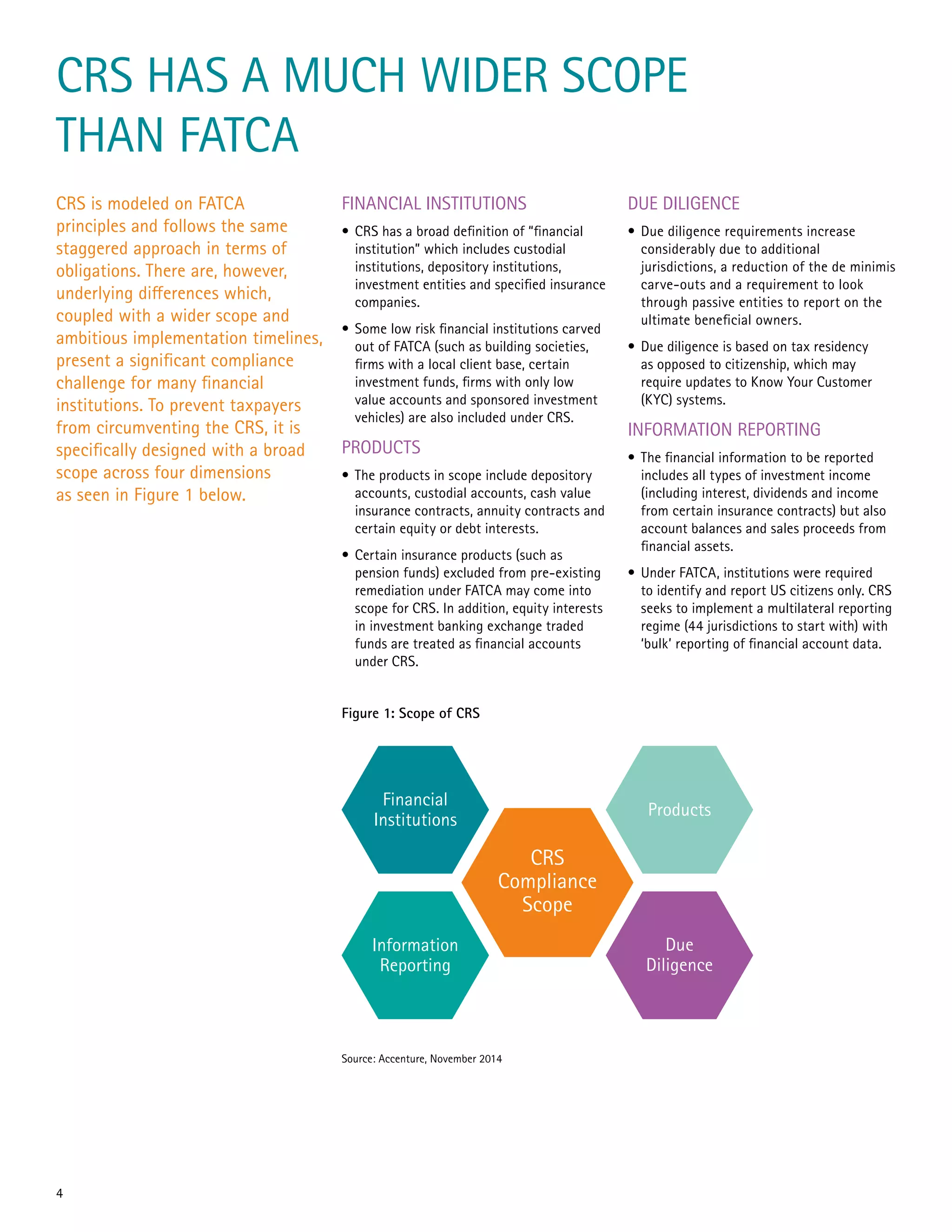

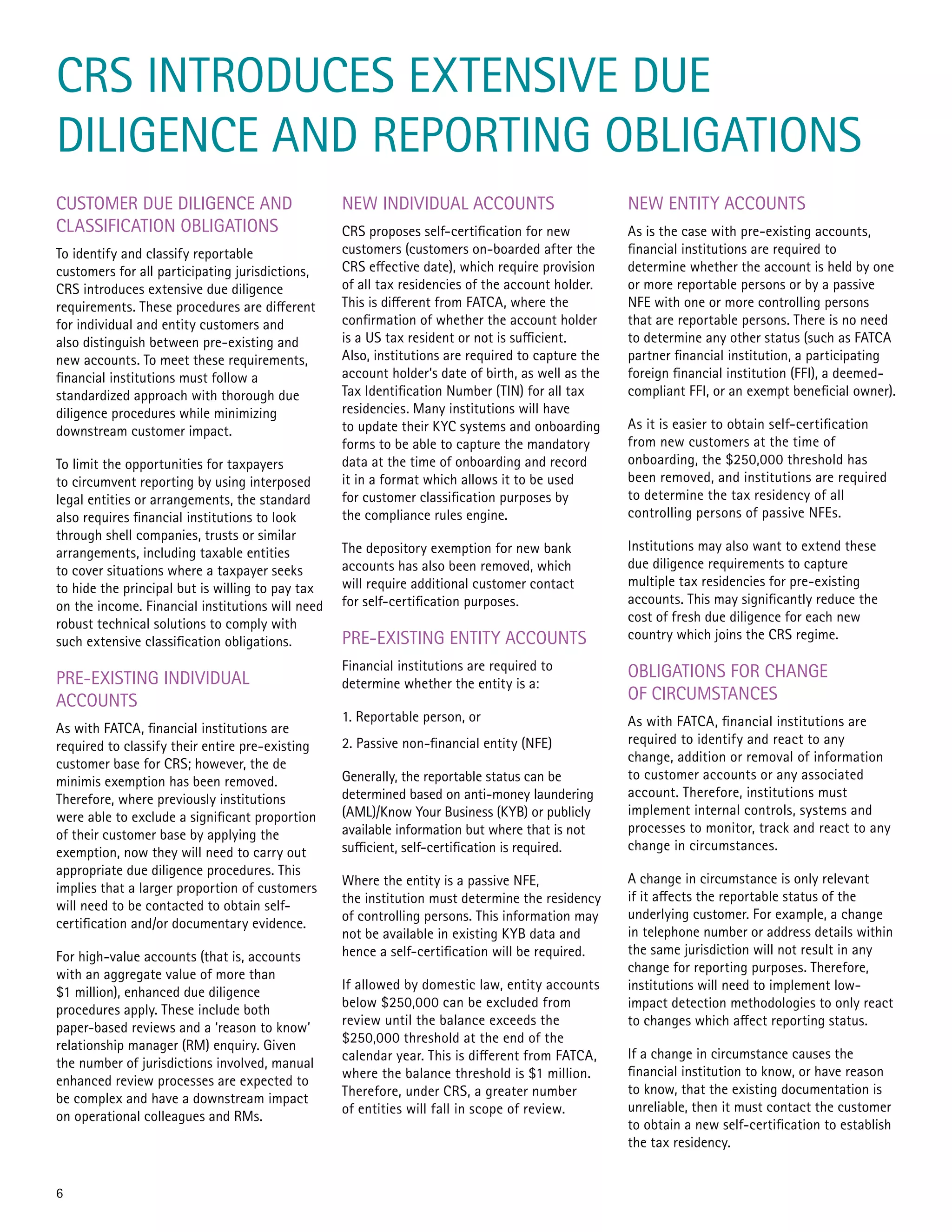

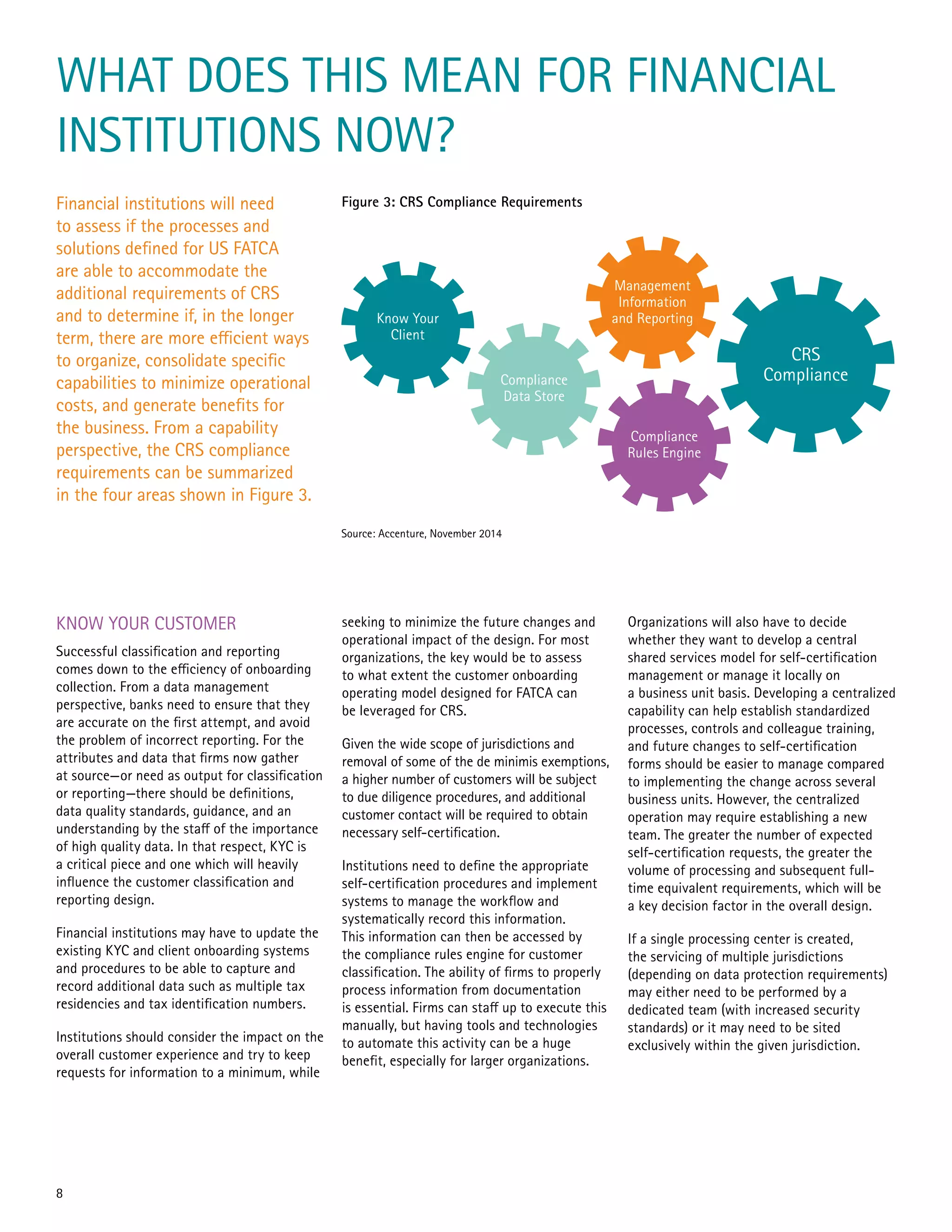

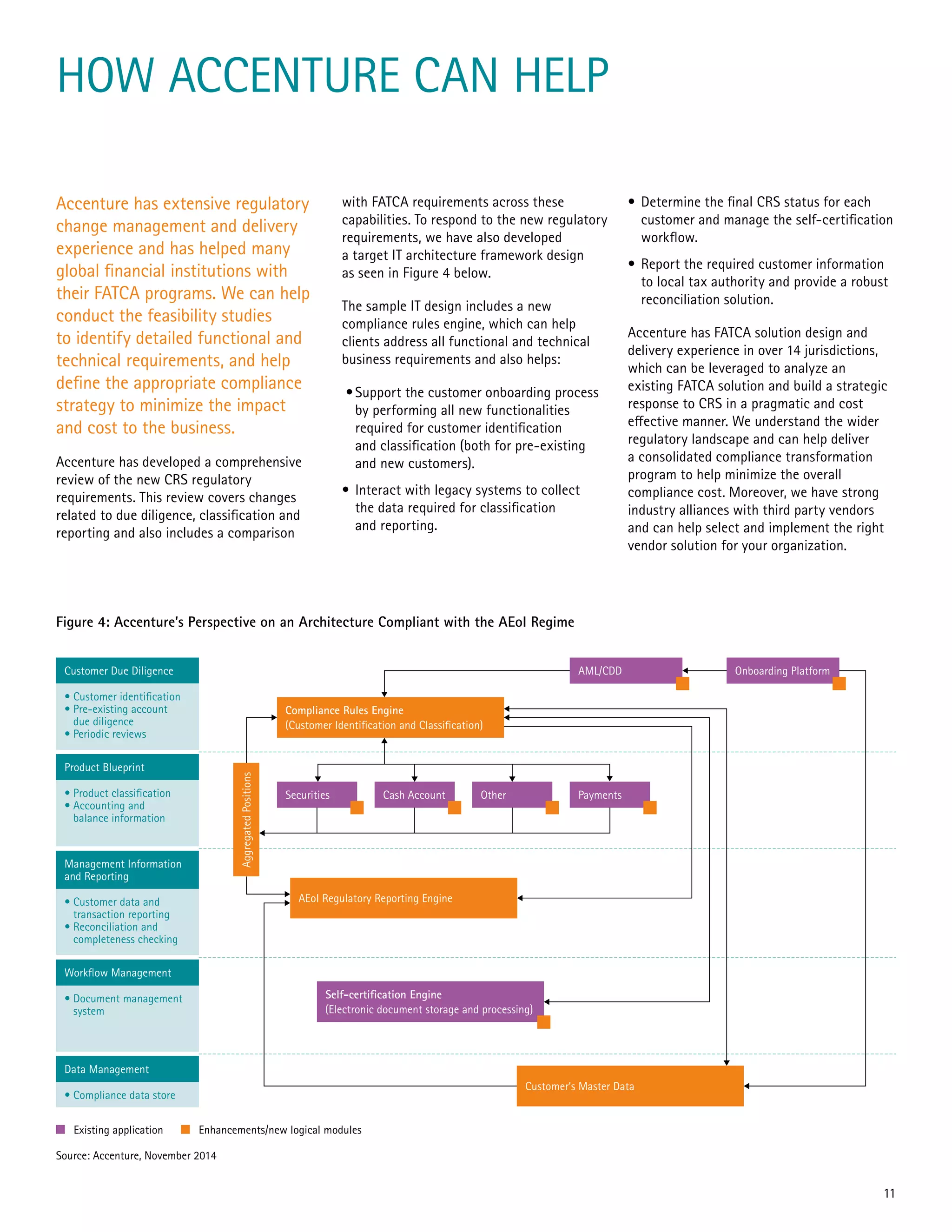

The document discusses the global compliance challenges arising from the automatic exchange of information regime, particularly the Common Reporting Standard (CRS) endorsed by the OECD and G20, which mandates financial institutions to report taxpayer financial data. This regime extends the principles of the US Foreign Account Tax Compliance Act (FATCA) and introduces extensive due diligence, reporting obligations, and customer classifications that highlight the need for financial institutions to adapt their compliance processes. With an ambitious implementation timeline beginning in 2016, financial institutions are urged to strategize for operational effectiveness and compliance cost management amidst increasing regulatory scrutiny.