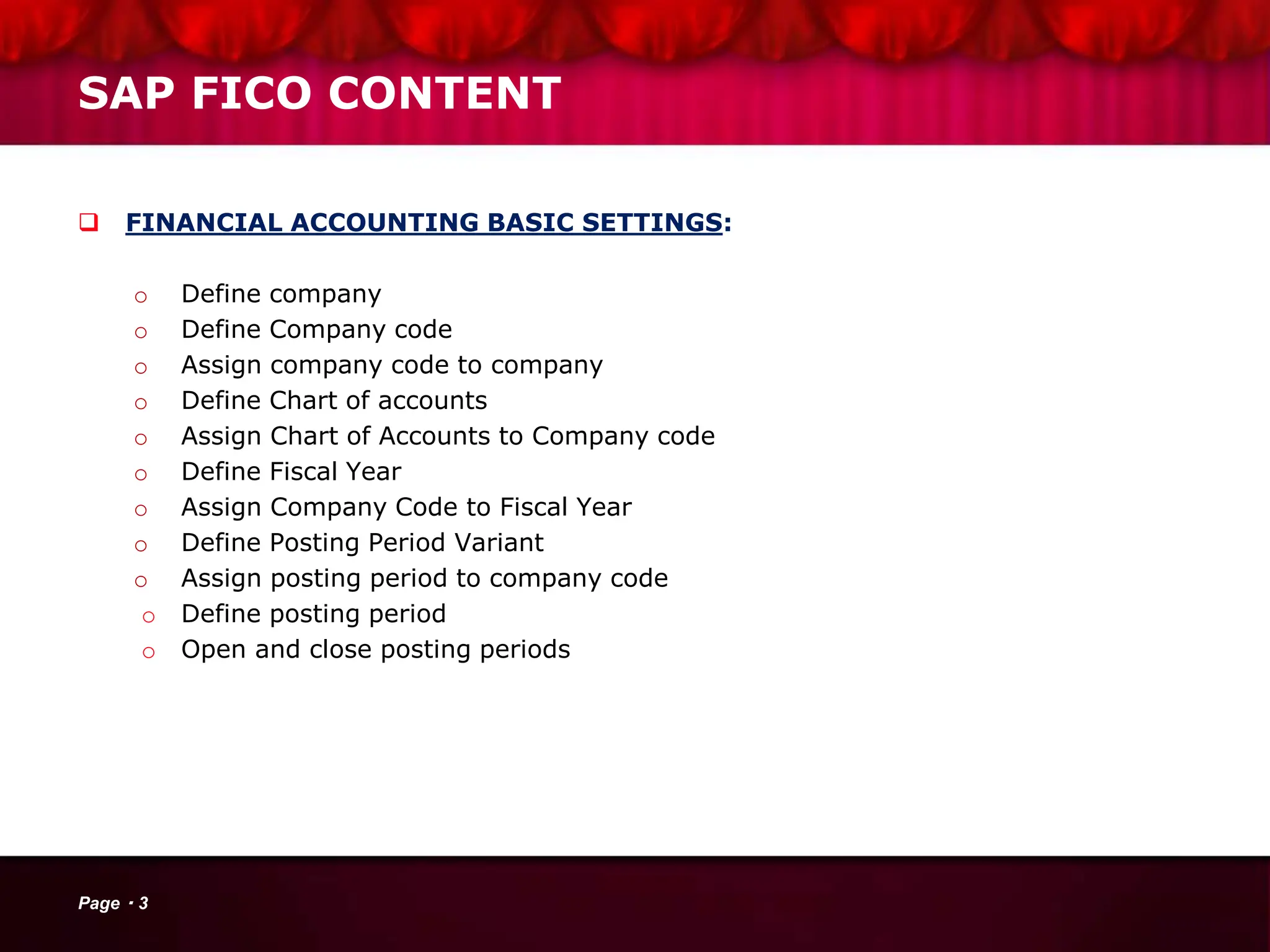

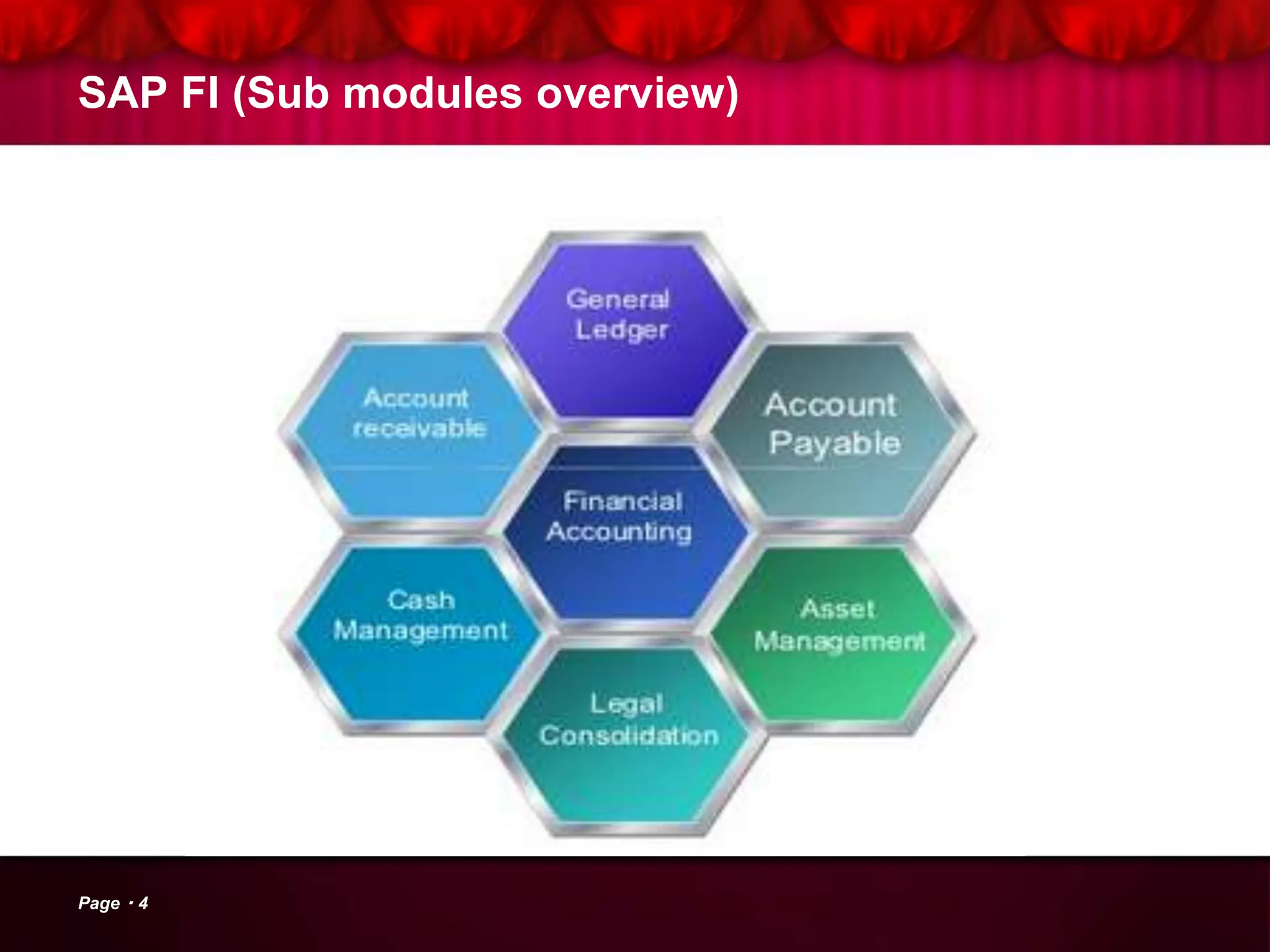

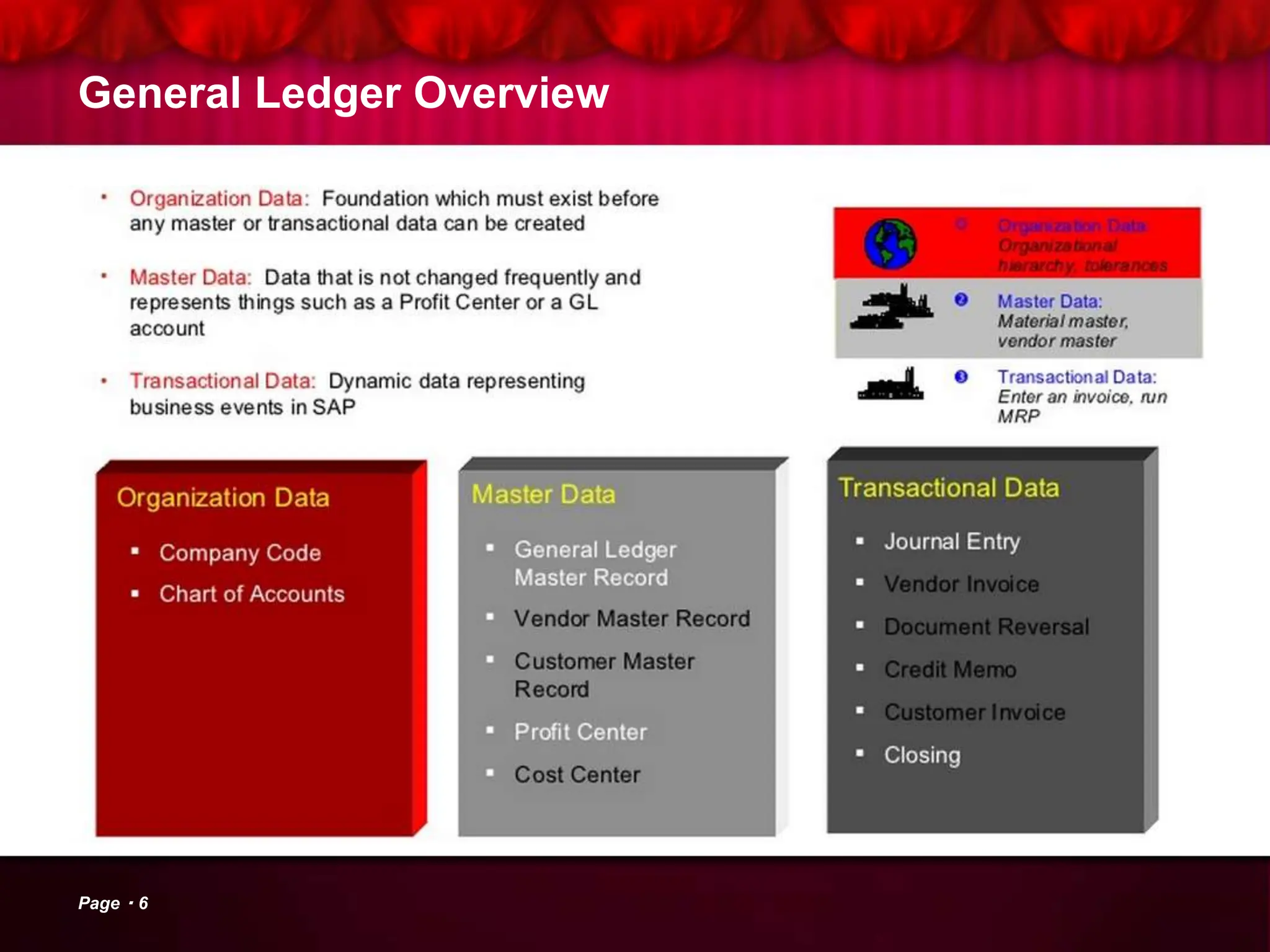

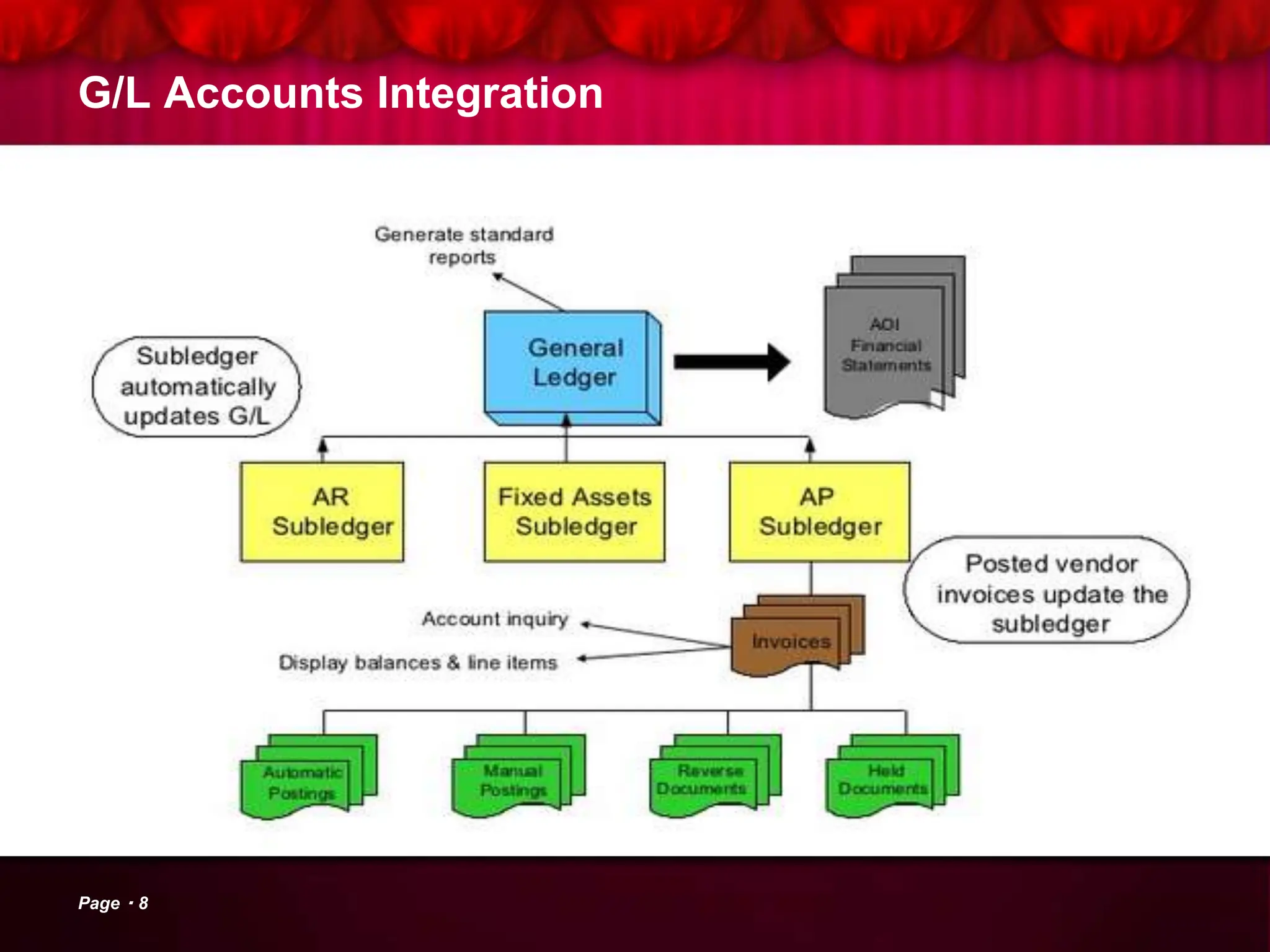

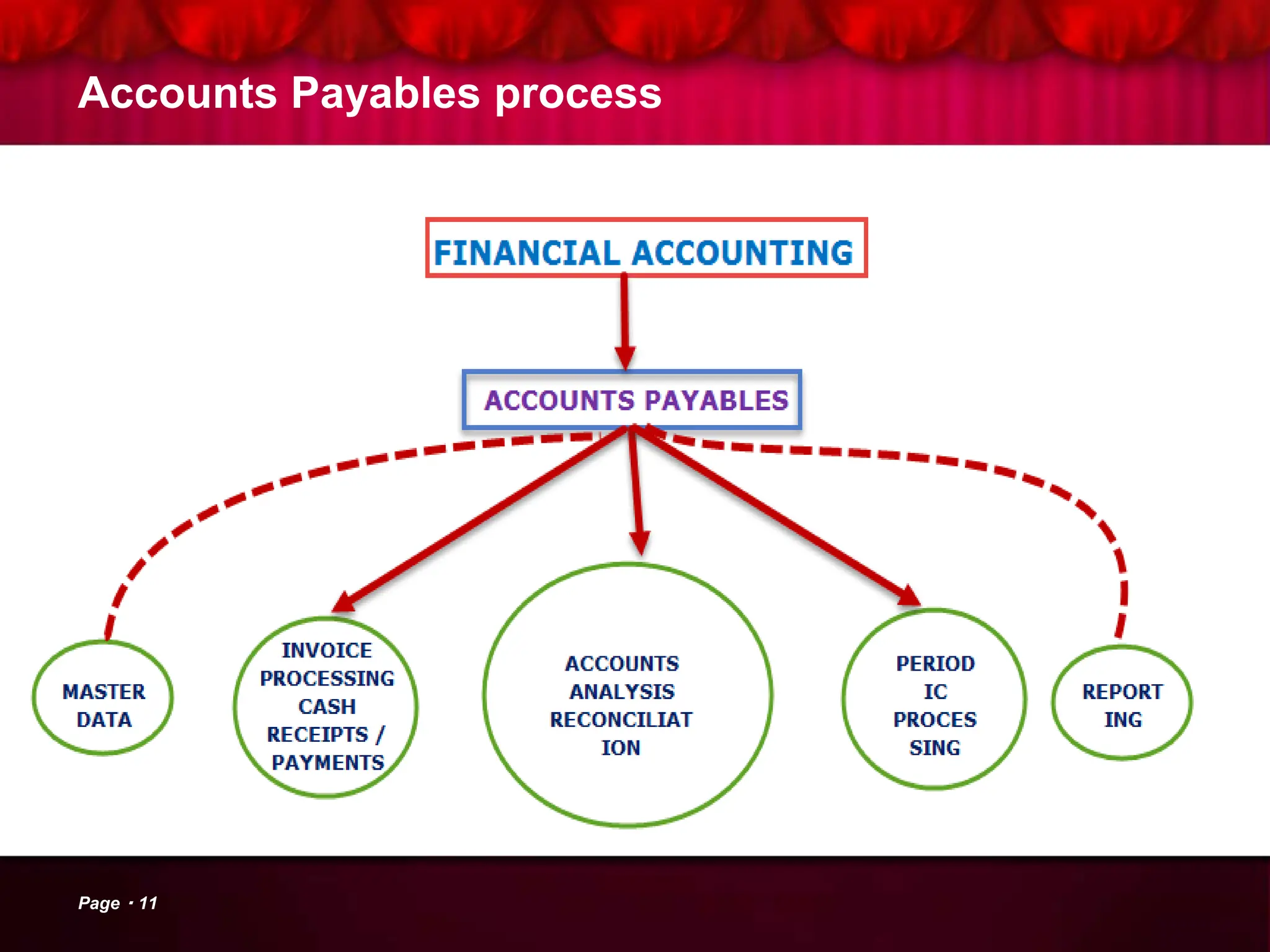

