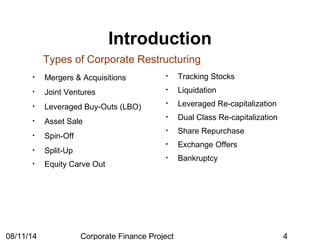

The document discusses corporate restructuring, including mergers and acquisitions, leveraged buyouts, and divestitures, emphasizing their significance for company performance and shareholder value. It details various types of restructuring practices, potential motivations, and impacts on financial stability, alongside case studies such as the Exxon-Mobil merger. The text also explores valuation methods for assessing corporate restructuring processes and the role of financial restructuring amidst changing market conditions.

![08/11/14 Corporate Finance Project 9

• Market multiple analysis

• Corporate valuation model

Vop =

• Equity residual model

Vequity =

• Adjusted Present Value (APV)

Vop = ,

rsU

= rrf

+ MRP*bU

bU

=bL

/ [1 + (D/S)(1-T)]

Merger Analysis: Valuing The Target Firm

Mergers & Acquisitions

∑

∞

= +1 )1(t

t

t

WACC

FCF

∑

∞

= +1 )1(t

t

s

t

r

FCFE

N

sU

N

t

sU

tt

N

t r

HV

r

TSFCF

)1()1(1 +

+

+

+

∑= gWACC

gFCF

HV N

N

−

+

=

)1(](https://image.slidesharecdn.com/corporaterestructuring-140811032159-phpapp01/85/Corporate-Restructuring-A-Financial-Perspective-9-320.jpg)