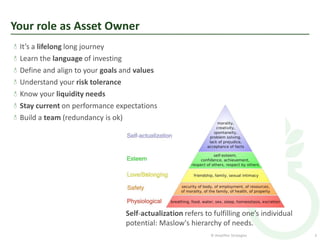

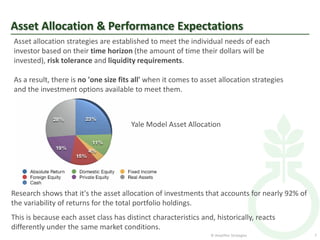

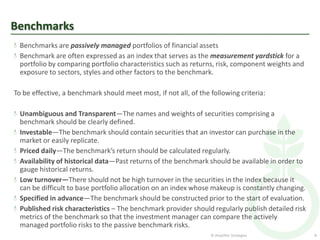

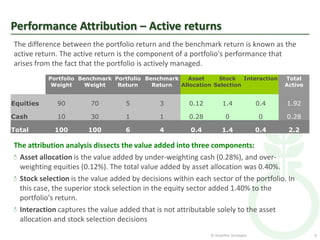

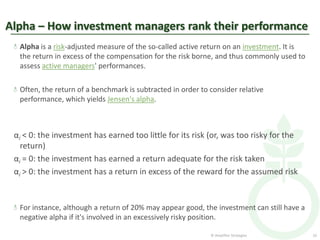

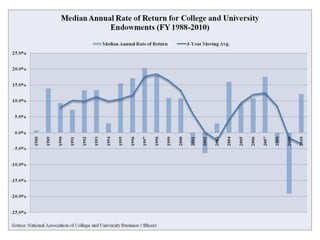

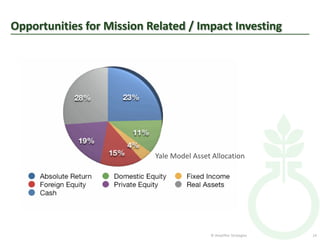

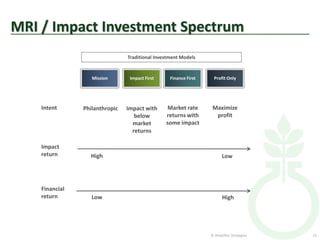

This document discusses reviewing investment performance and opportunities for mission-related and impact investing. It provides an overview of an investor's role, working with investment advisors, asset allocation, performance expectations, and benchmarks. It also discusses where mission and financial performance can intersect for impact investing. The document explores the spectrum of impact versus financial returns and provides examples of how to find quick wins and create lasting impact through investing.