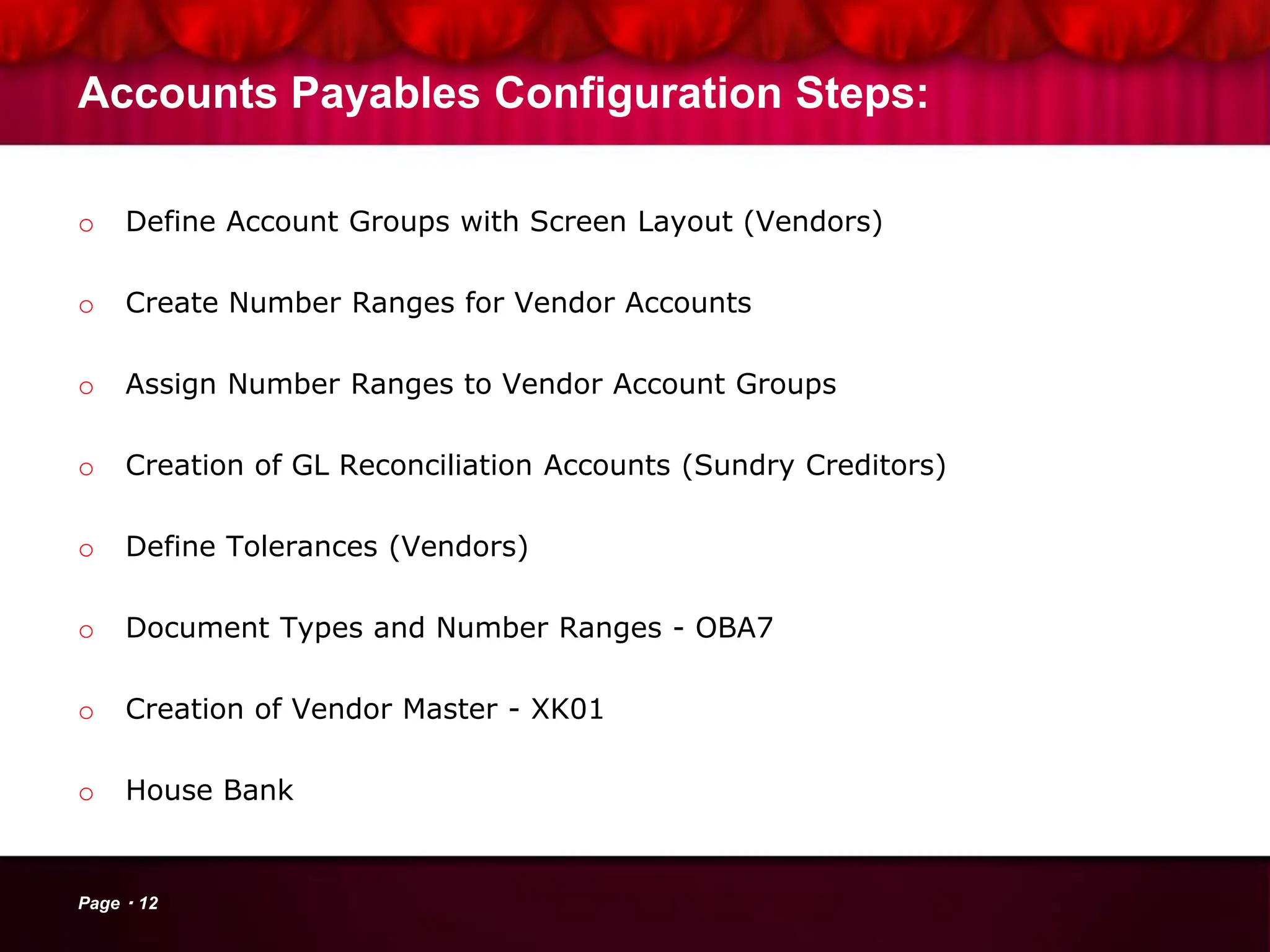

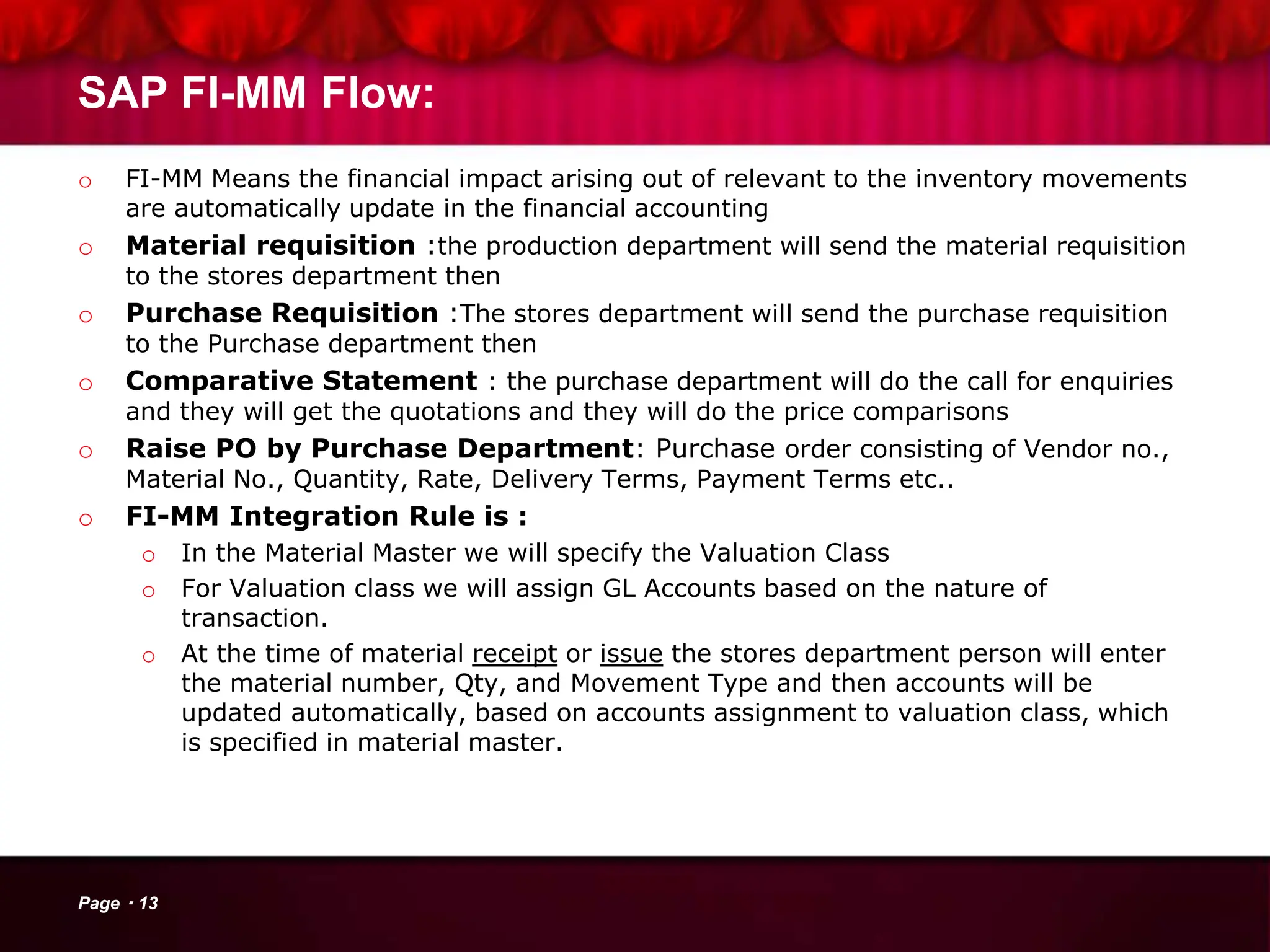

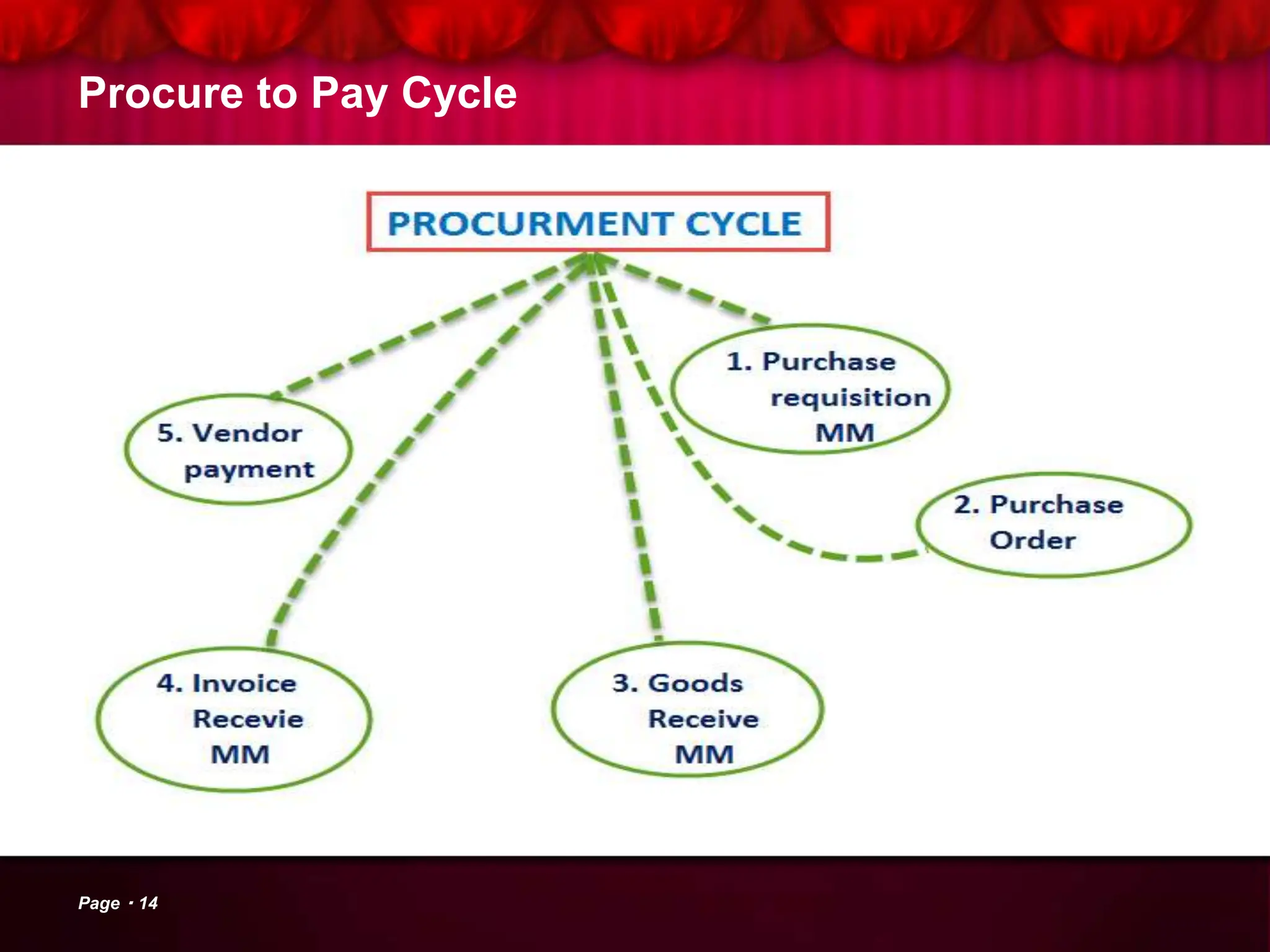

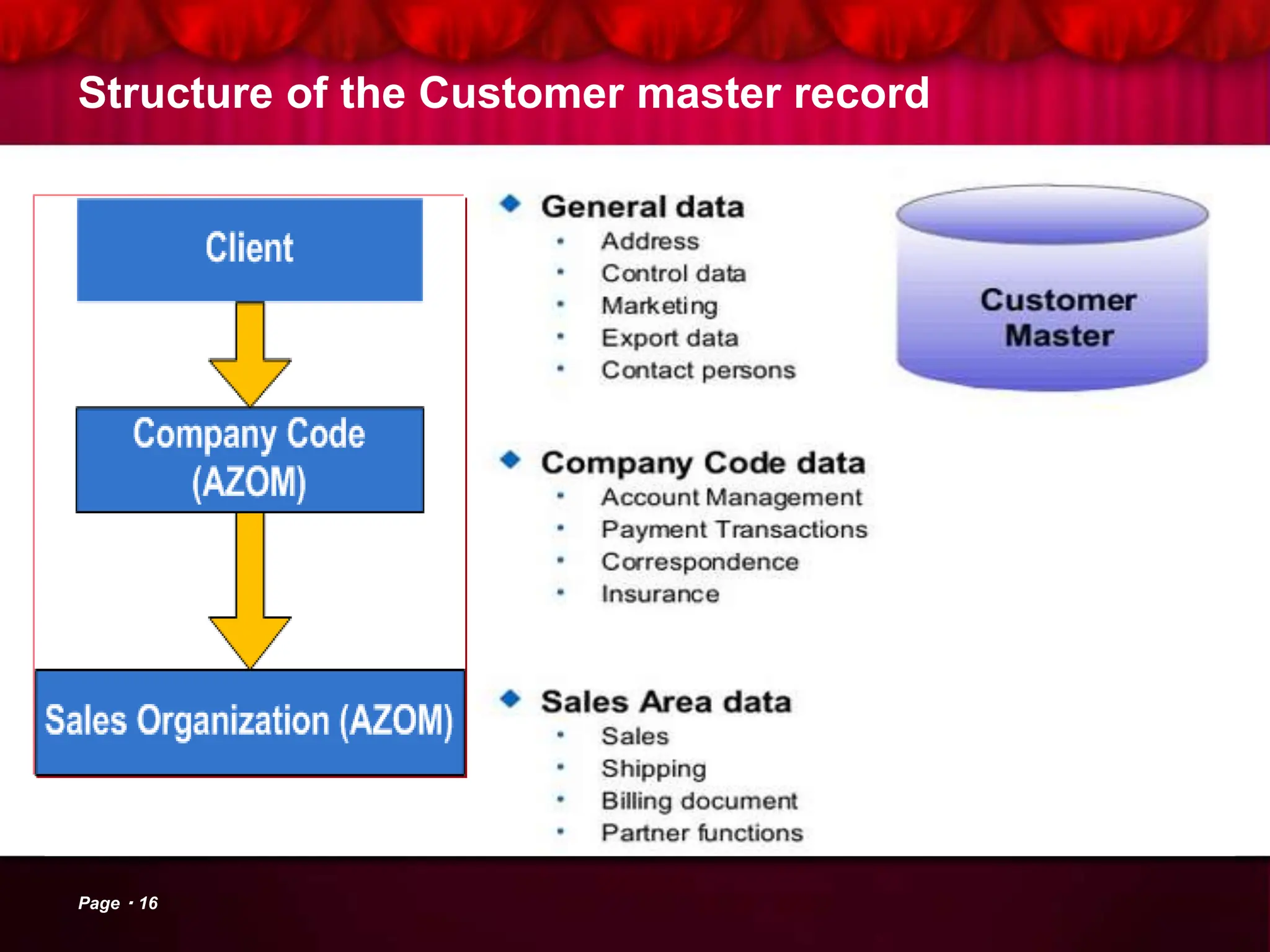

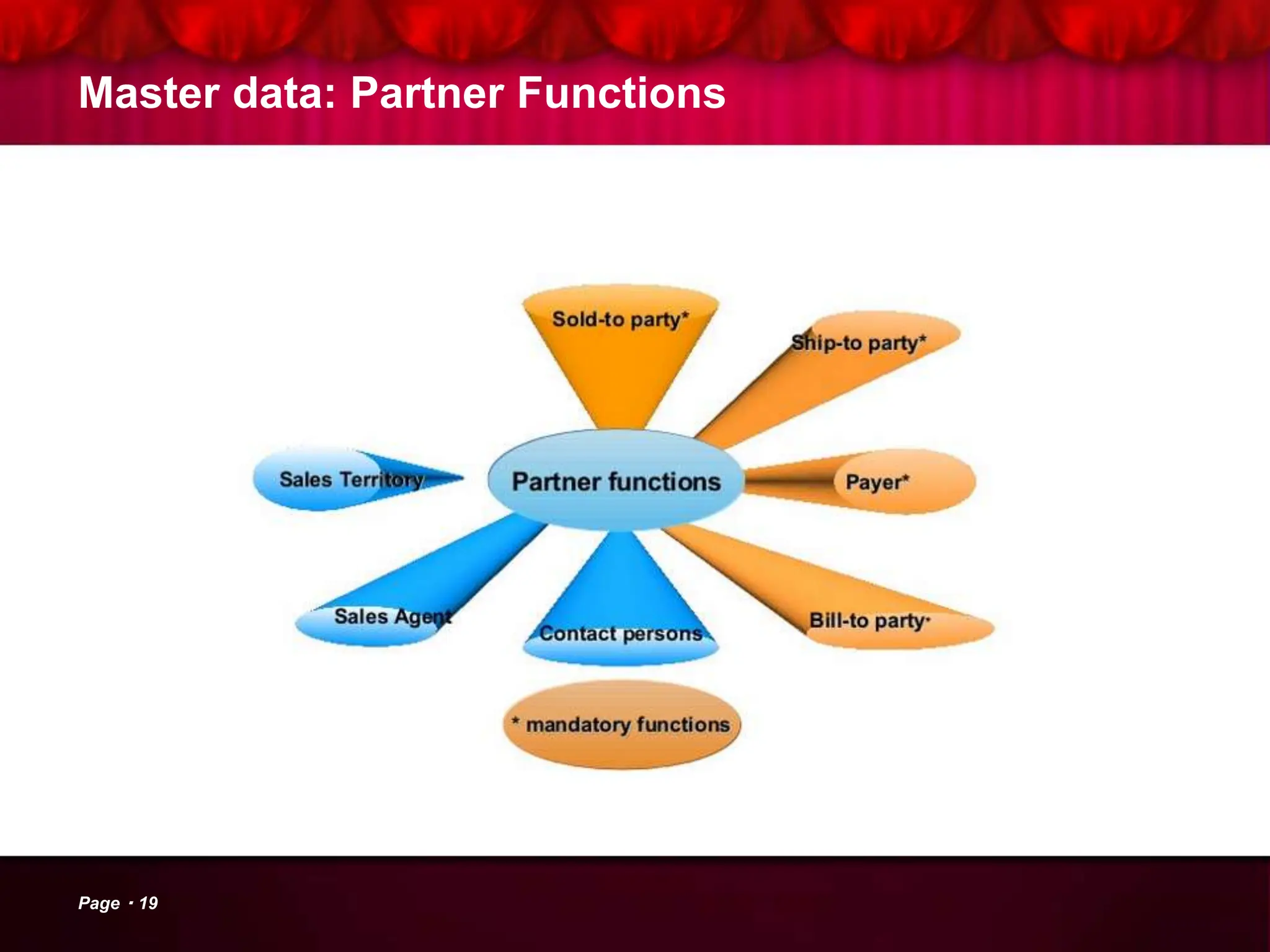

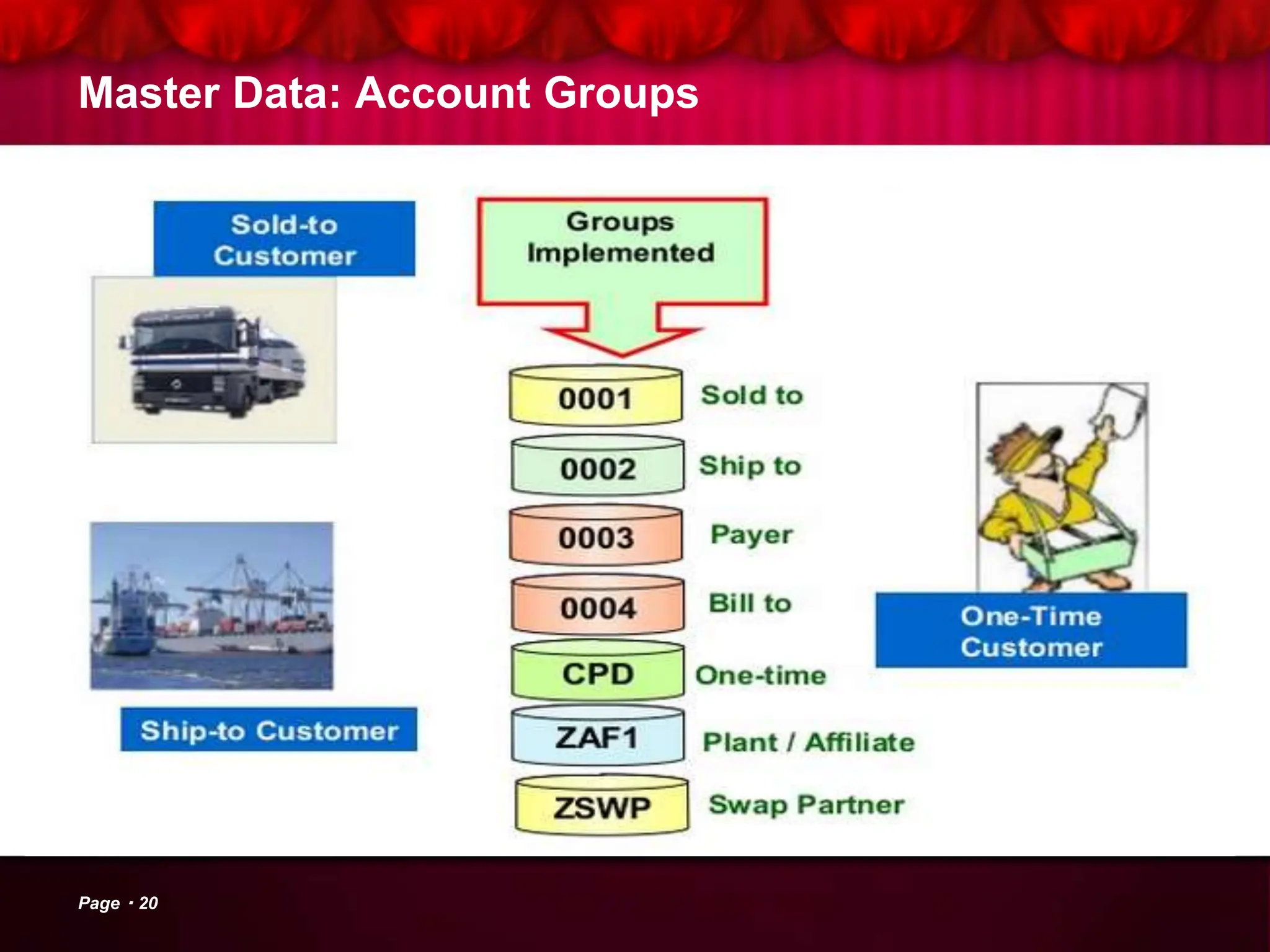

