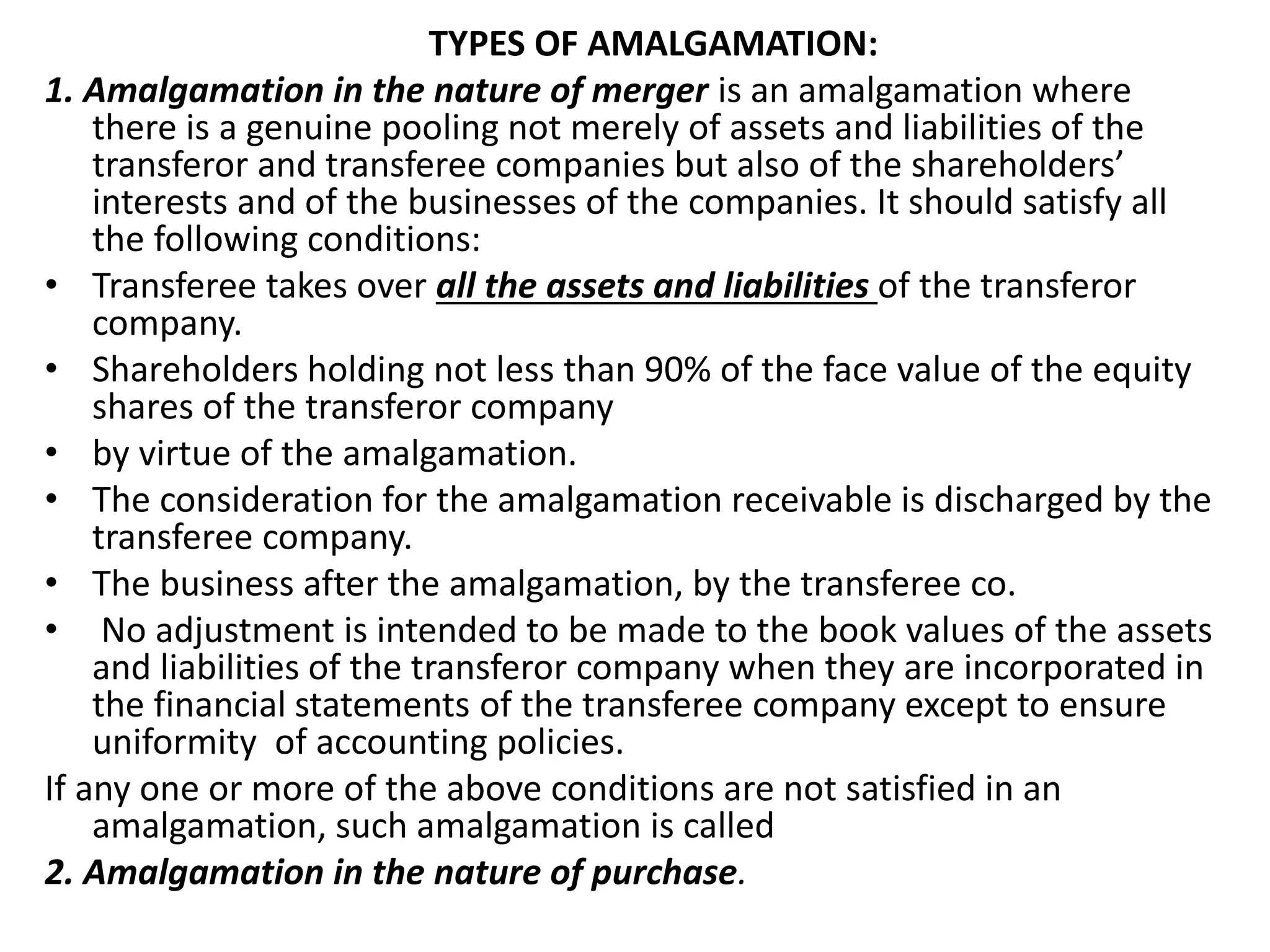

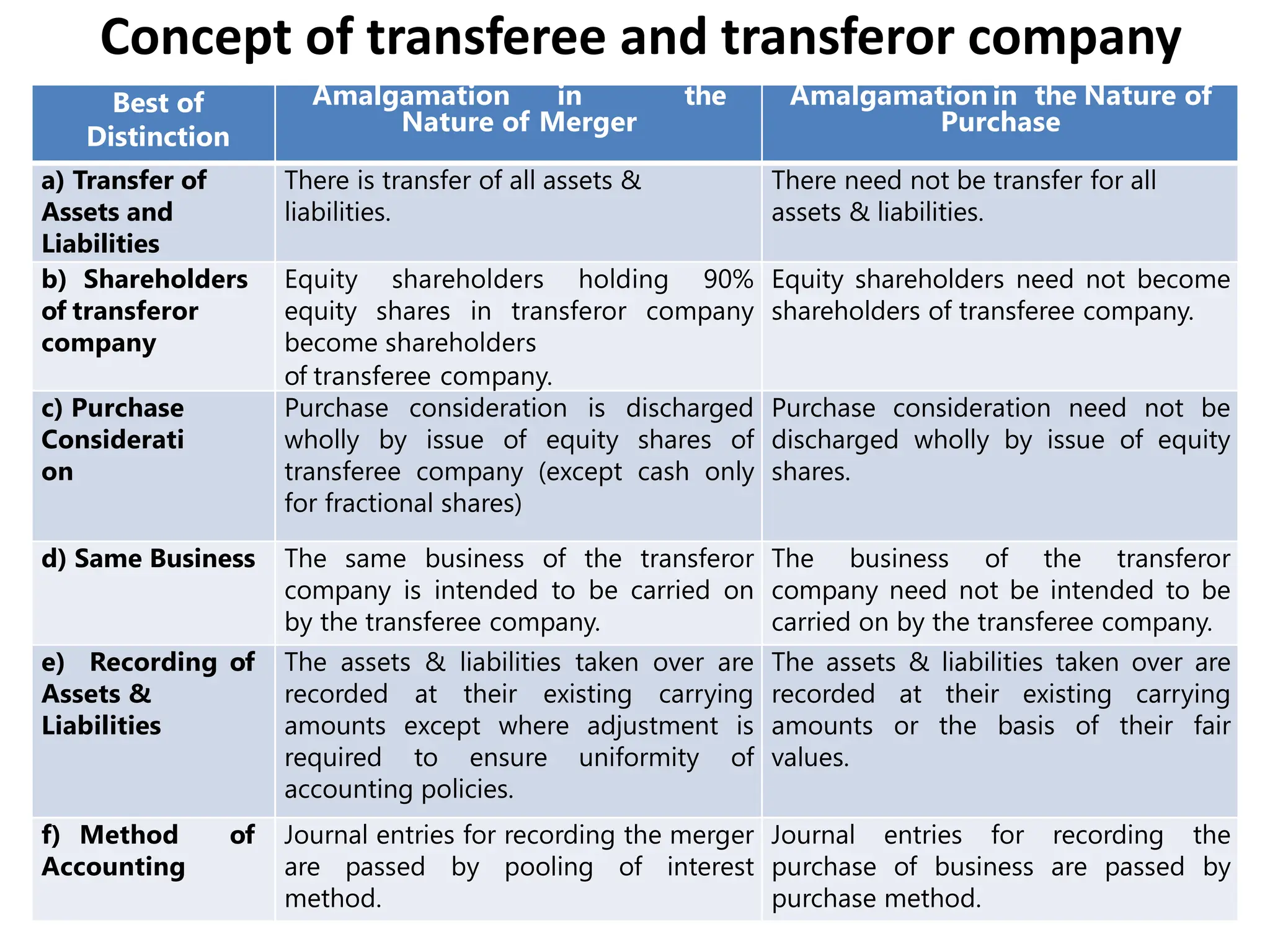

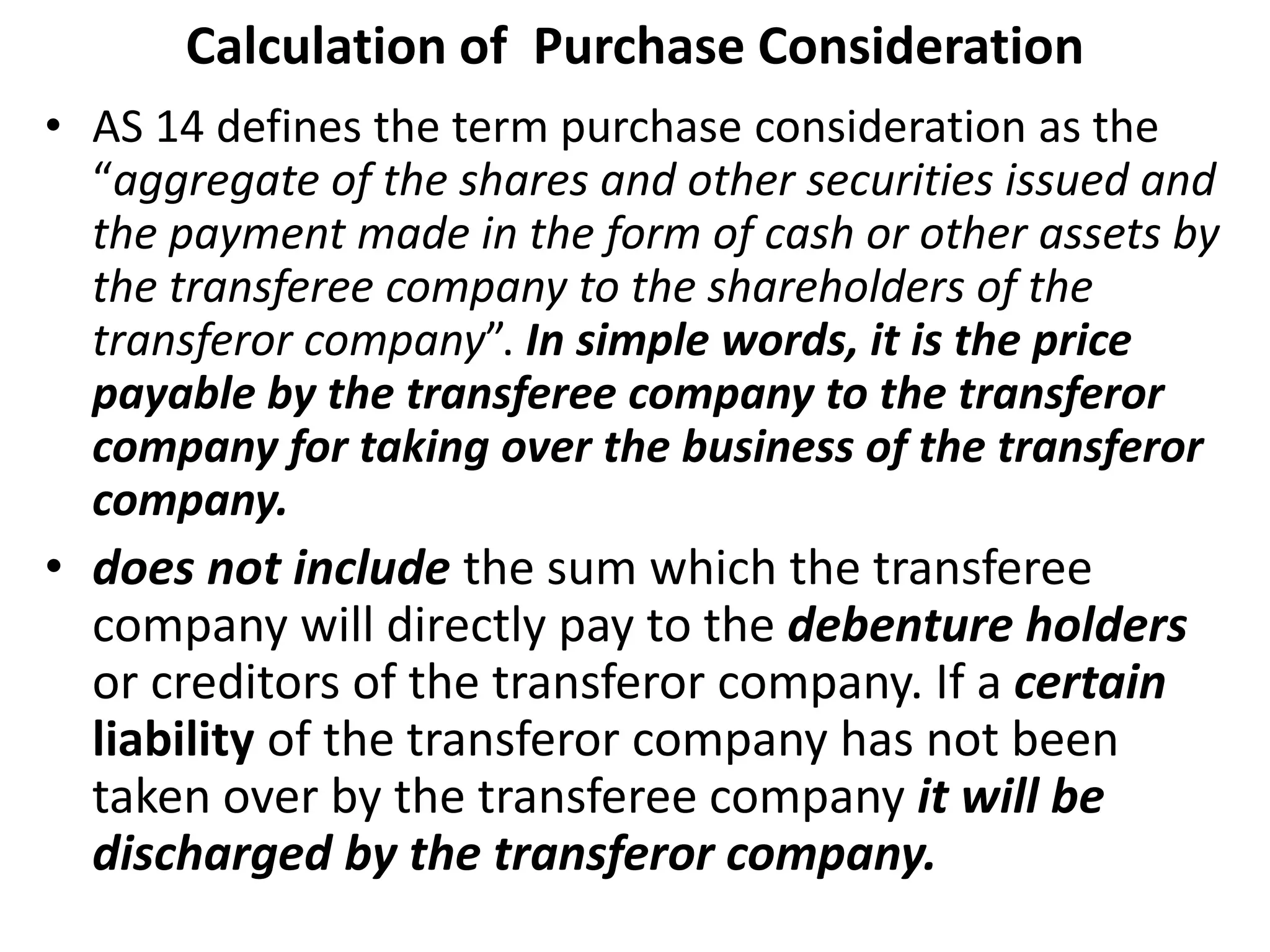

The document explains the concept and accounting methods related to the amalgamation of companies, where two or more companies combine to form a new entity or one absorbs the other. It outlines the distinction between amalgamation in the nature of a merger and purchase, detailing criteria for each type, including treatment of assets, liabilities, and shareholder interests. The calculation of purchase consideration is defined, emphasizing its role in financial transactions during the amalgamation process.