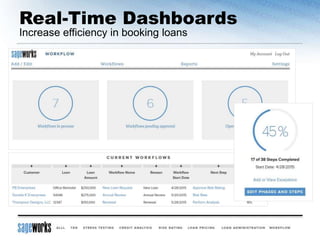

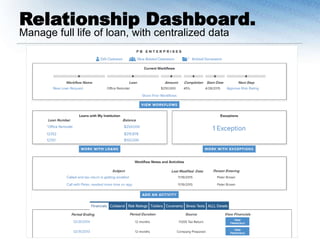

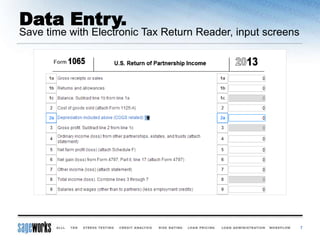

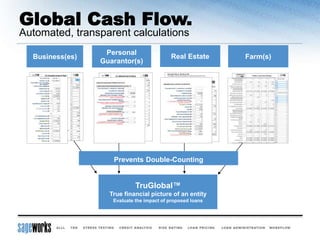

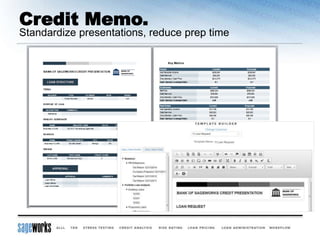

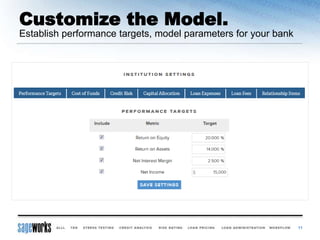

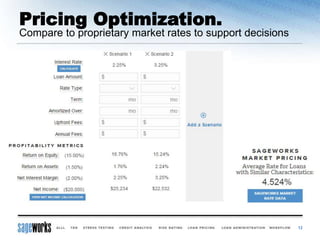

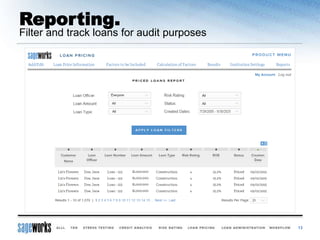

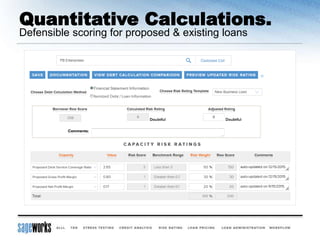

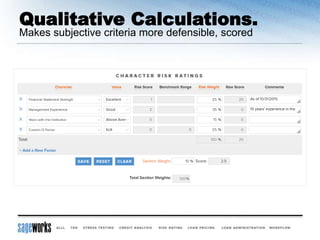

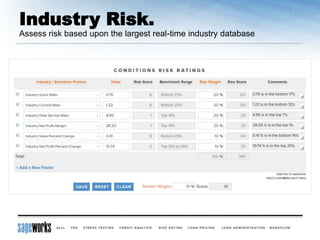

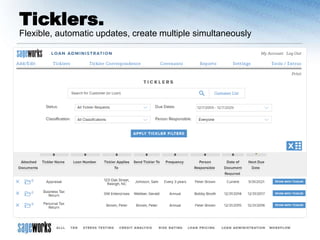

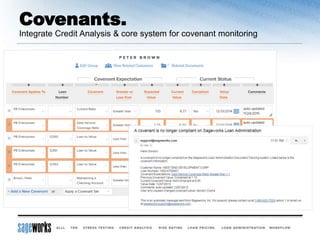

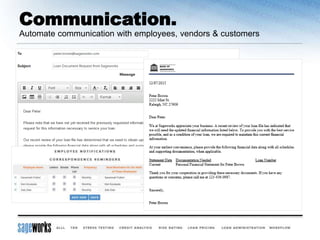

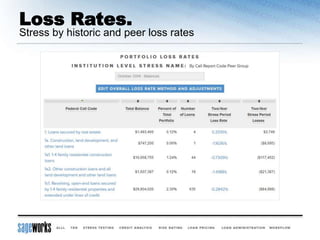

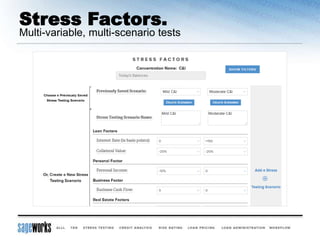

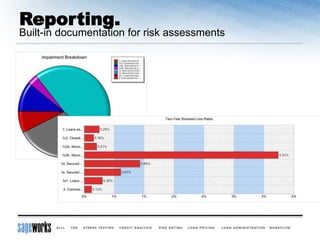

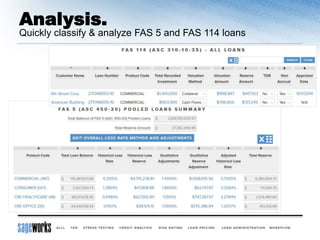

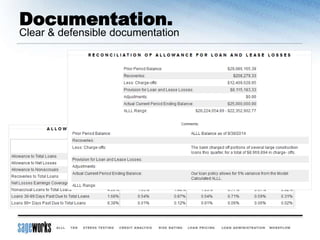

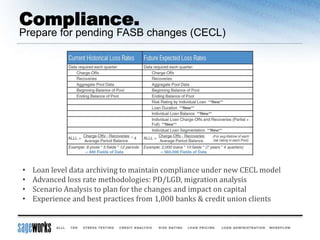