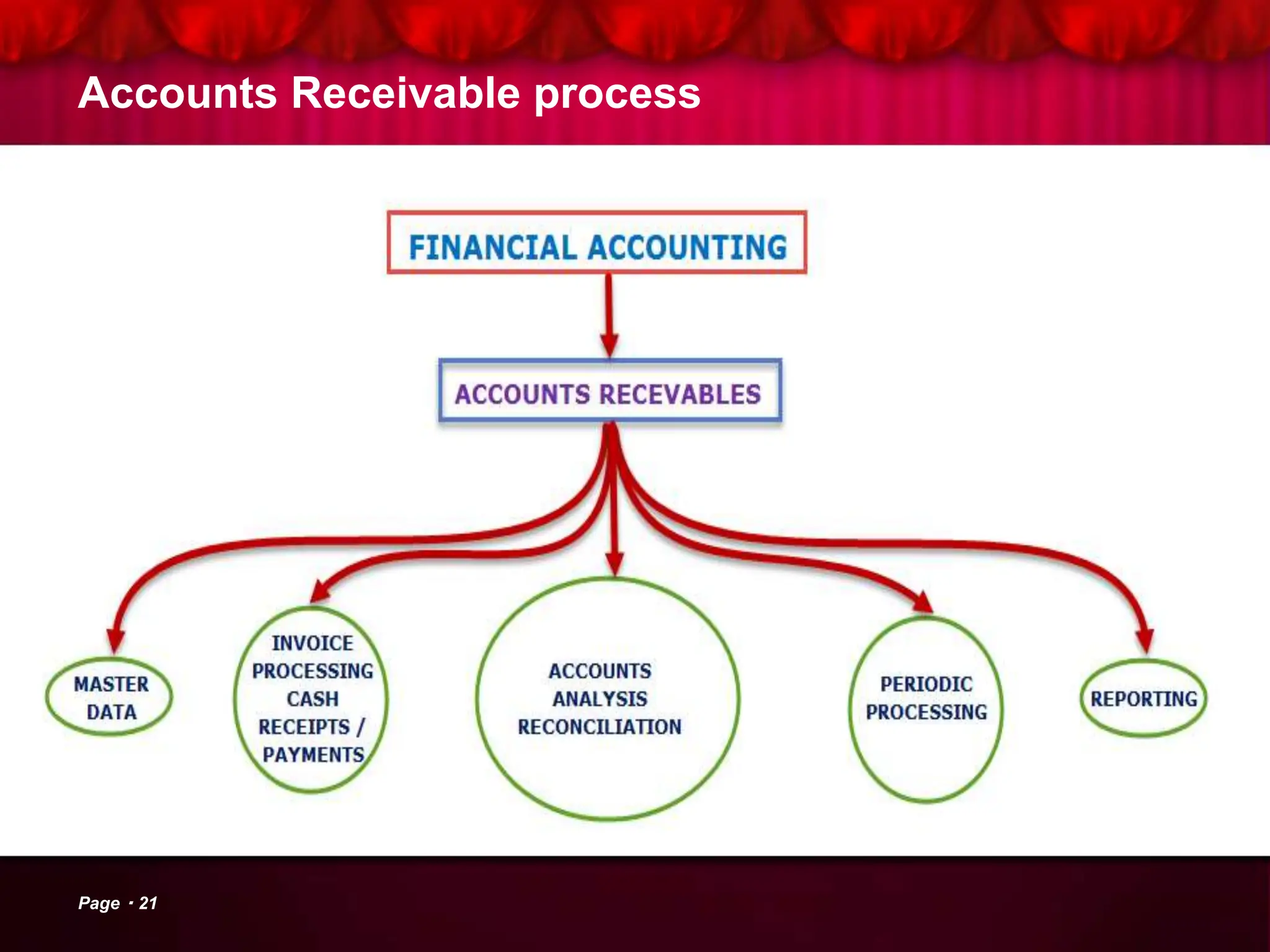

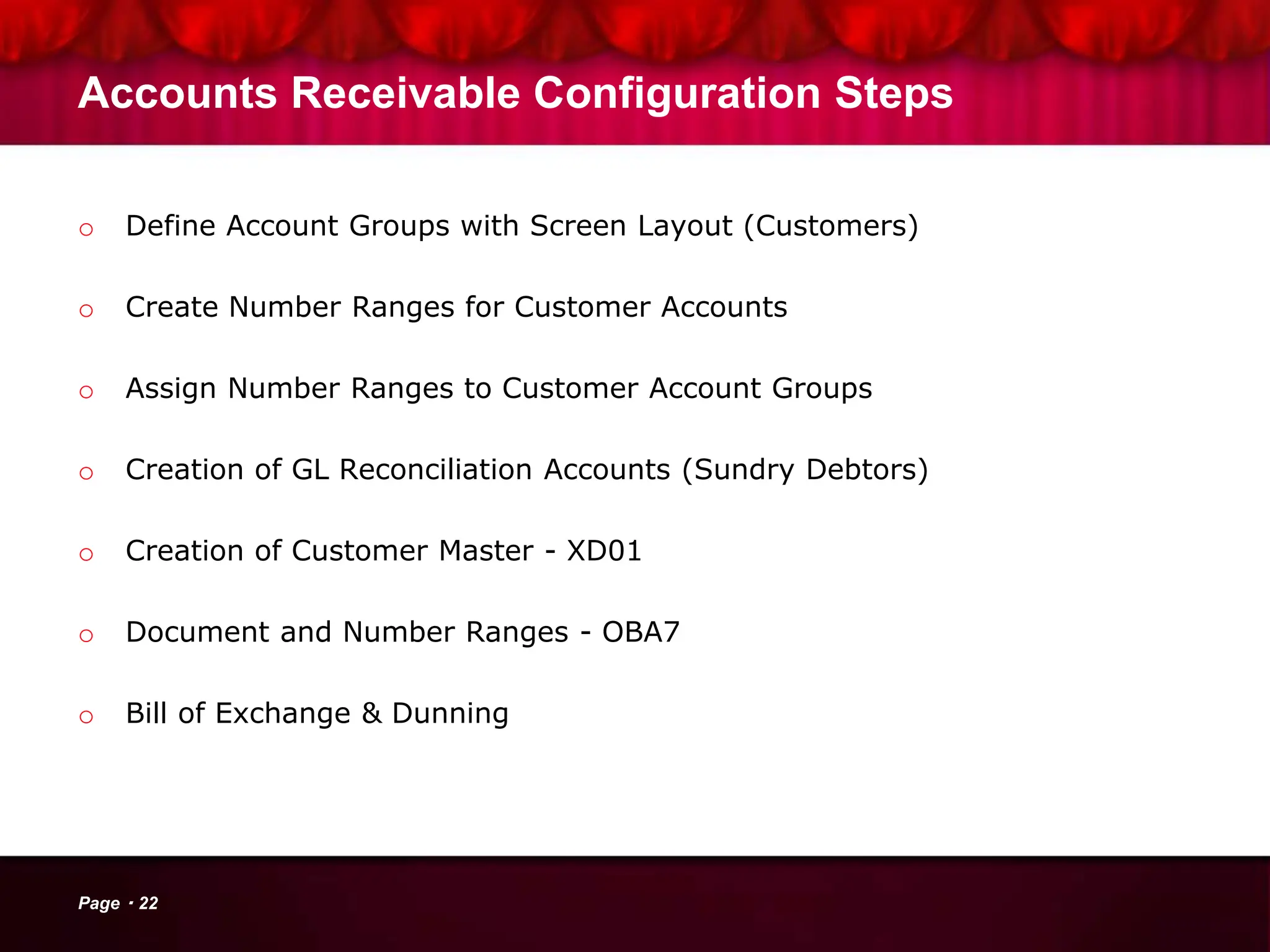

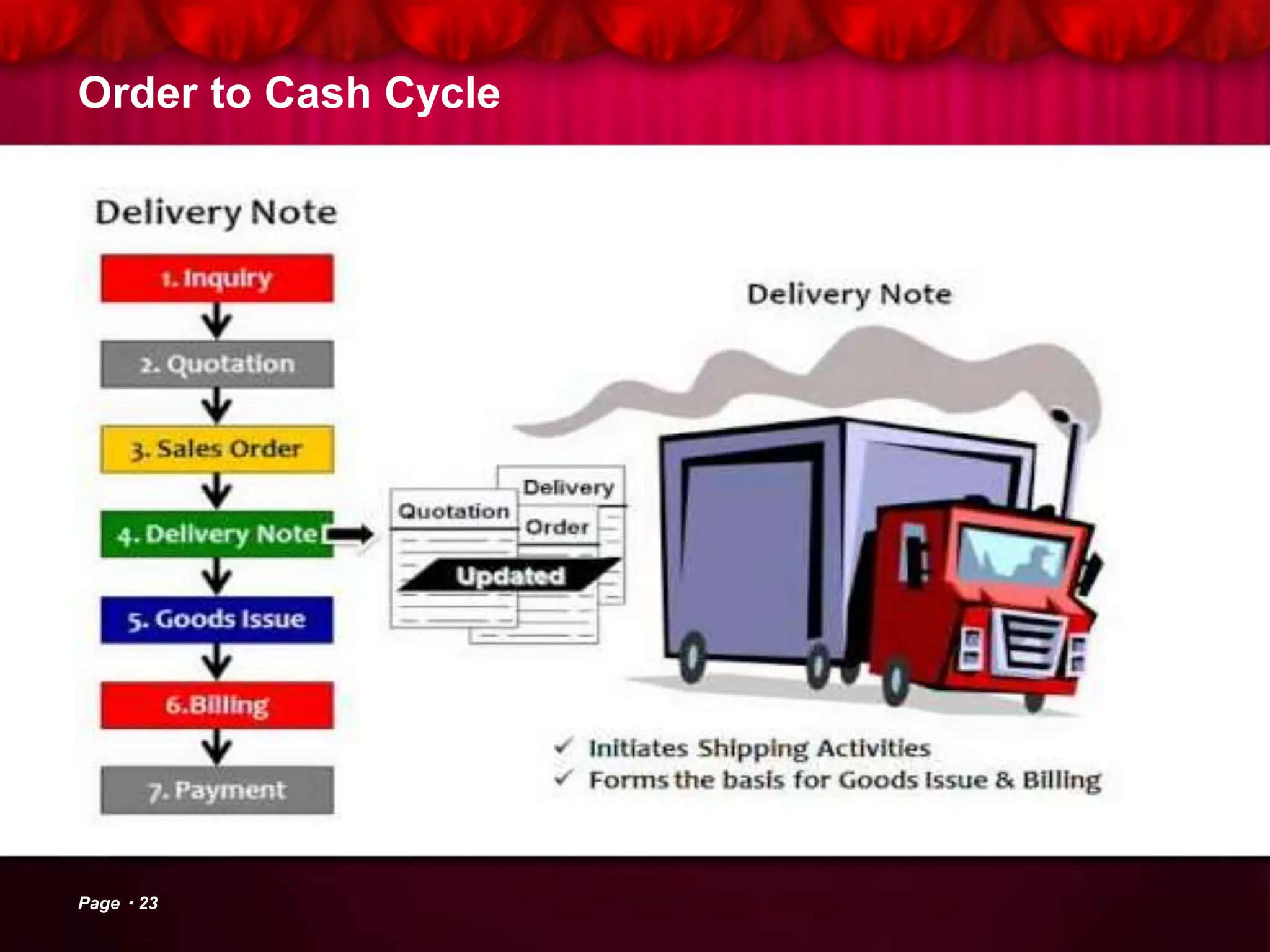

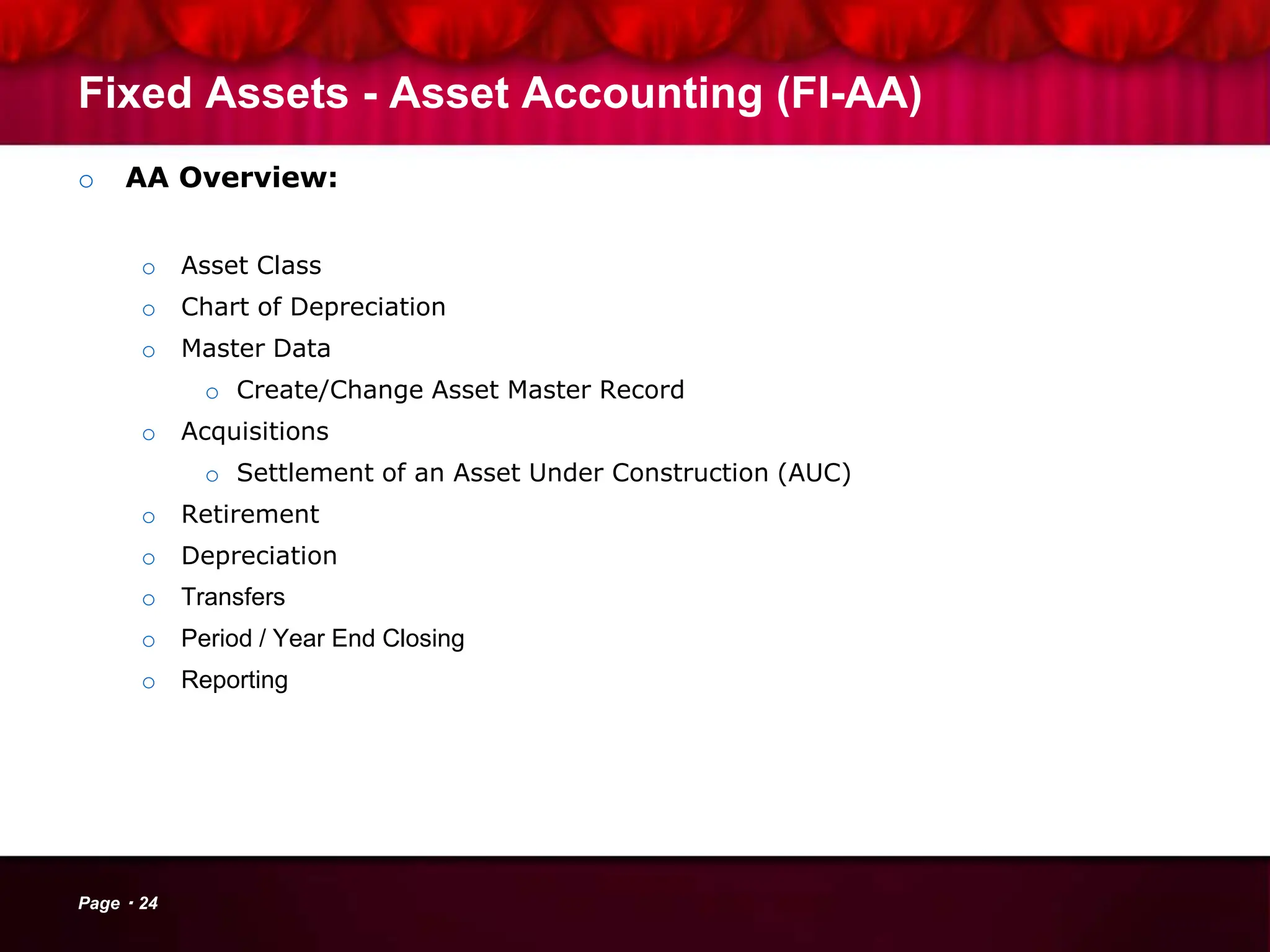

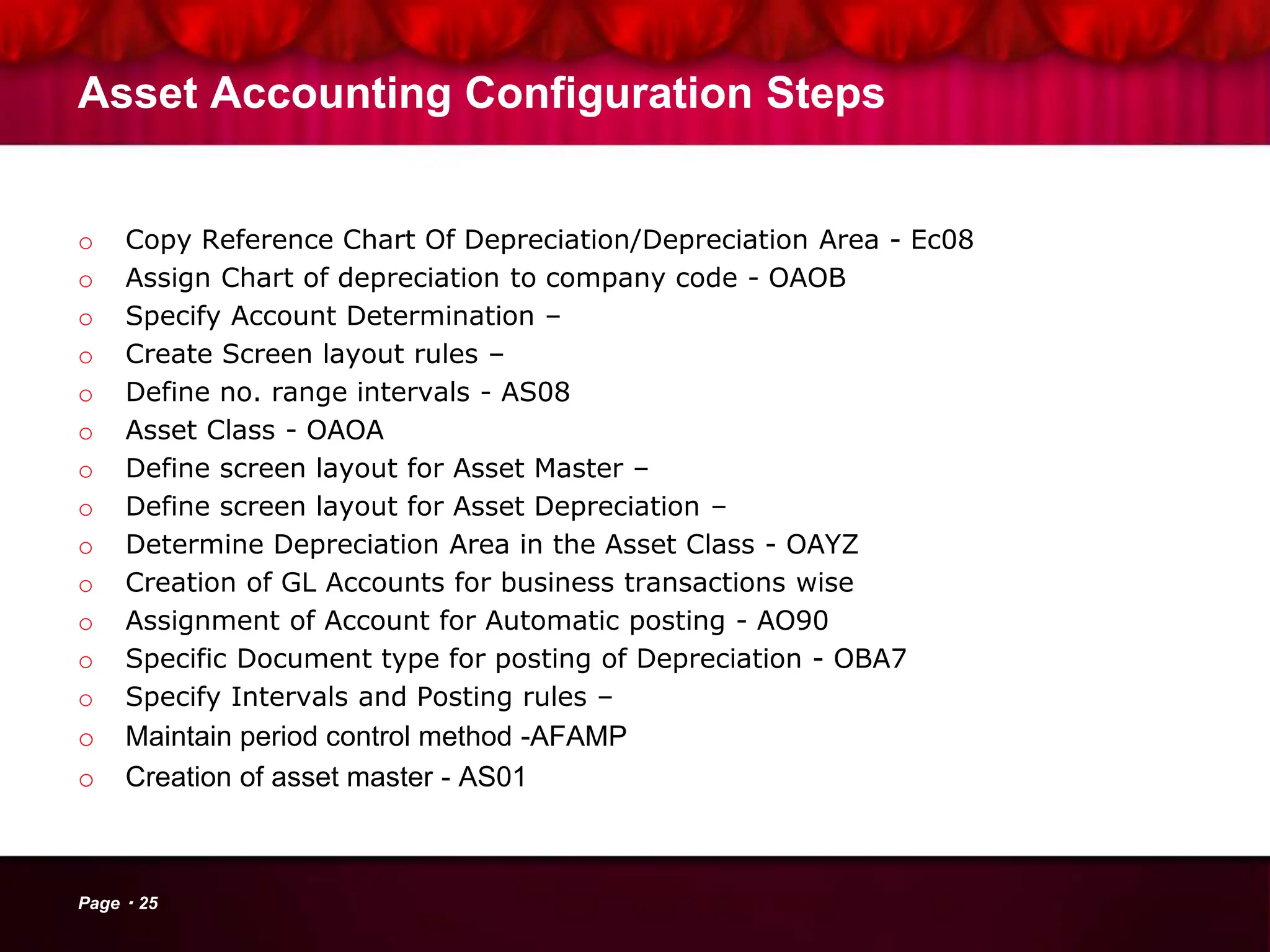

