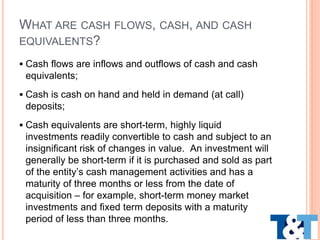

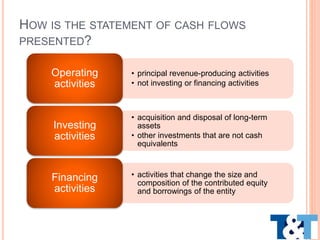

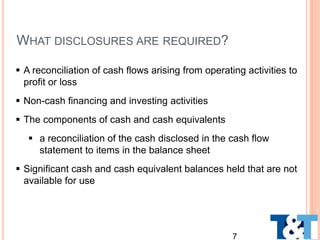

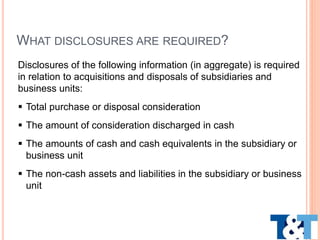

This document discusses the requirements of IND AS 7 regarding the statement of cash flows. It defines cash flows, cash, and cash equivalents. It explains the three categories of cash flows - operating, investing and financing activities. It provides examples of cash flow activities that fall under each category. It discusses the direct and indirect methods for preparing the statement of cash flows. It addresses the classification and disclosure requirements regarding interest, dividends, taxes, acquisitions and disposals.