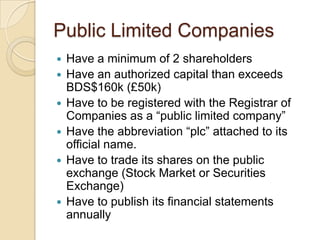

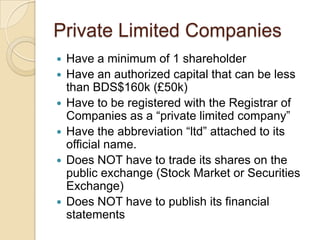

This document provides an introduction to limited liability companies. It defines a limited liability company as a business structure where owners are only liable up to their investment. It discusses the two types of limited liability companies - public and private. Public companies must meet minimum shareholder, capital, and reporting requirements, while private companies have fewer requirements. The document outlines the management, capital structure as shares, types of shares, how dividends are paid, use of debentures, and key accounting aspects like the income statement, appropriation of profit, and balance sheet presentation for a limited liability company.

![LIMITED LIABILITY COMPANIES

(an introduction)

Principles of Accounts [CXC – CSEC]](https://image.slidesharecdn.com/limitedliabilityco-140108205935-phpapp01/85/Limited-liability-Companies-introduction-2-320.jpg)

![Accounting aspects

One is expected to present (at this

level)

◦ The Trading, Profit & Loss a/c

[generally called the income statement]

◦ The Appropriation of Net Profit

[usually attached to the income statement]

◦ The Balance Sheet](https://image.slidesharecdn.com/limitedliabilityco-140108205935-phpapp01/85/Limited-liability-Companies-introduction-12-320.jpg)