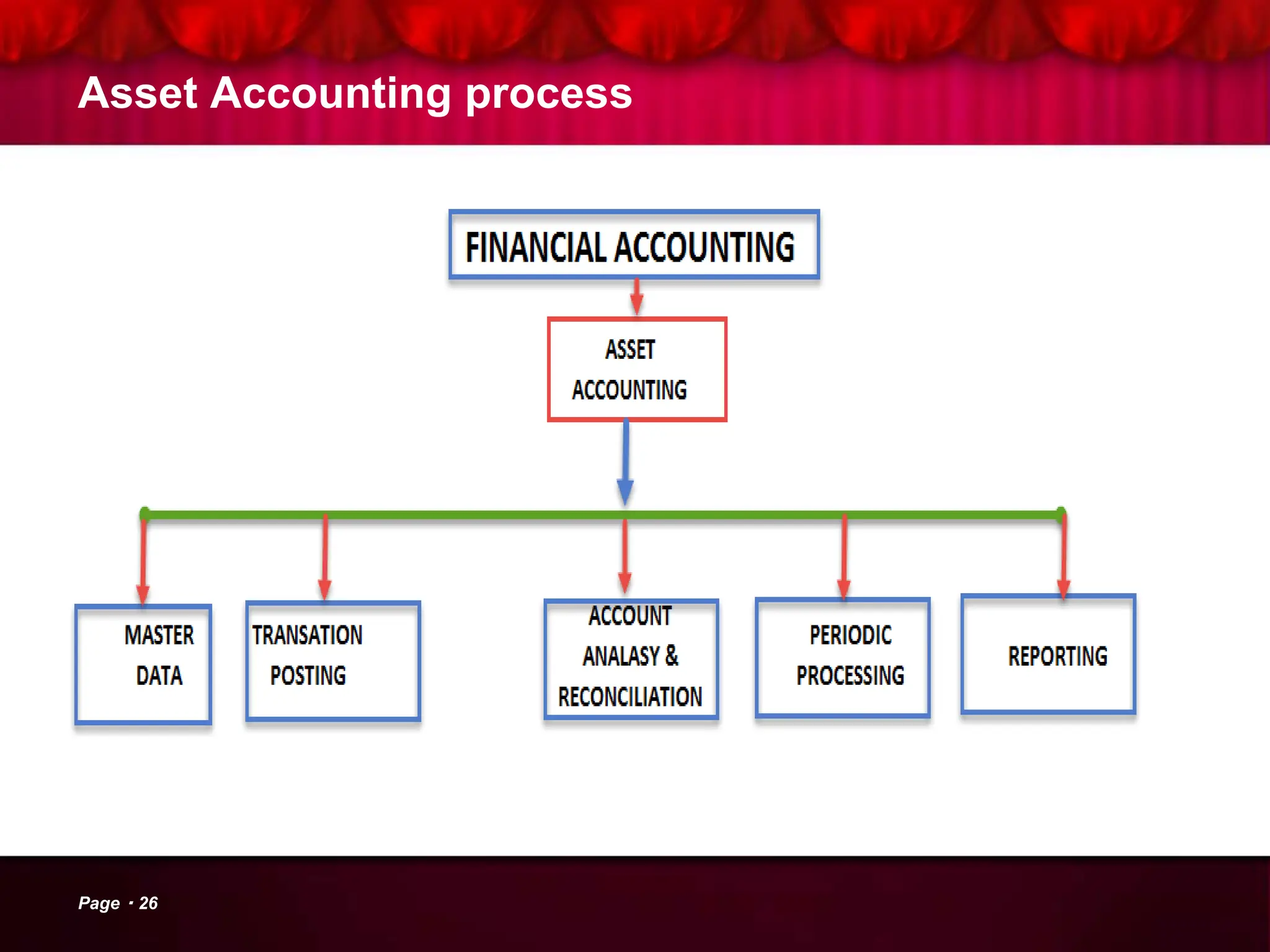

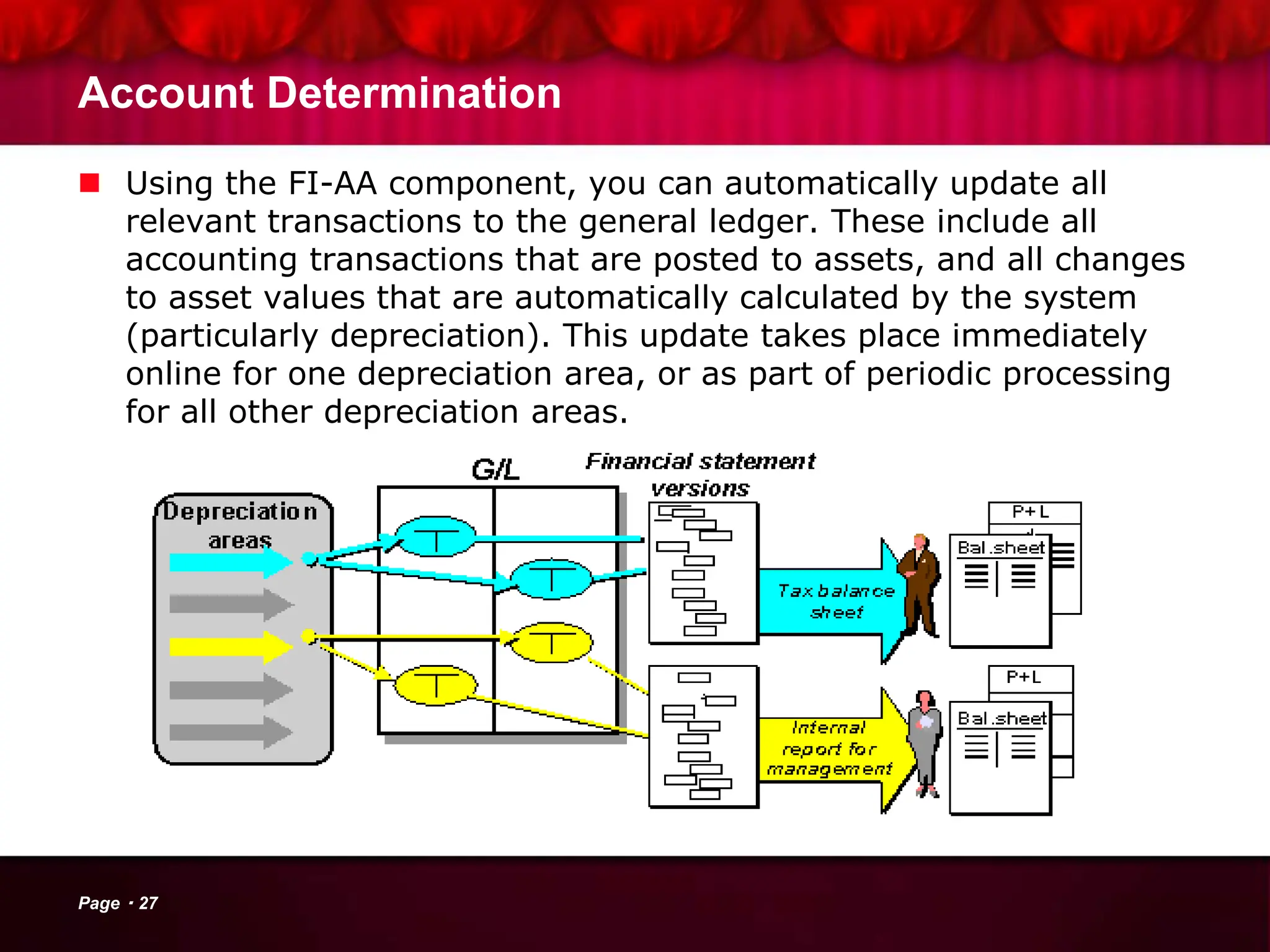

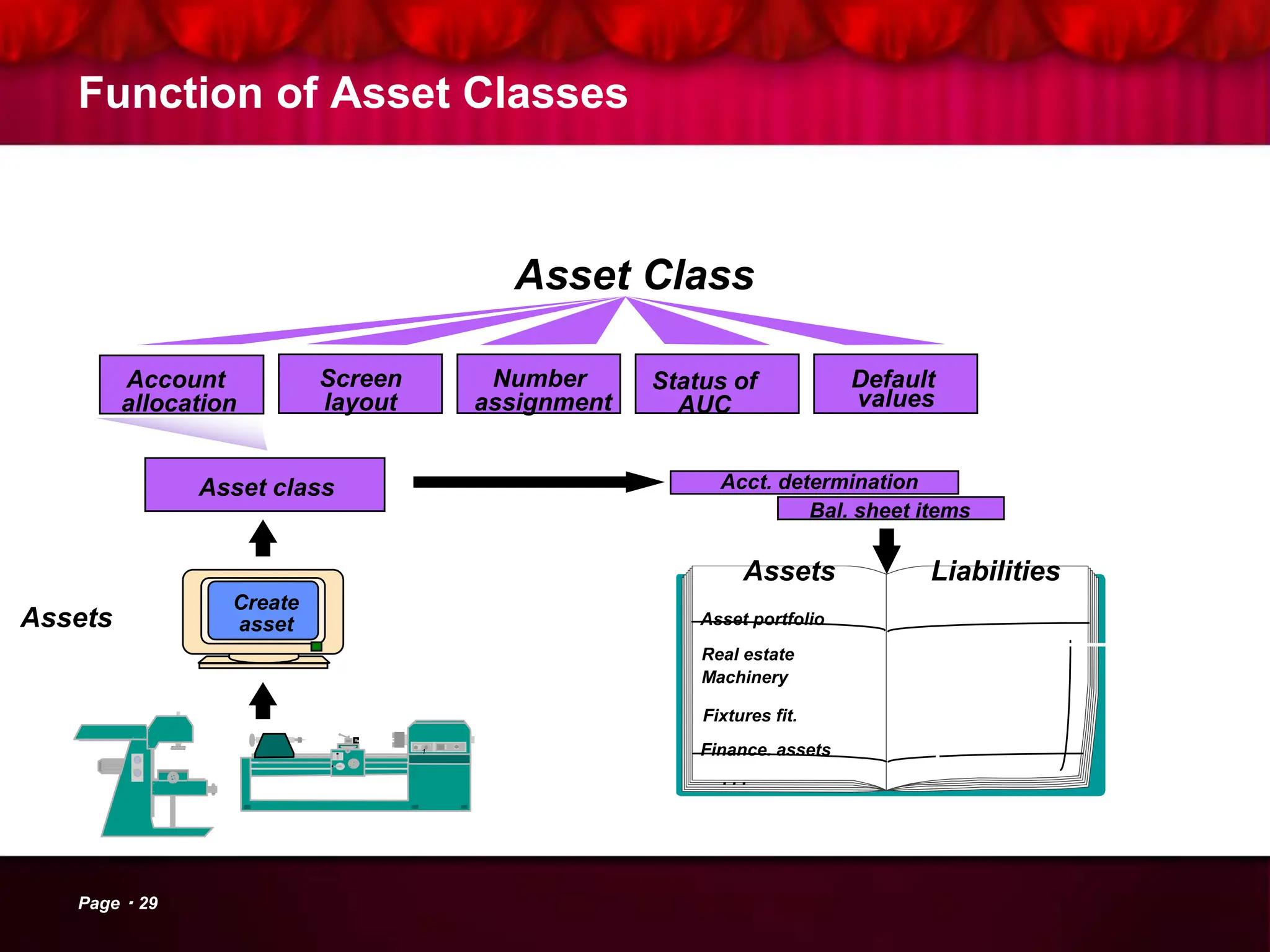

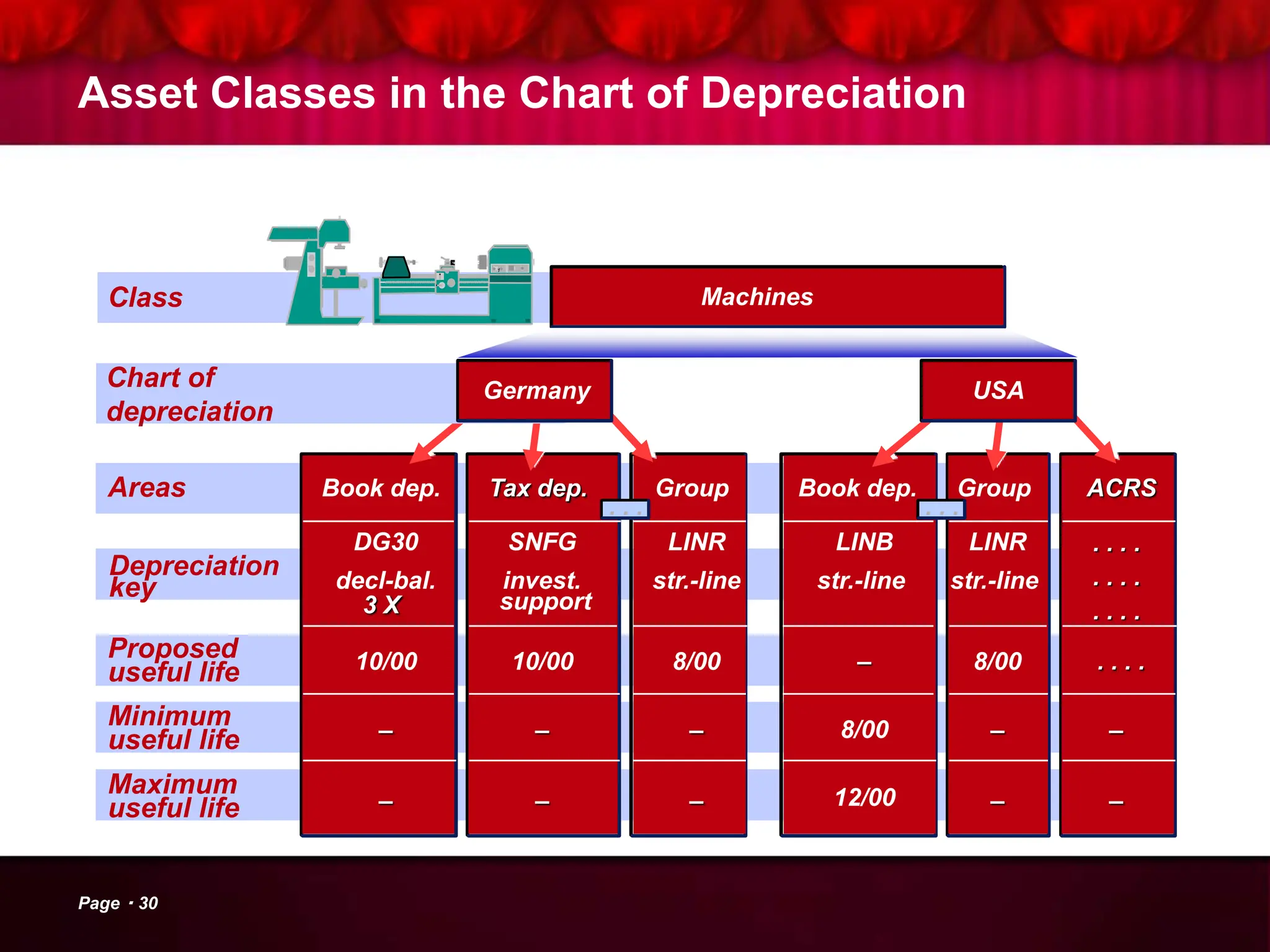

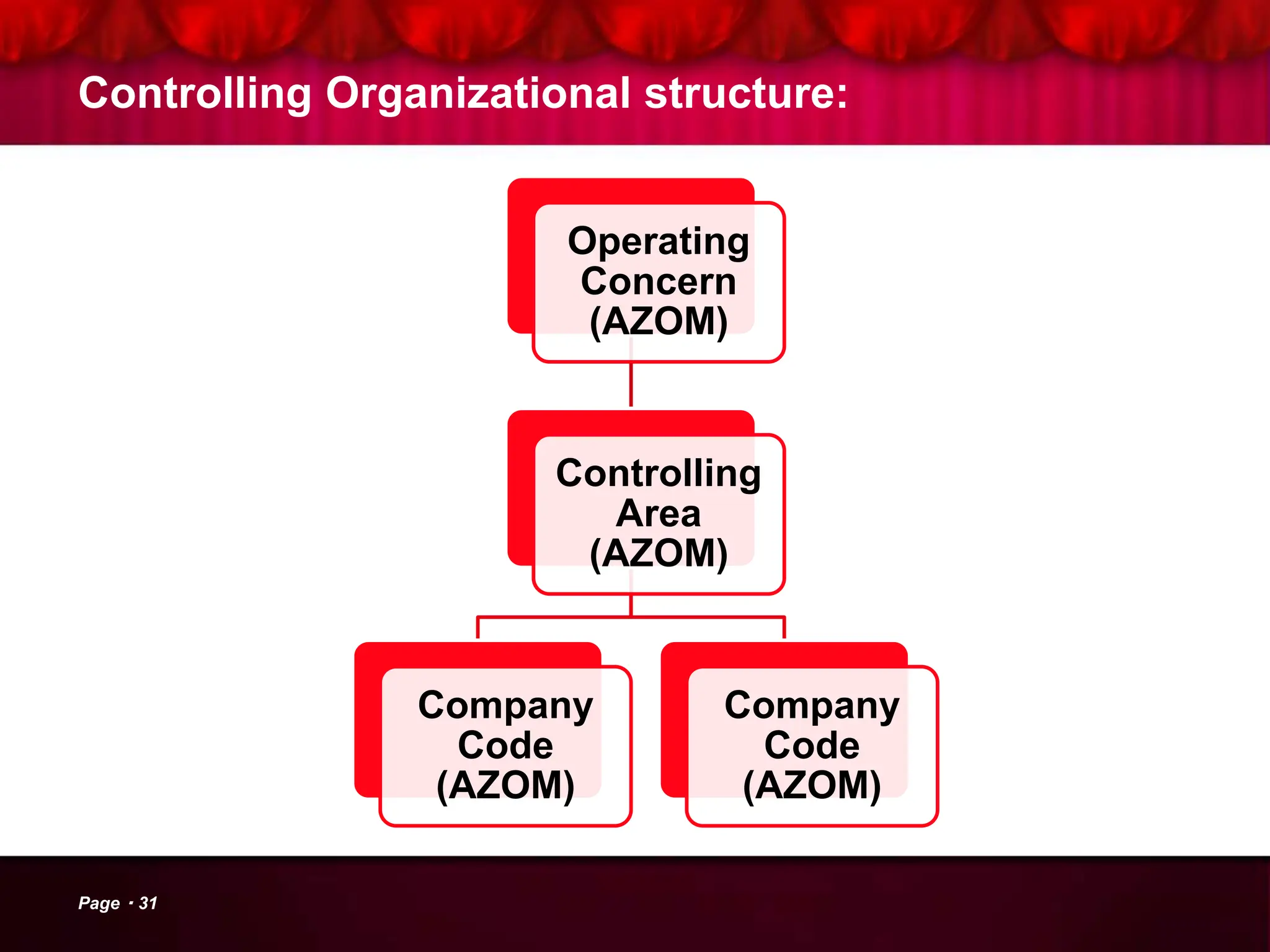

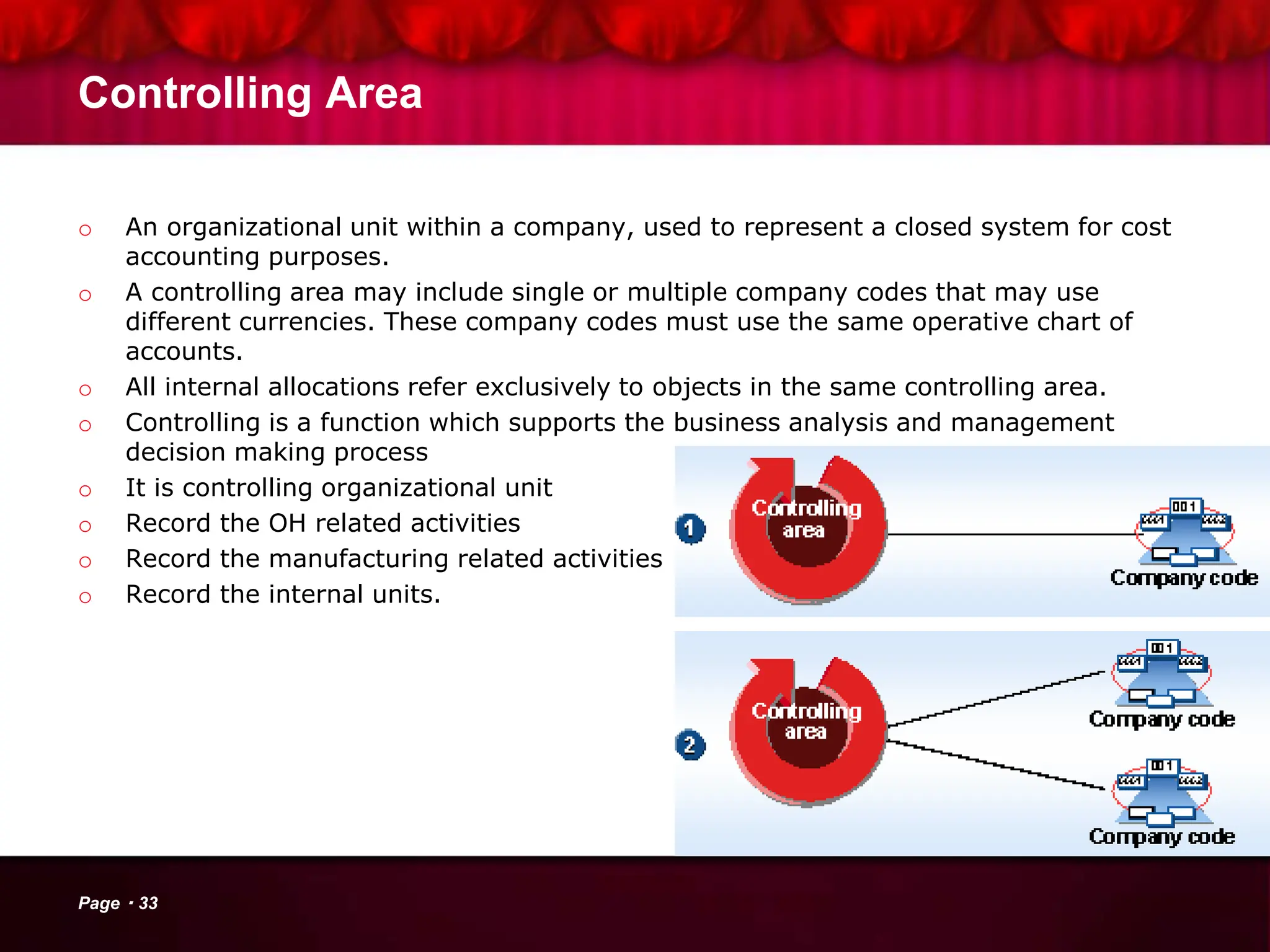

