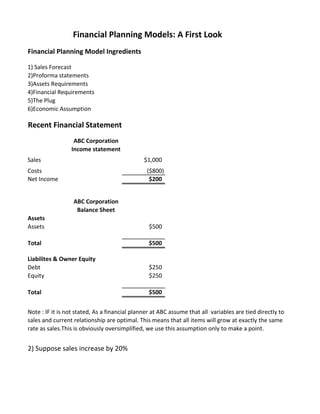

The document outlines the financial planning model ingredients, including sales forecasts and proforma statements, emphasizing the relationship between sales growth and financial policy. It discusses how an increase in sales affects the balance sheet, particularly in terms of liabilities and equity, and introduces the concept of 'plug' variables, which are adjustments made to balance financial projections. Ultimately, it highlights the managerial decisions necessary to finance asset growth as sales increase.