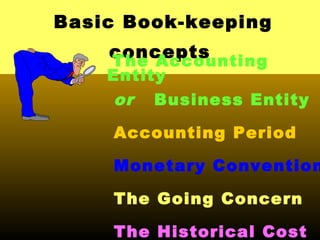

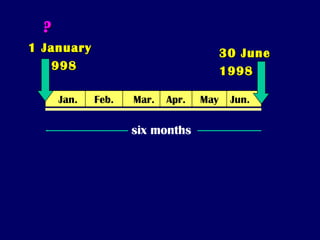

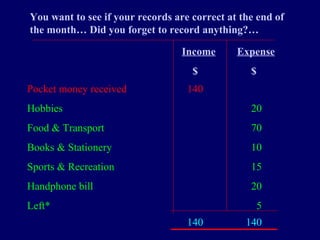

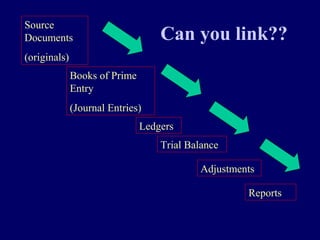

The document introduces key accounting concepts: the accounting entity assumes transactions only related to the business are recorded; the accounting period divides a business's life into fixed time periods like months or years; the monetary convention uses money as the unit of measurement; the going concern assumption considers the business a continuous operation; and the historical cost principle records assets at their original acquisition cost. It then provides examples of basic bookkeeping, recording expenses in categories and preparing a basic income statement to check if records are accurate and money is being managed properly. Finally, it outlines the basic accounting cycle of collecting source documents, recording journal entries, posting to ledgers, preparing a trial balance, making adjustments, and producing financial reports.