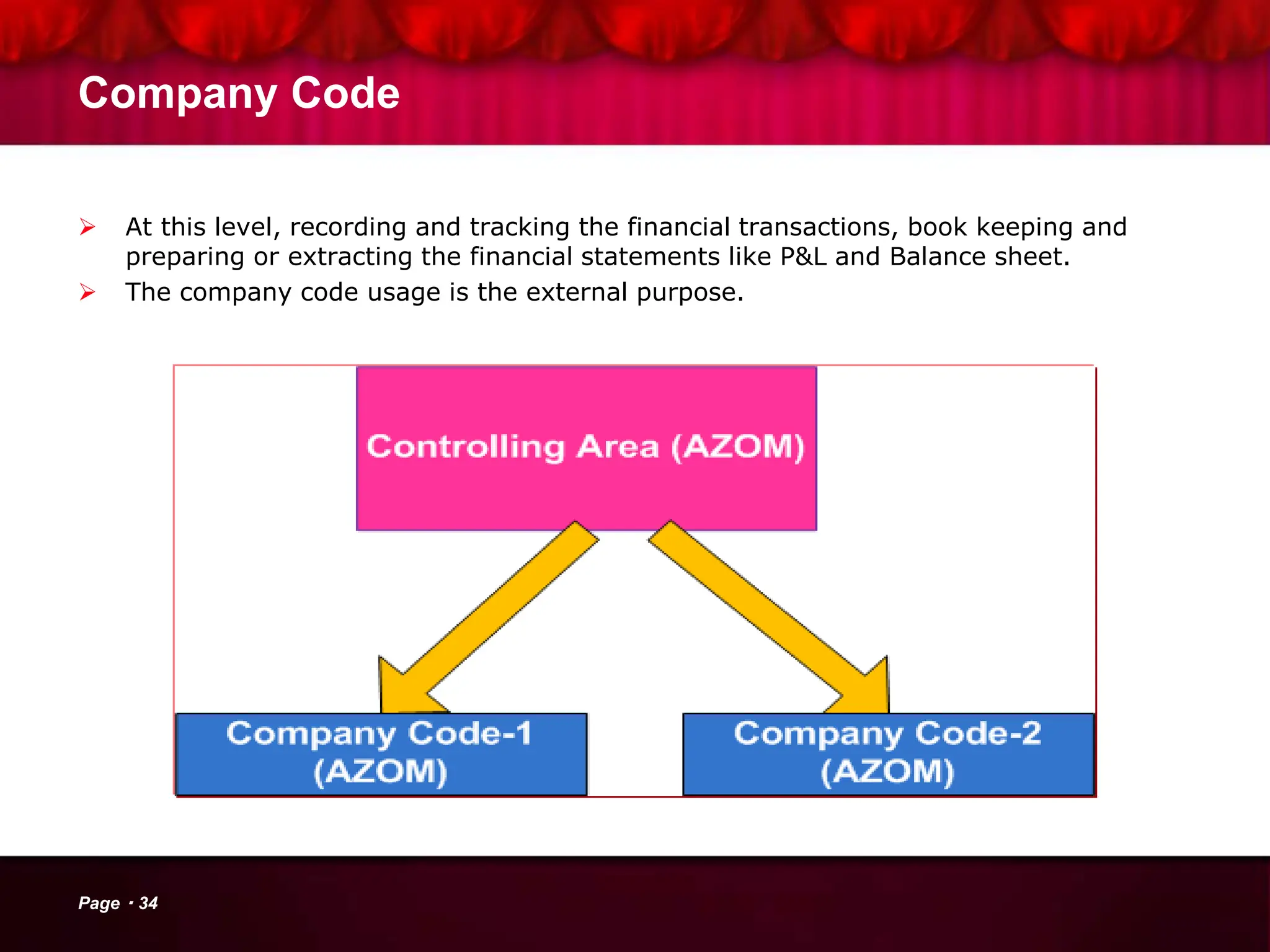

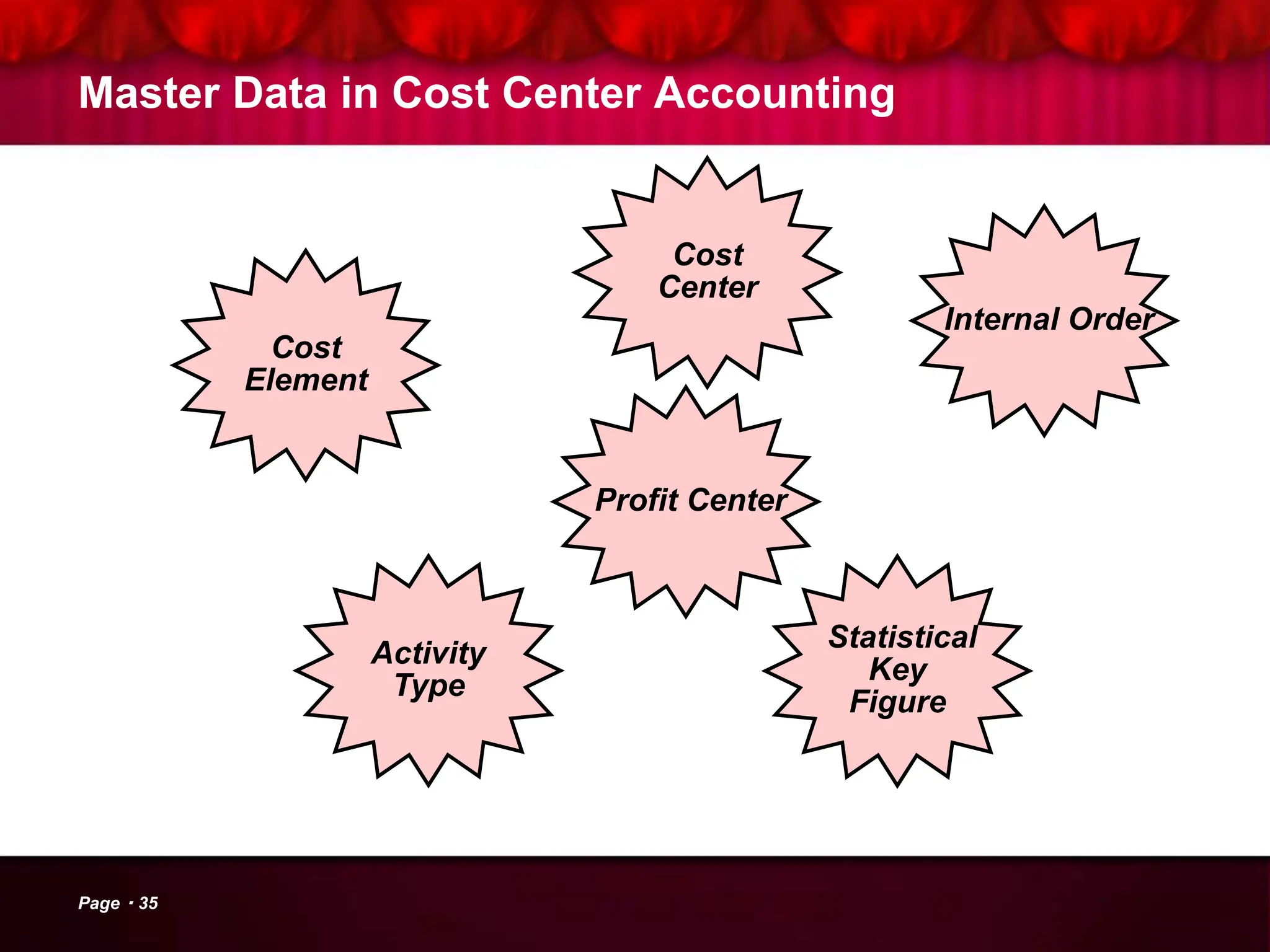

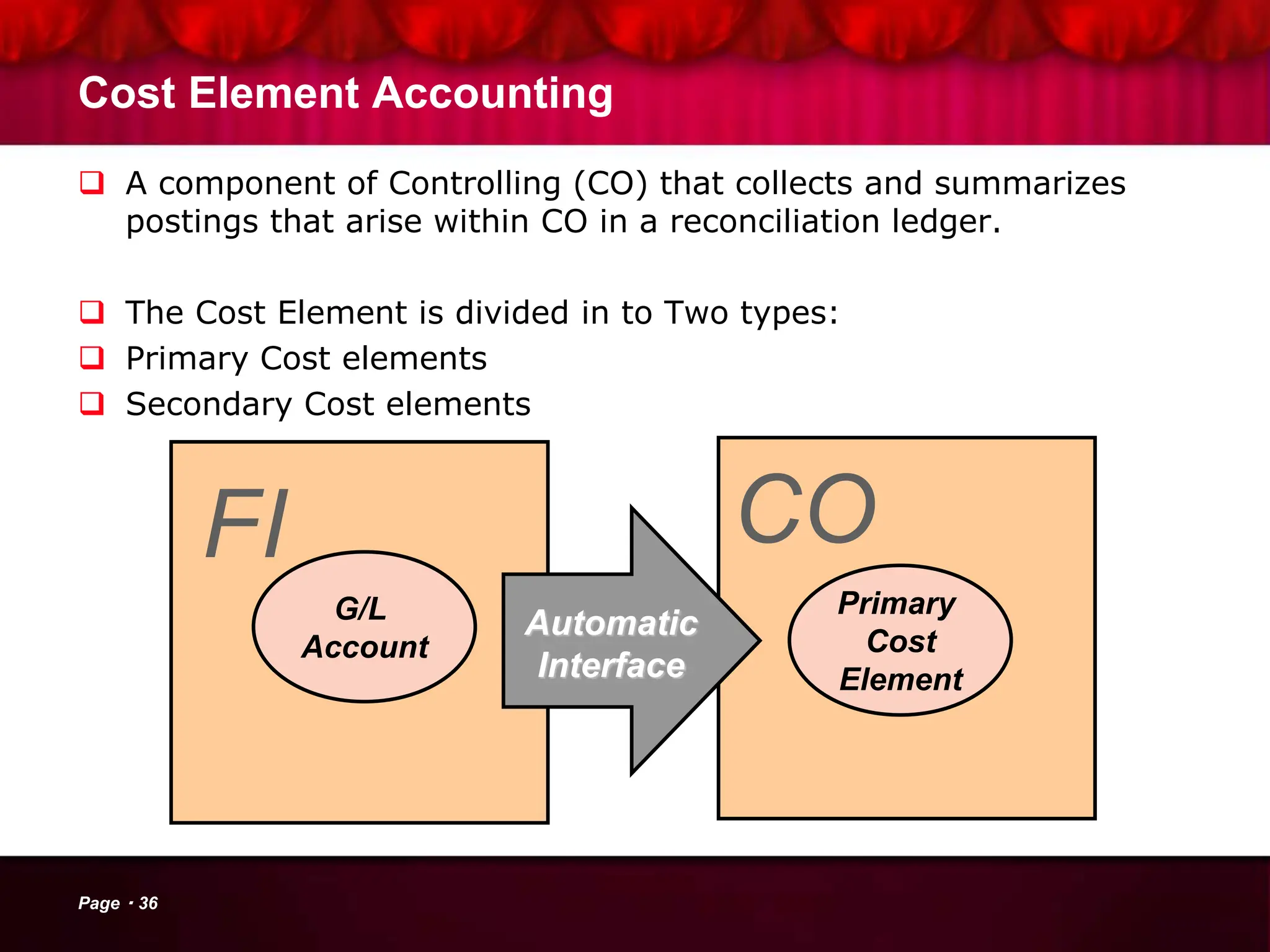

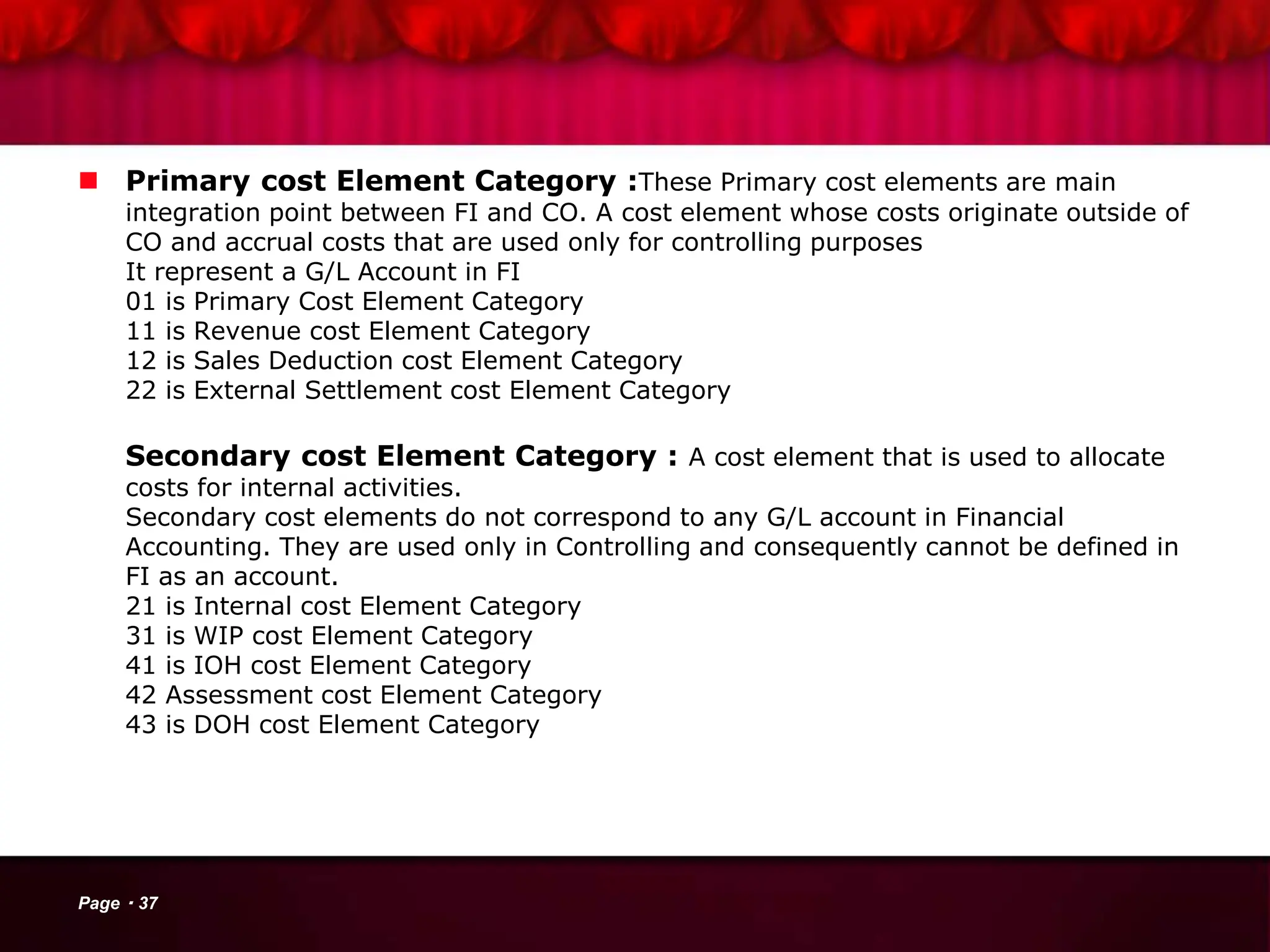

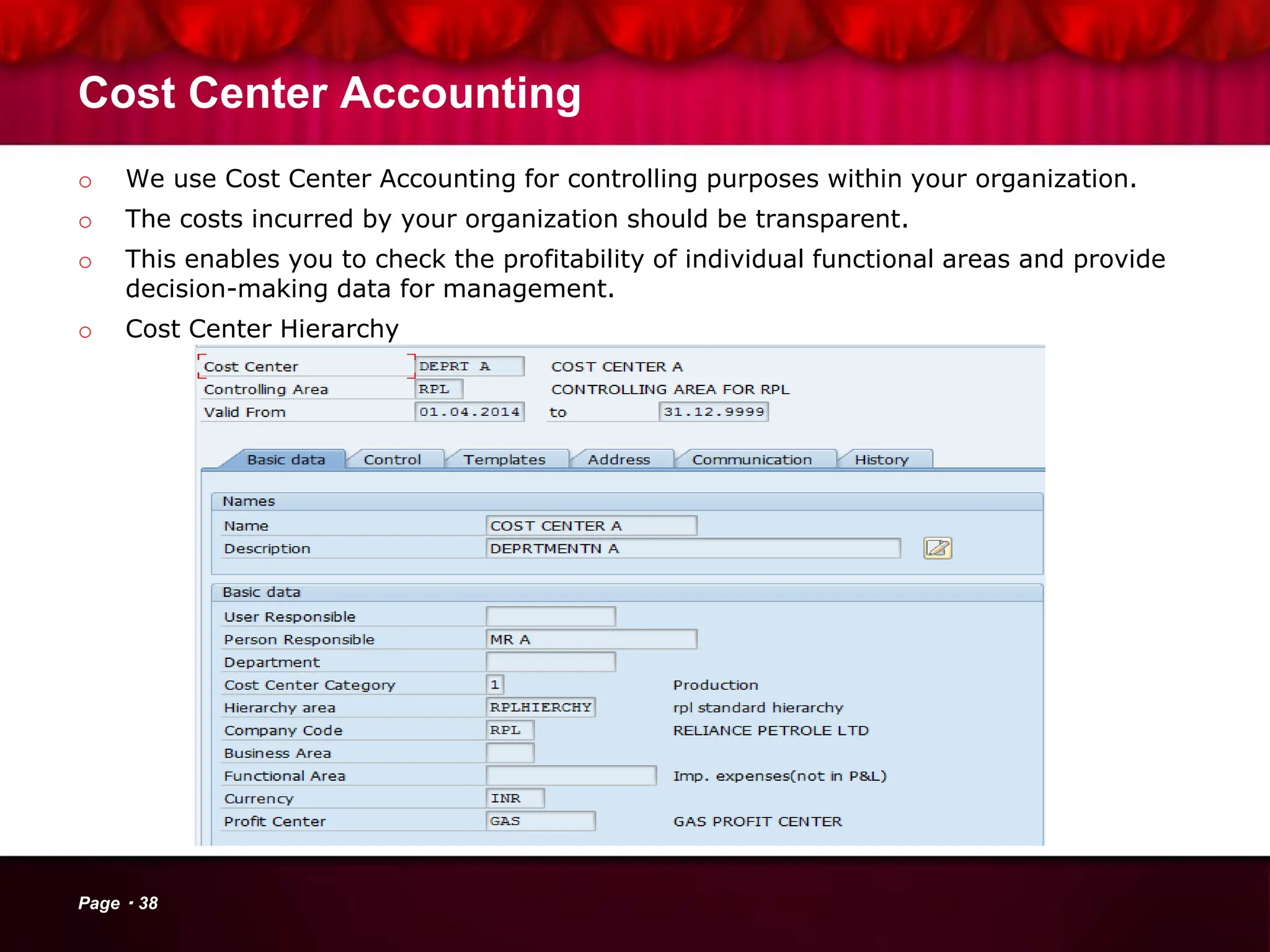

