Embed presentation

Download to read offline

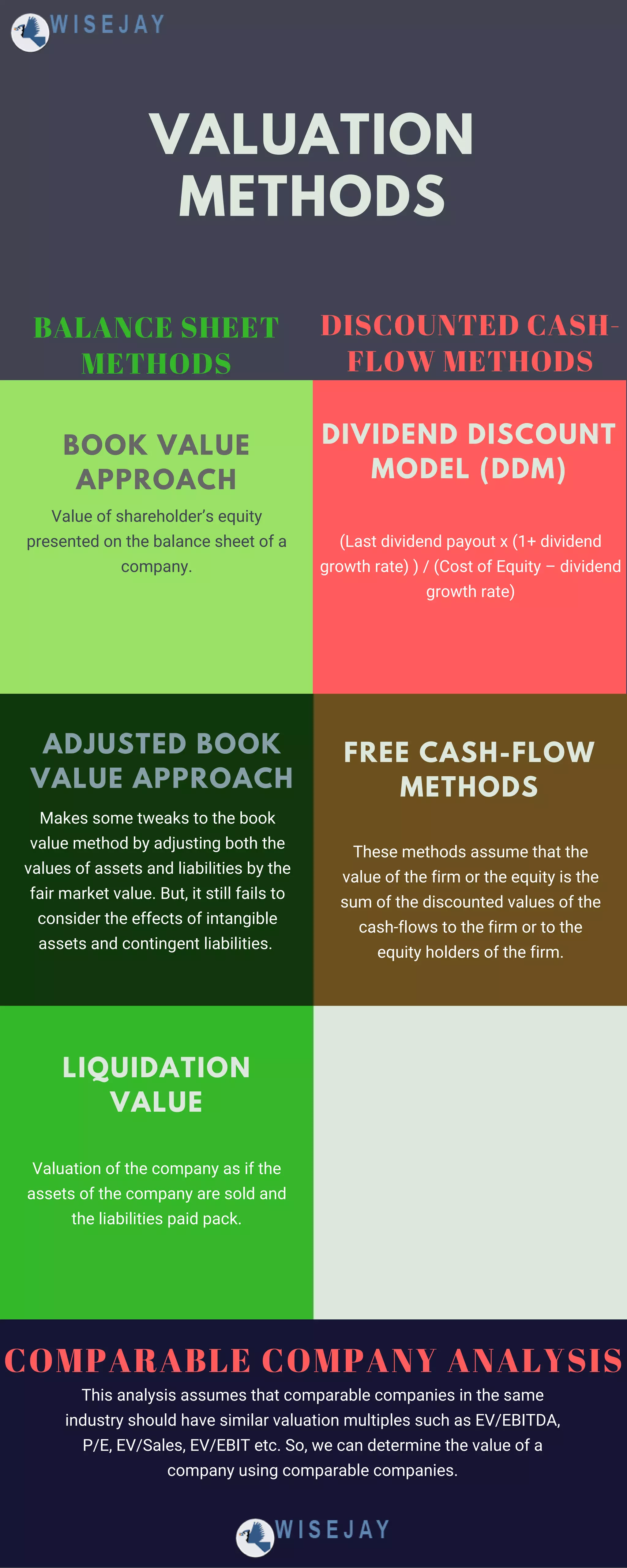

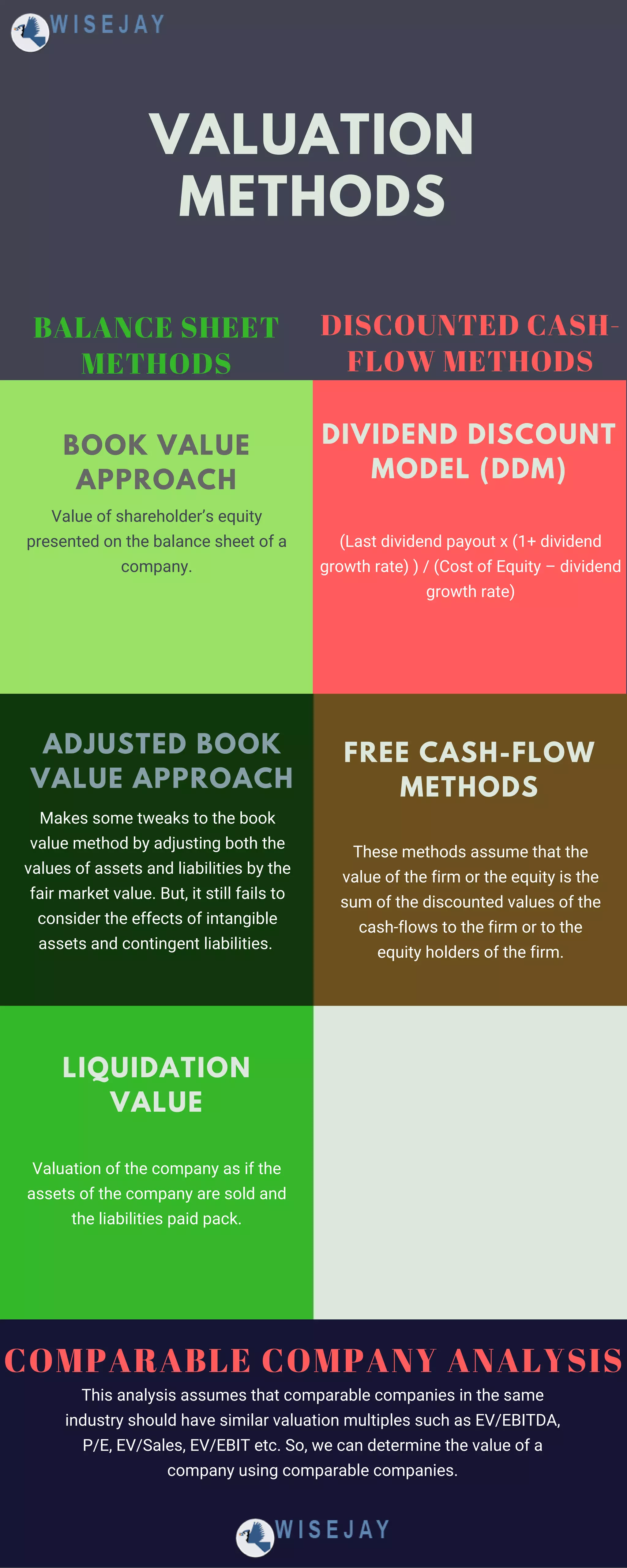

The document discusses various approaches to company valuation, including adjusted book value, dividend discount model, and comparable company analysis. It highlights the importance of fair market value adjustments and notes limitations related to intangible assets and contingent liabilities. Several valuation methods are mentioned, such as free cash-flow and liquidation value assessments.