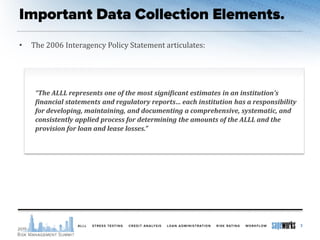

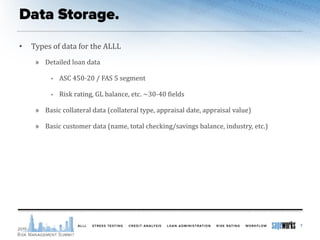

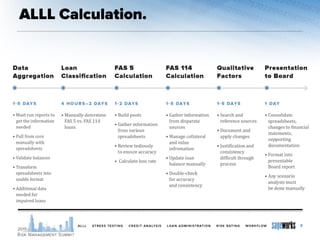

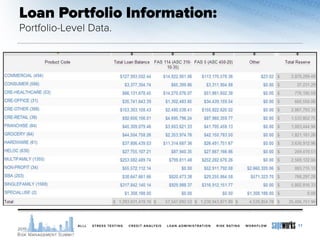

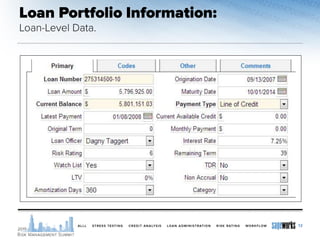

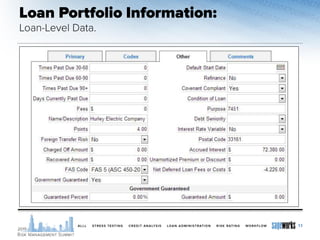

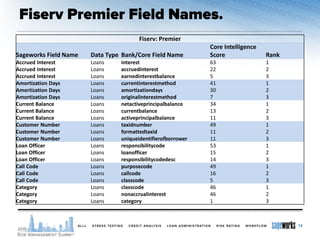

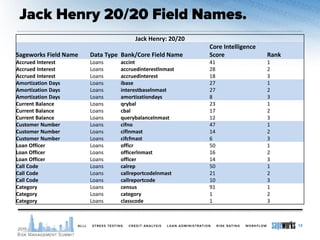

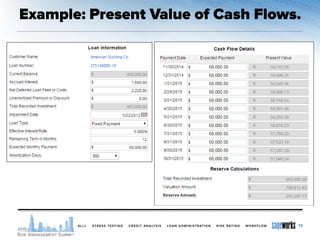

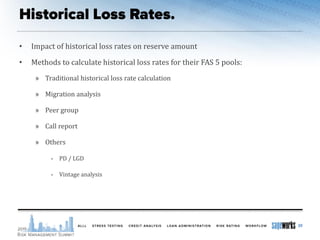

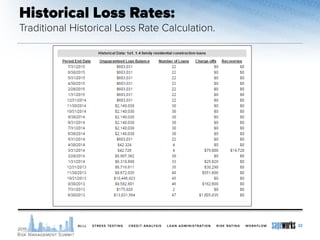

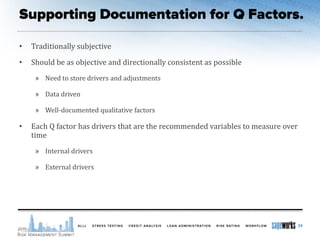

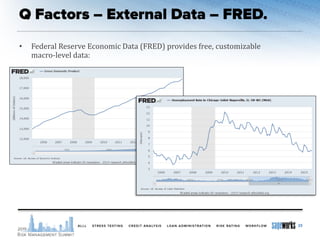

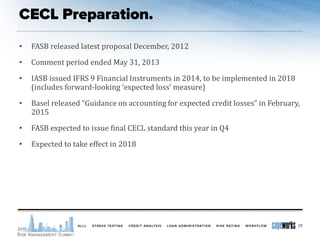

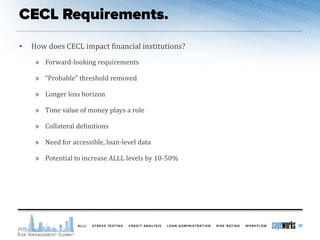

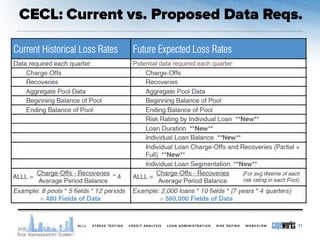

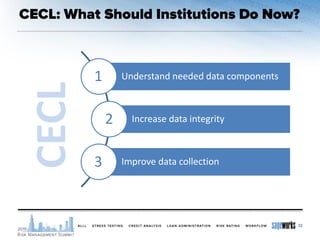

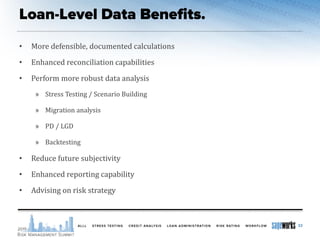

This document discusses key data elements that financial institutions need to collect and store to properly calculate allowances for loan and lease losses (ALLL) and comply with regulatory requirements. It covers loan-level data, collateral data, customer data, risk ratings, and historical loss rates. The document also discusses challenges related to data quality and availability, and preparations needed for the new Current Expected Credit Loss (CECL) model. Overall, it emphasizes the importance of centralized, accessible loan-level data for accurate ALLL calculations and regulatory reporting.