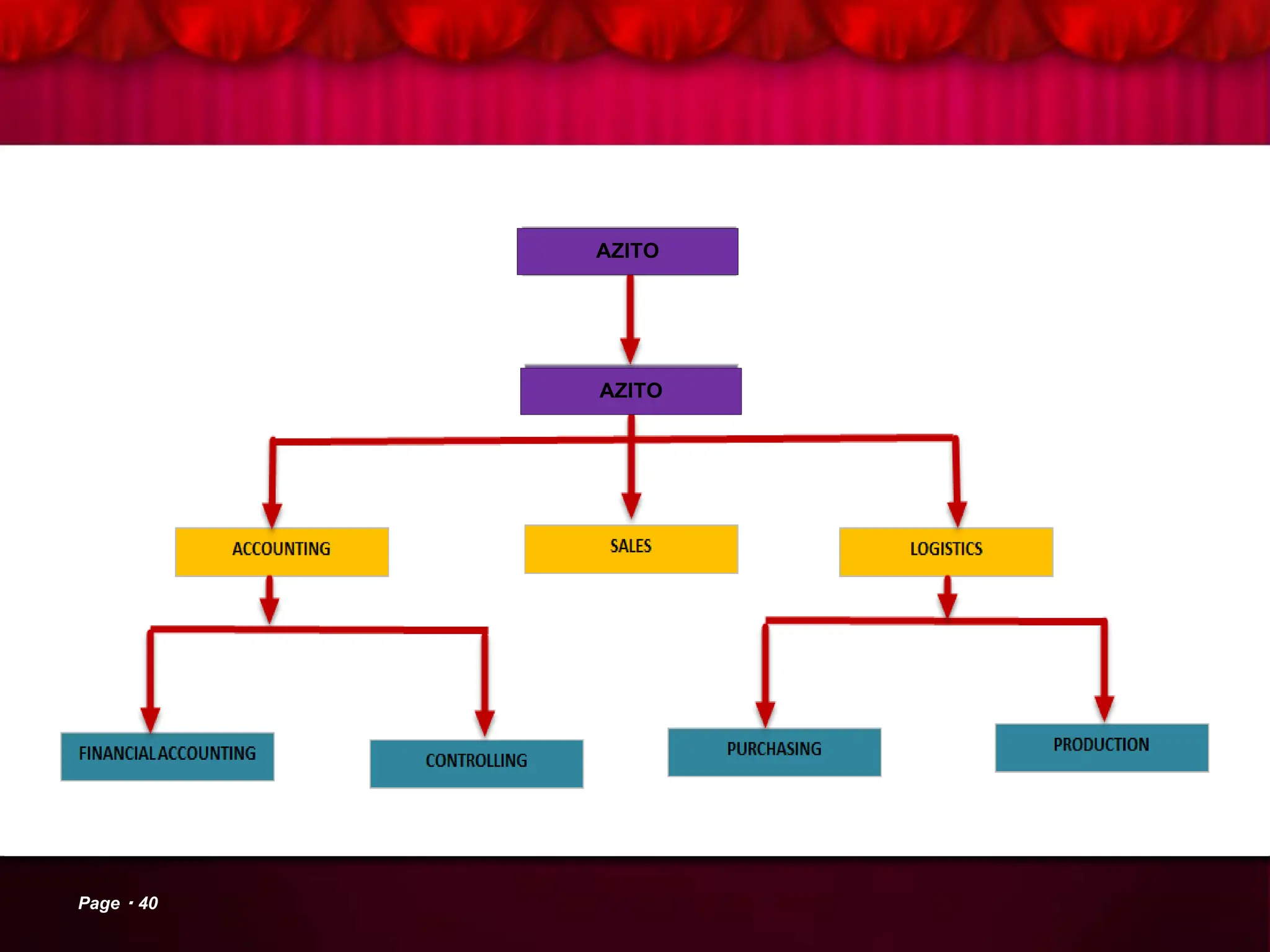

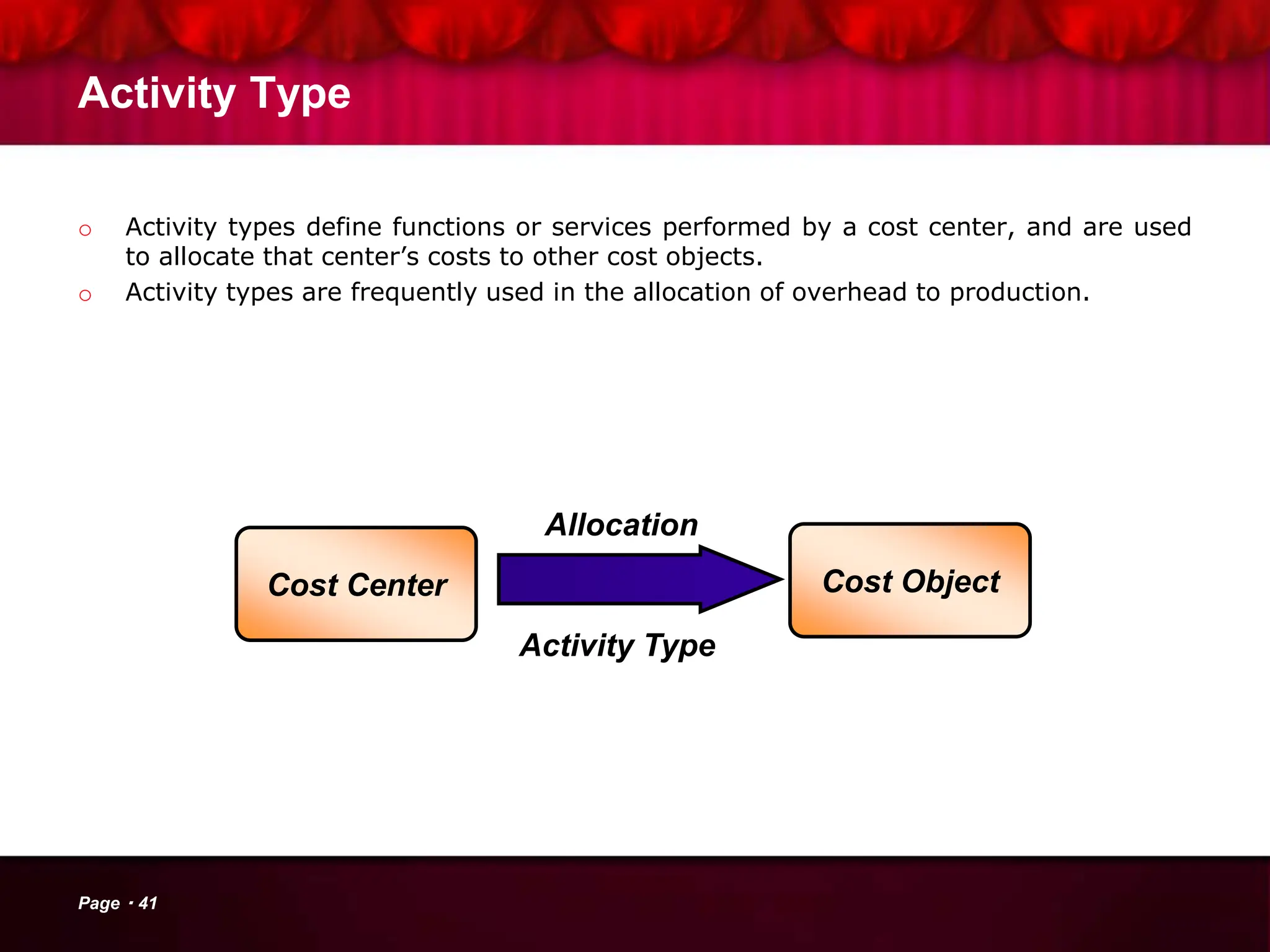

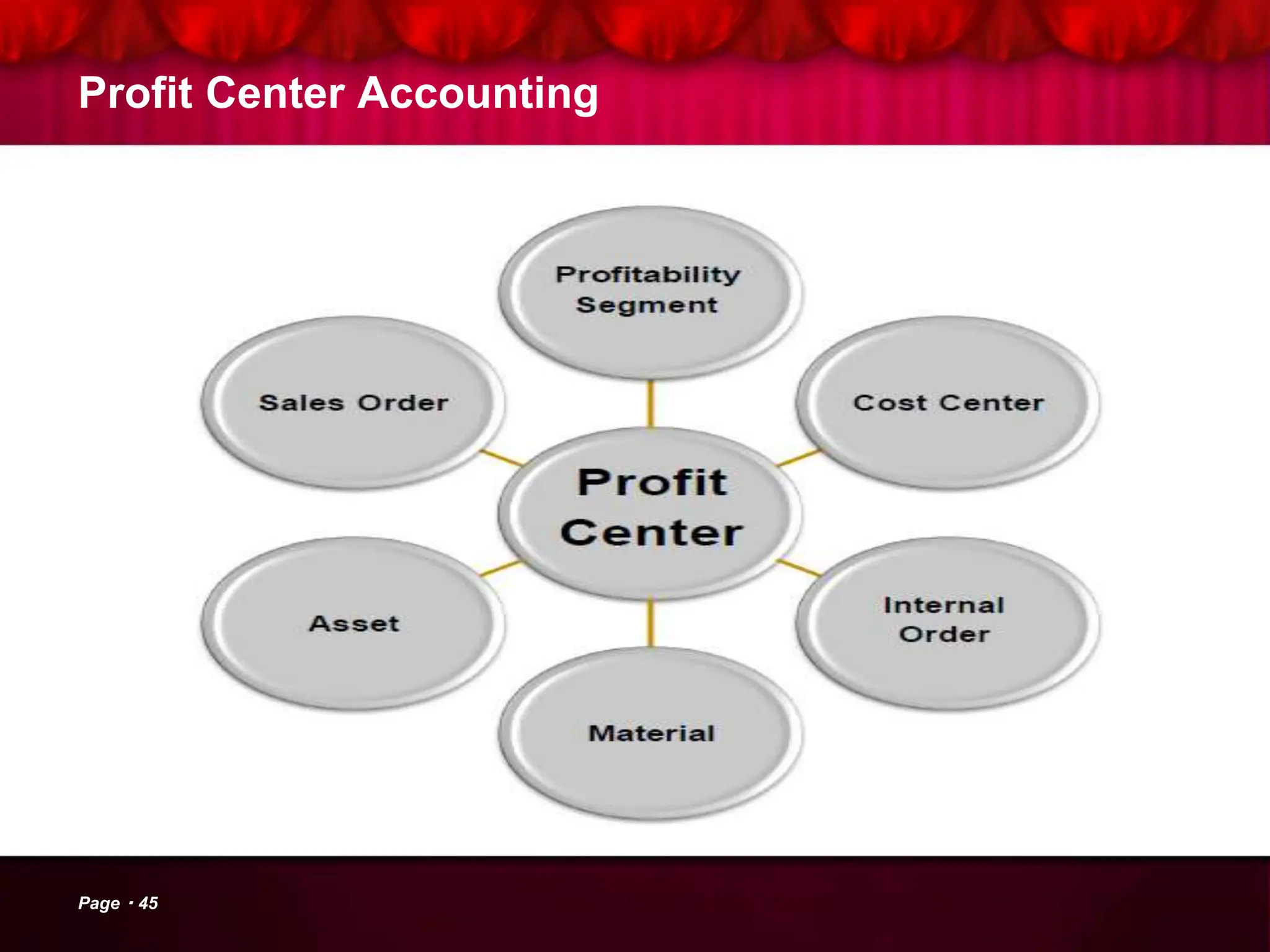

The document provides a comprehensive overview of SAP Financial Accounting (FI) and Controlling (CO) modules, detailing key functionalities such as general ledger accounting, accounts payable and receivable processes, asset accounting, and reporting capabilities. It outlines configuration steps, master data management, and integration flows, including procure-to-pay and order-to-cash cycles. The material also explains concepts like cost center accounting and profit center accounting, emphasizing their roles in financial management and decision-making.