Embed presentation

Downloaded 191 times

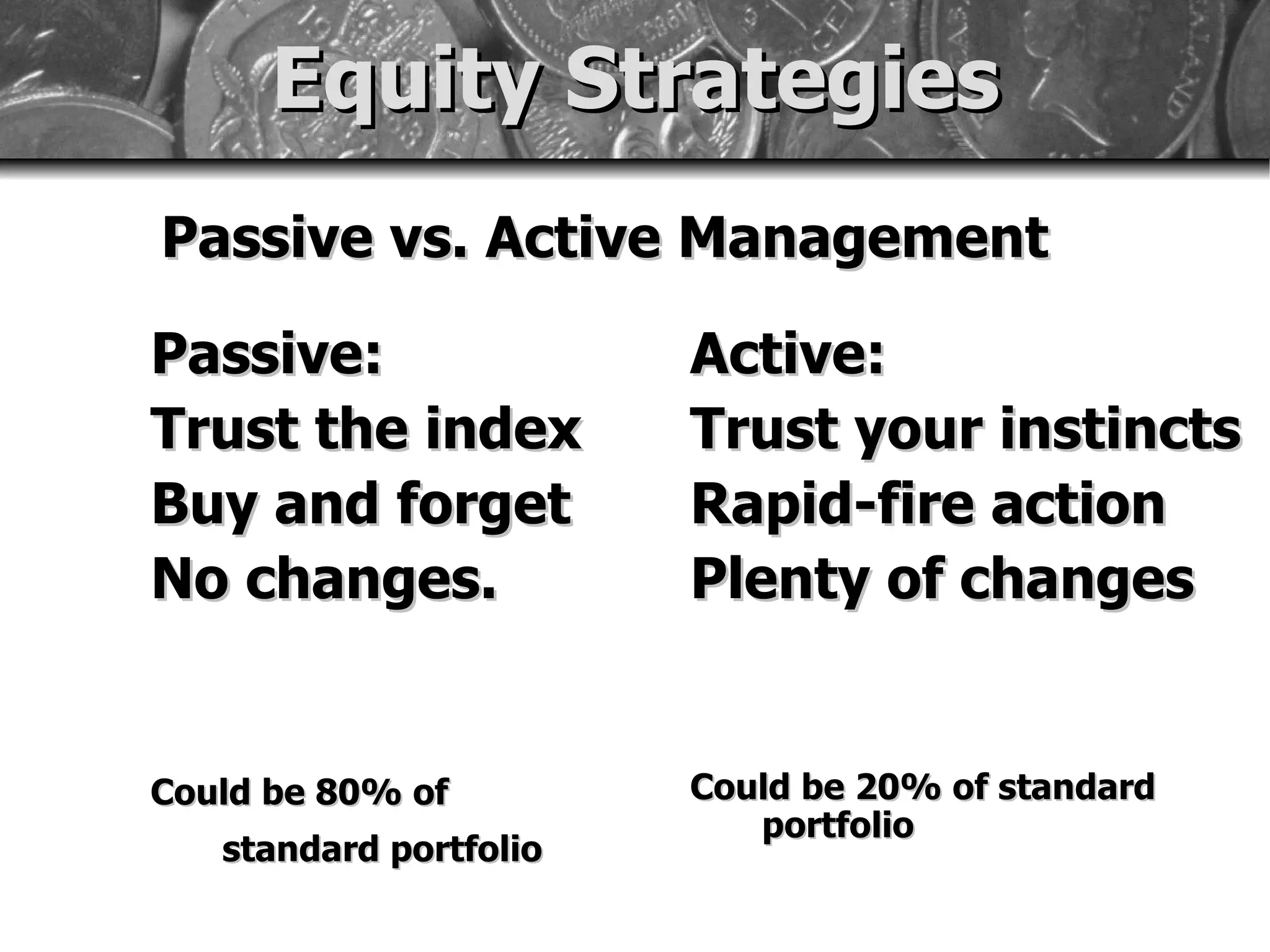

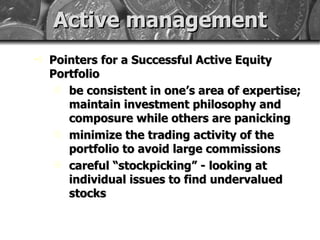

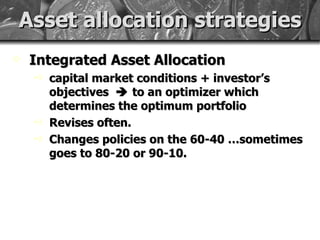

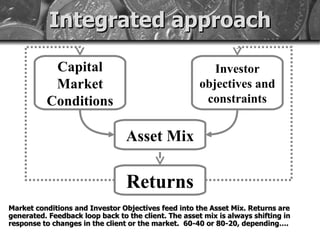

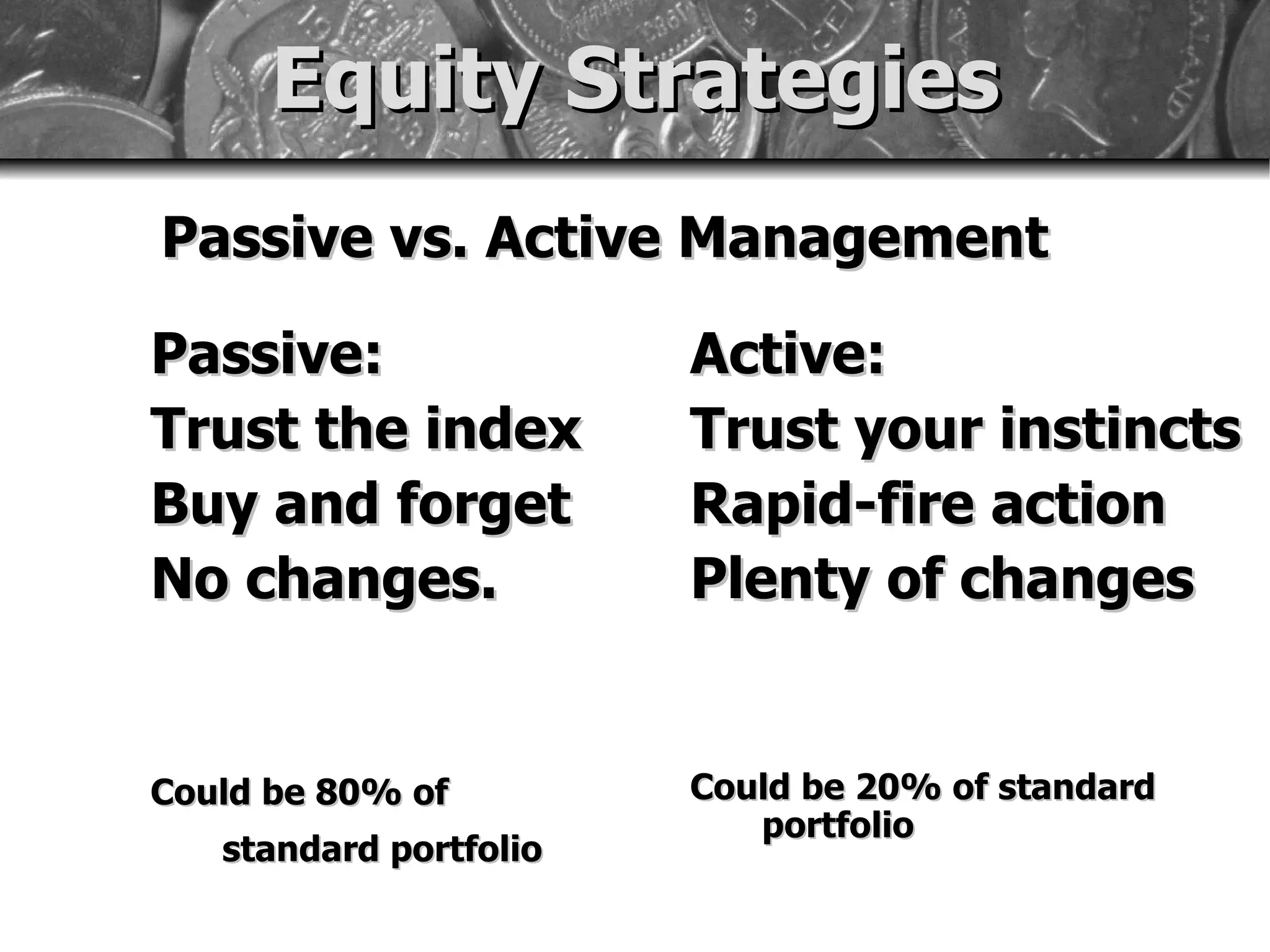

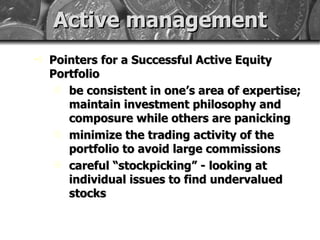

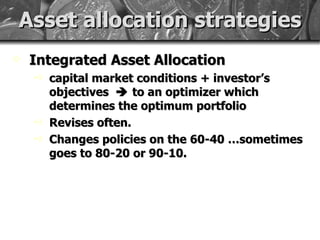

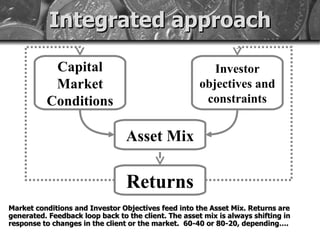

Passive portfolio management involves buying and holding index funds with minimal changes, suitable for 80% of a standard portfolio, while active management relies on stock picking and frequent changes for the remaining 20%, requiring consistency, a clear philosophy, and minimizing trading. An integrated asset allocation approach determines an optimal mix based on capital market conditions and investor objectives, regularly revising the mix such as from 60-40 stocks to bonds or 80-20, with feedback shaping further adjustments over time.