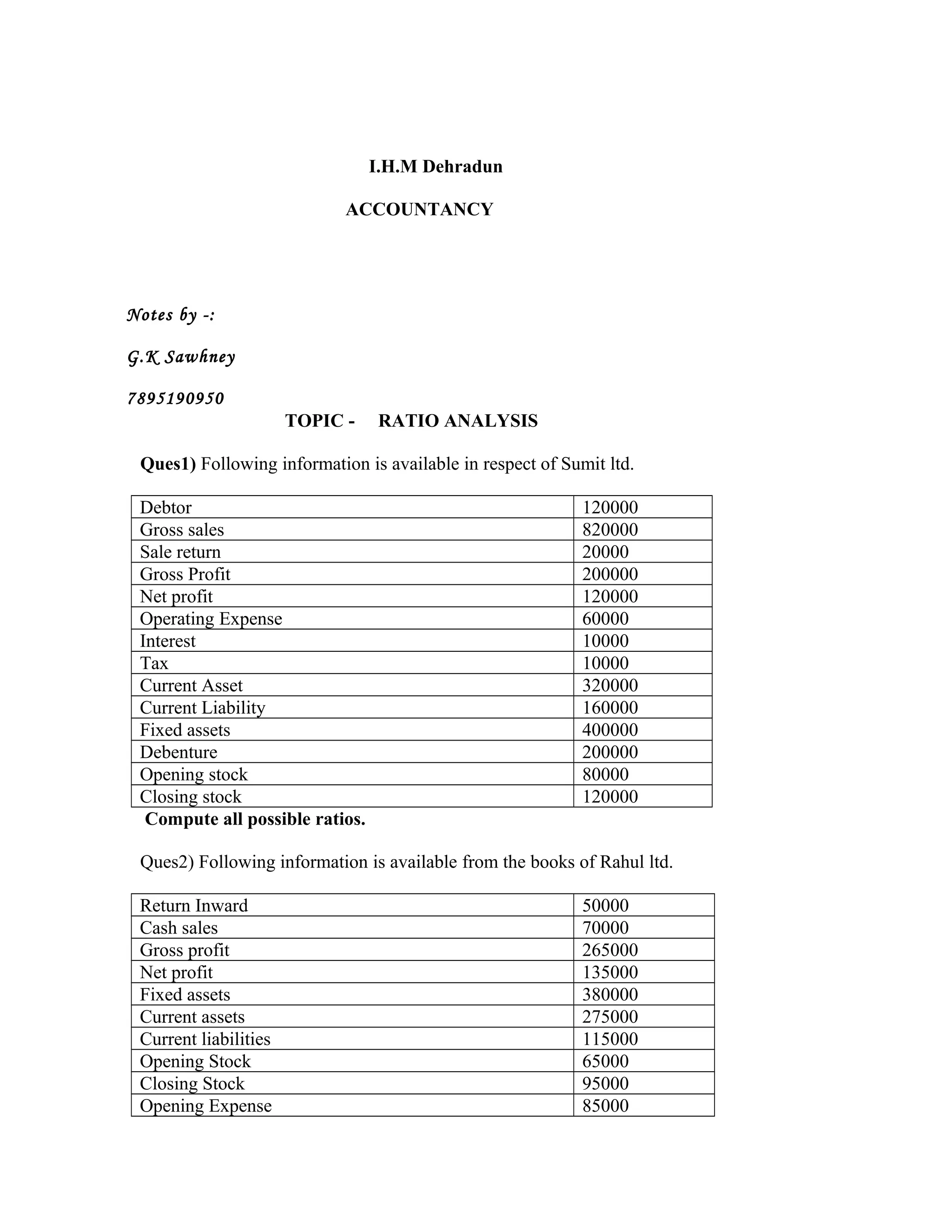

This document contains sample ratio analysis questions and solutions for accounting students. It includes 8 questions with financial information for various companies (Sumit Ltd, Rahul Ltd, Ashish Ltd, Star Hotels, Aditi Ltd, Asish Ltd) and asks the student to calculate various financial ratios for each, such as current ratio, quick ratio, inventory turnover, gross profit ratio, and others. The document is intended to help accounting students learn how to calculate common financial ratios used in ratio analysis.