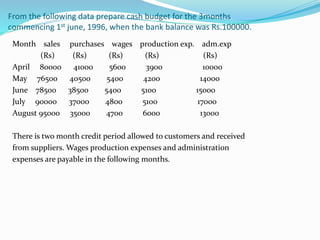

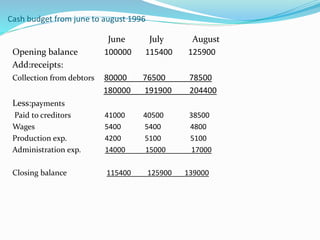

A cash budget is a forecast of estimated cash receipts and payments over a period, such as a month or week. It is important as it allows companies to predict and address possible cash shortages before a crisis. A cash budget also helps identify timing of commitments, periods of excess funds, and weaknesses in debt collection. To prepare a cash budget, all estimated cash inflows such as sales, loans, and asset sales are recorded, as well as estimated cash outflows like expenses, principal payments, and capital expenditures. The cash budget is then used to forecast the ending cash balance for each period.