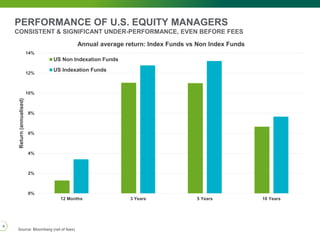

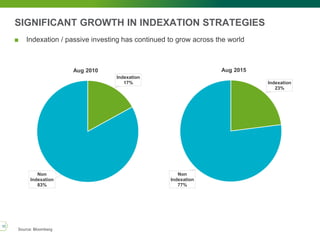

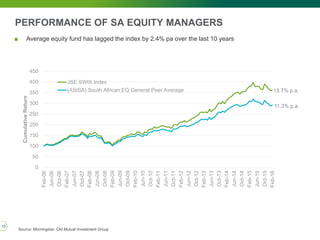

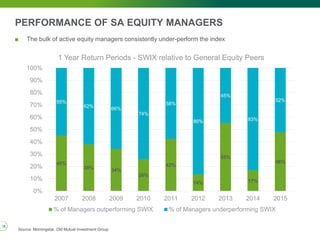

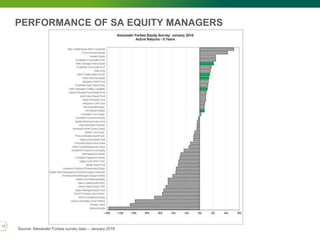

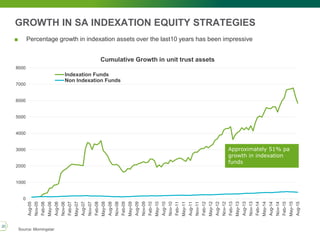

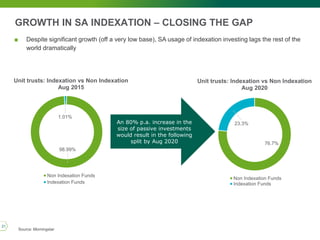

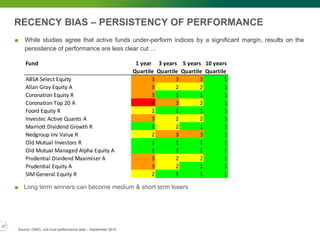

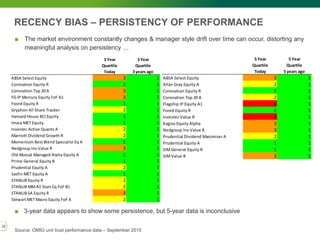

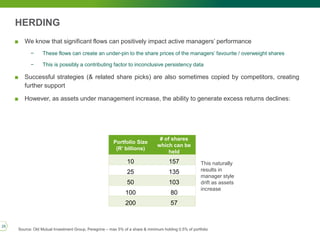

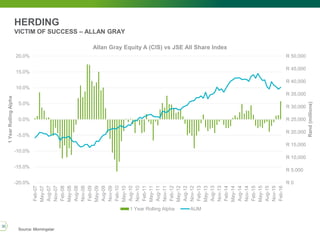

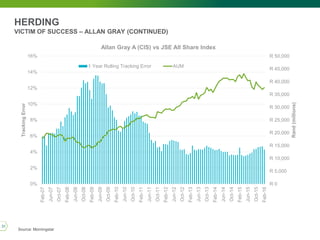

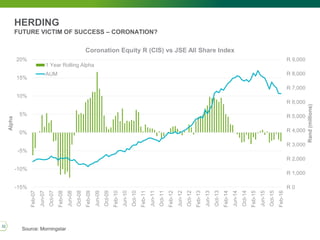

The document discusses implications for South African investors of significant changes affecting the investment landscape. It summarizes that over the last 10 years, most active equity managers in South Africa have underperformed the market index, though some have used large marketing budgets to retain investors. Regulatory changes and cost pressures are now driving many investors toward index funds. Behavioral biases still cause some investors to prefer active managers, choosing those with recent strong performance, but studies show manager performance is generally not persistent and indexing provides better returns over the long run.