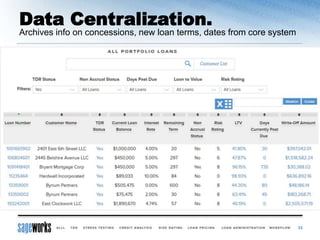

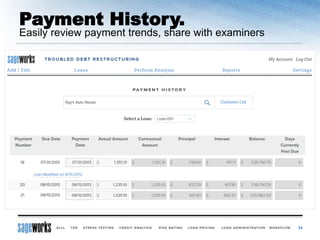

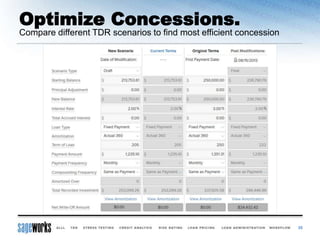

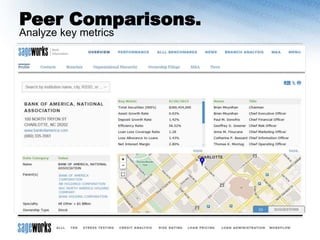

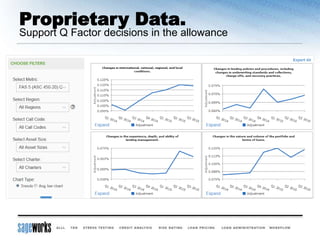

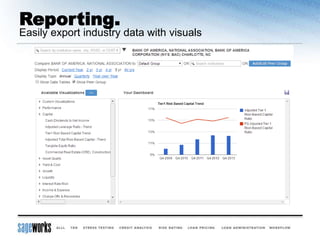

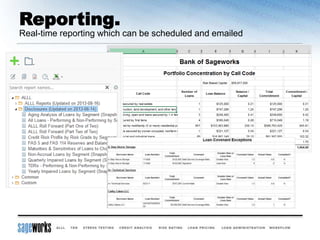

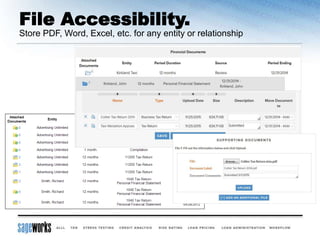

The document outlines the features of Sageworks software designed to improve efficiency and accountability in lending operations through real-time dashboards, credit analysis, and risk management. It includes tools for loan booking, pricing optimization, and performance tracking, while also providing capabilities for stress testing and compliance with reporting standards. Additionally, it offers automated documentation and peer analysis to enhance decision-making and support better portfolio management.