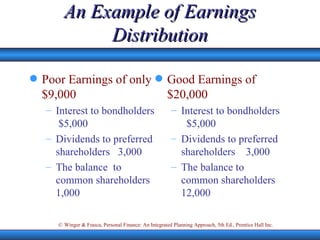

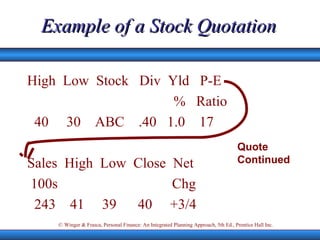

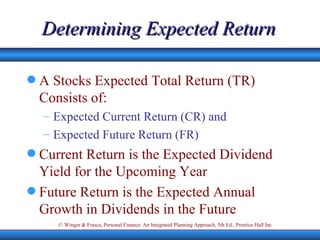

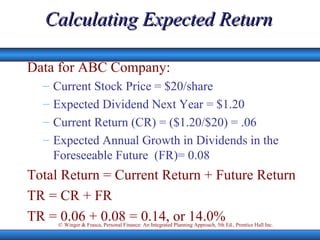

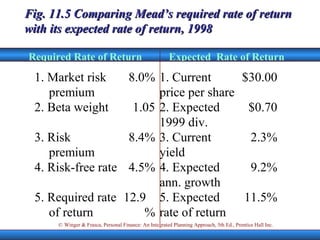

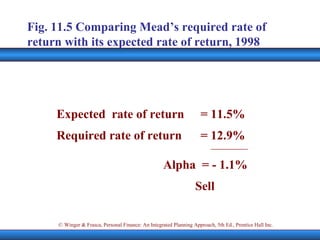

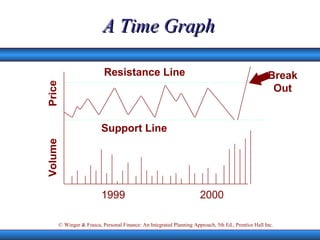

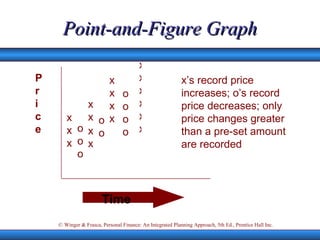

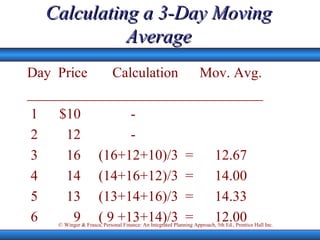

The document summarizes key concepts about common stock, including shareholders' rights, distributions to shareholders, fundamental and technical analysis techniques. It discusses characteristics of common stock like voting rights and residual claims, as well as how earnings and dividends are distributed. Methods of fundamental analysis like CAPM, P/E ratios, and book values are covered. Technical analysis indicators including moving averages and point-and-figure charts are also introduced.