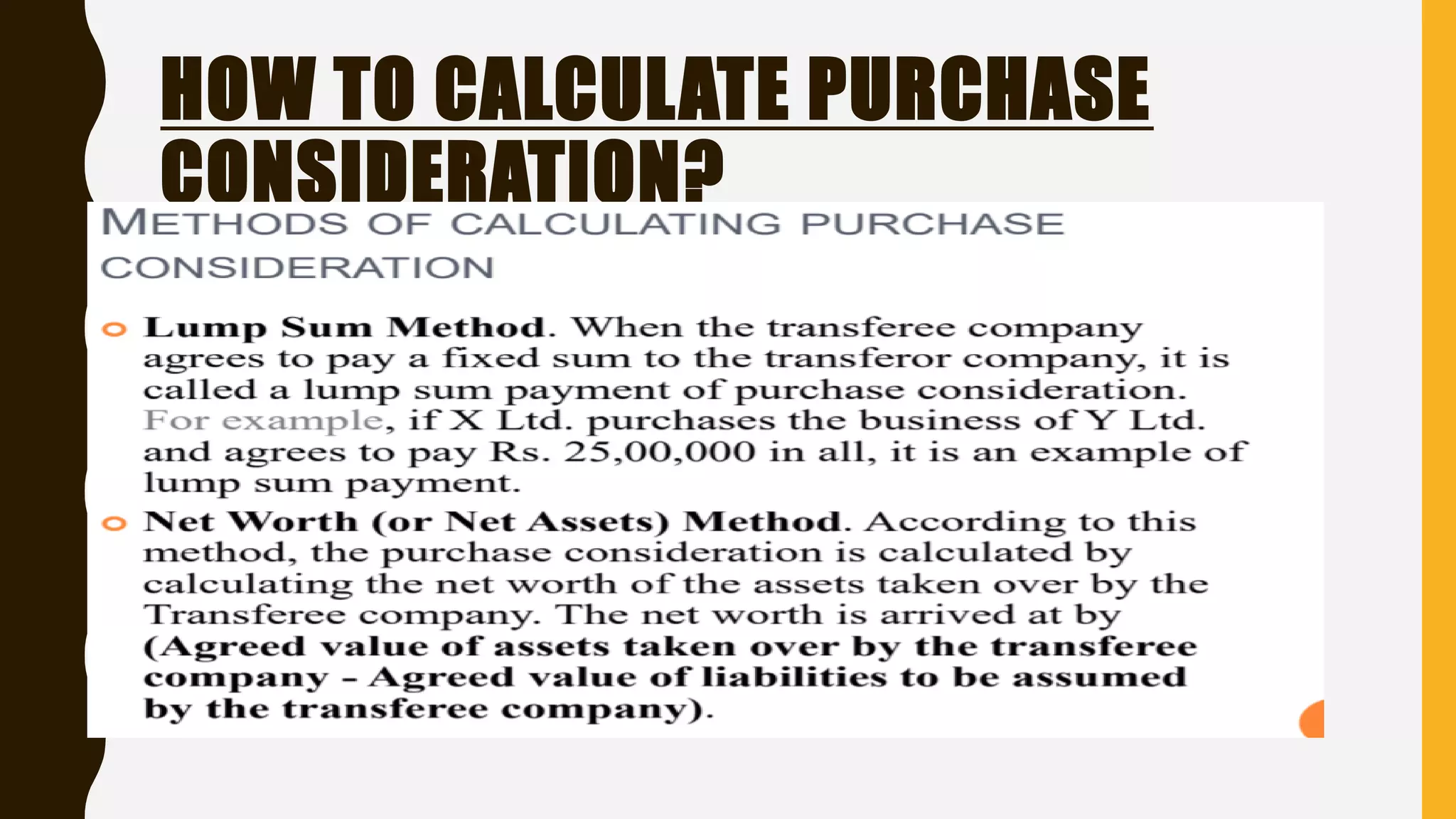

The document discusses amalgamation, absorption, and external reconstruction of companies, detailing their definitions and characteristics. It compares the pooling of interest method and the purchase method of accounting, highlighting differences in how assets and liabilities are recorded during mergers. Additionally, it outlines how to calculate purchase consideration in mergers.