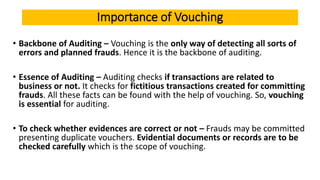

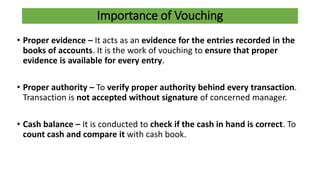

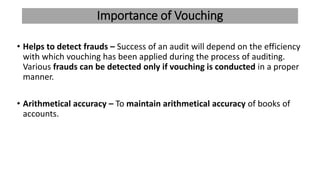

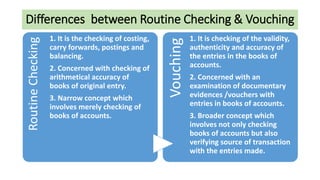

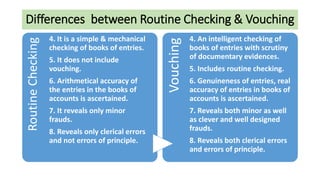

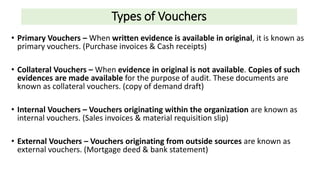

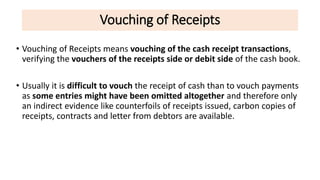

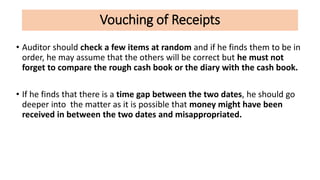

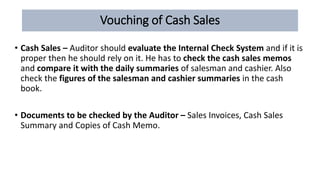

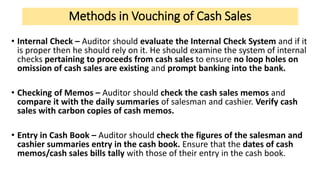

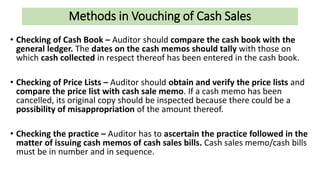

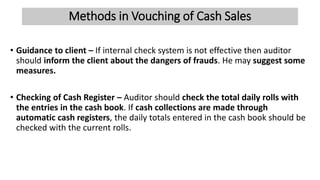

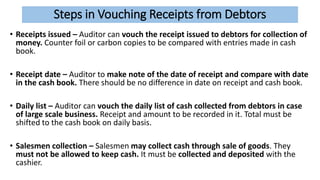

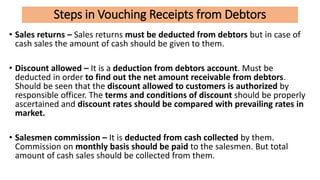

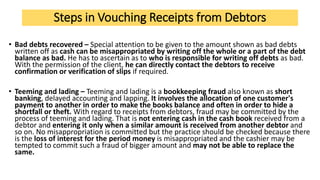

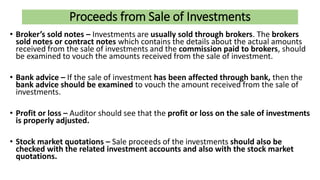

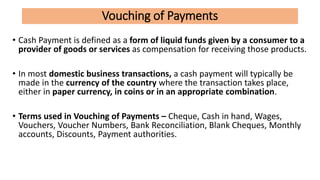

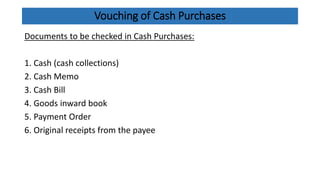

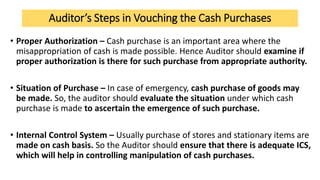

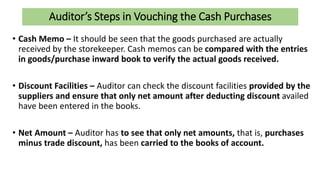

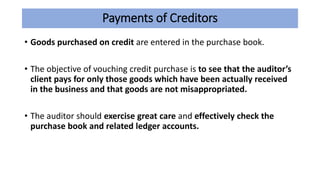

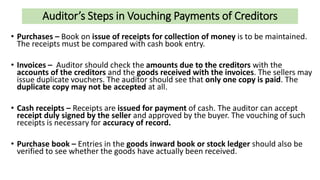

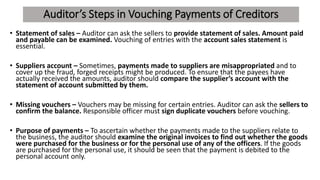

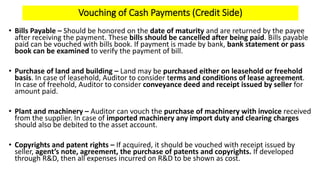

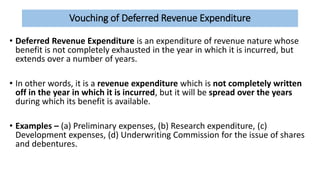

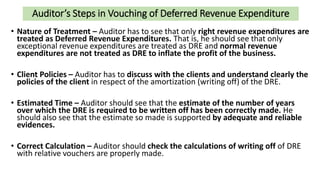

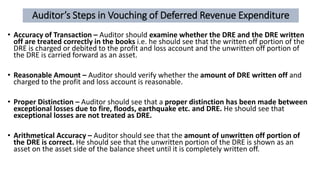

The document discusses the principles and practices of vouching in auditing, including its meaning, importance, and the types of vouchers involved. It emphasizes vouching as a critical component for detecting errors and fraud in financial records by verifying the accuracy and authenticity of entries through original documentary evidence. Additionally, it contrasts vouching with routine checking, outlining the necessary steps auditors should take while vouching various transactions like receipts and payments.