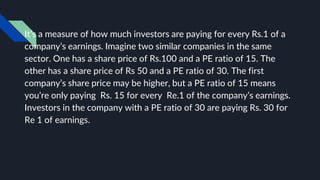

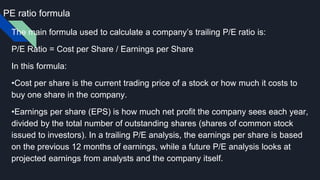

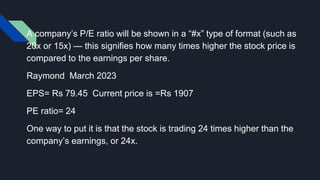

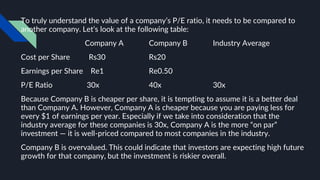

PE ratio is a metric that compares a company's stock price to its earnings per share. It indicates how much an investor pays for each dollar of earnings. A PE ratio is calculated by dividing the current stock price by the earnings per share. PE ratios help investors compare similar companies and determine if a stock is undervalued, appropriately priced, or overvalued. Factors like growth rates, profit margins, returns, macroeconomic conditions, and intangible assets can impact a company's PE ratio. Comparing a company's PE ratio to its industry peers provides useful insight into how the market values that company.