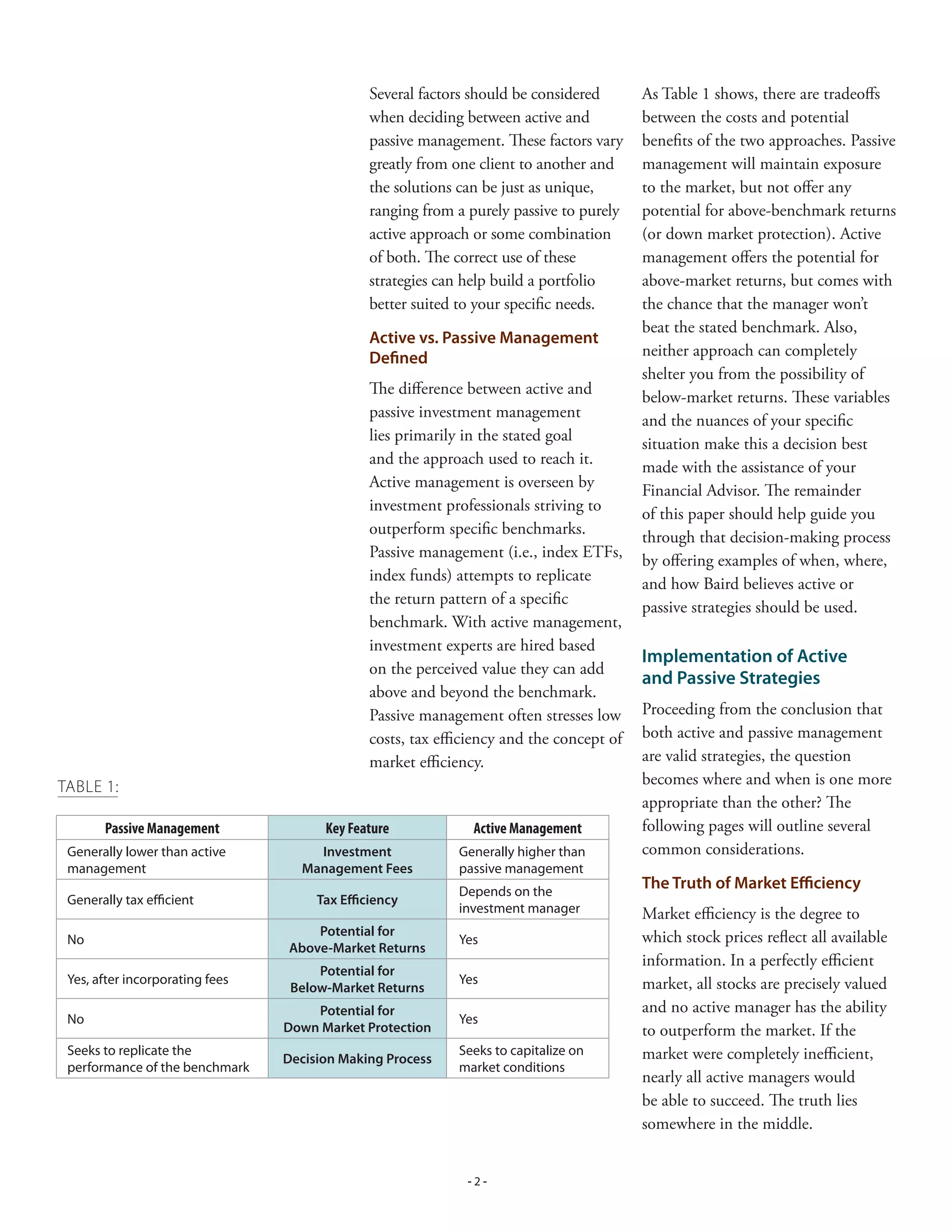

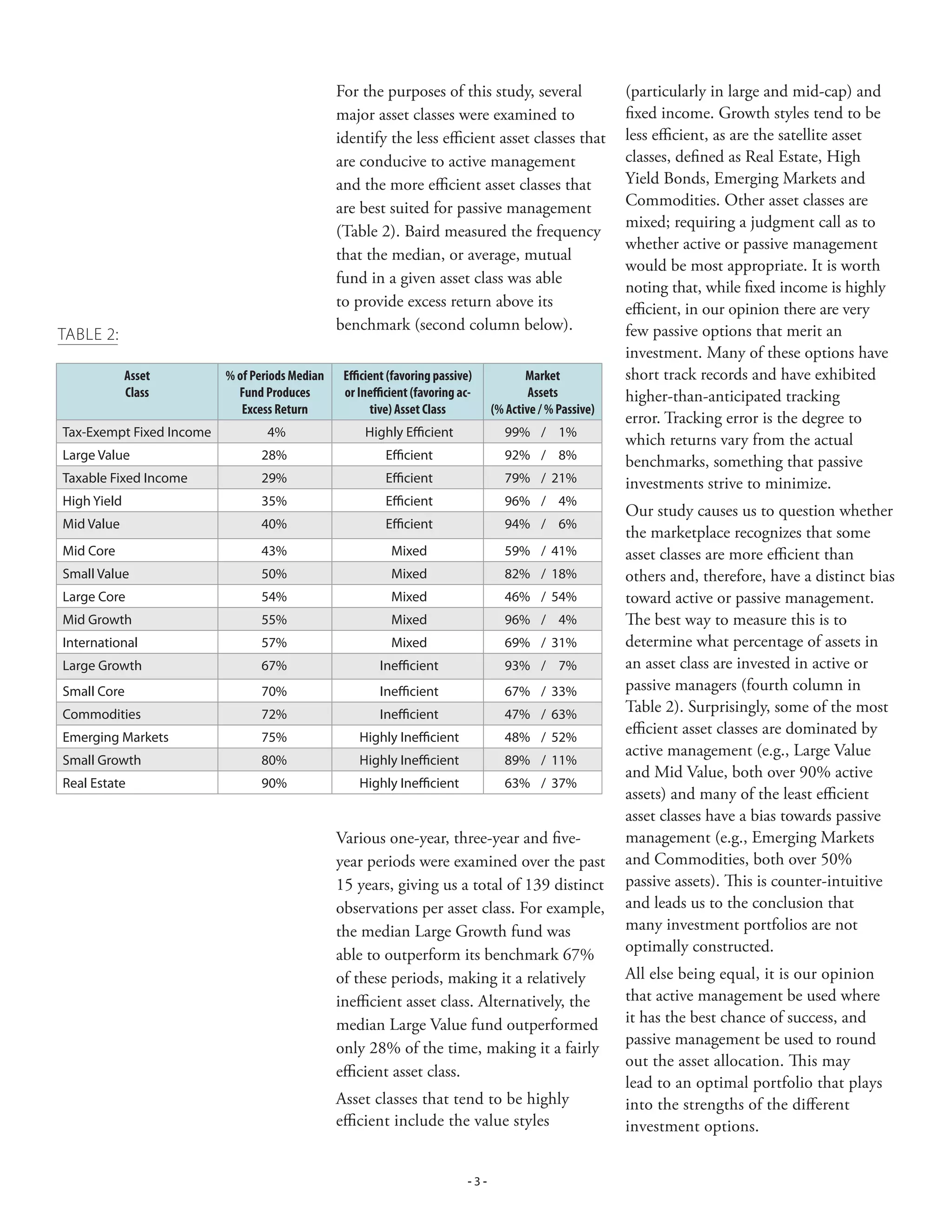

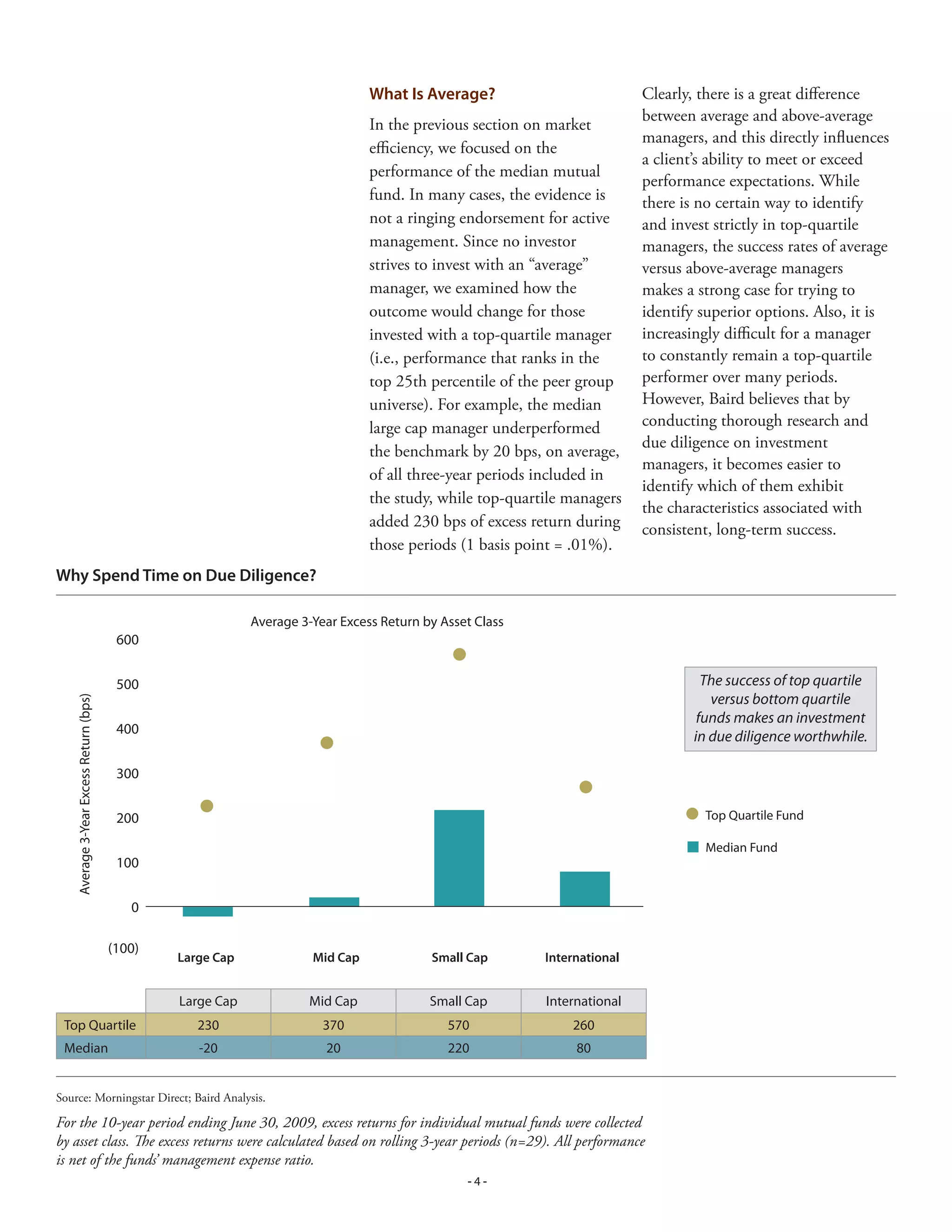

This document discusses the differences between active and passive investment management approaches. It notes that both approaches have merits and drawbacks, so the best strategy depends on an investor's individual needs and preferences. Active management aims to outperform benchmarks by closely managing investments, but has higher fees, while passive management tracks market indexes at lower cost but without potential for above-average returns. The document examines factors like market efficiency, manager performance, fees, time horizons, and tax considerations that influence whether active or passive is more appropriate for different investors and asset classes. It emphasizes the importance of thorough due diligence to identify managers more likely to outperform average peers.