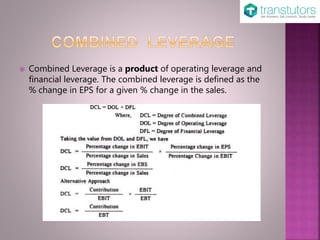

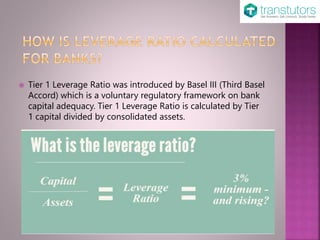

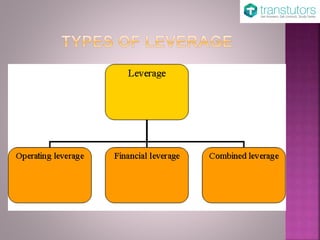

The document discusses leverage in finance, explaining its use of financial instruments to generate profit beyond investment amounts, along with leverage ratios to assess companies' capital structures. It defines key concepts such as operating and financial leverage, describes various leverage and activity ratios, and discusses the Tier 1 leverage ratio established by Basel III for bank capital adequacy. Overall, the document offers insights into how leverage impacts earnings and financial health in a firm.

![ The Financial Leverage

measures the relationship

between EBIT and the EPS.

EPS= [(EBIT – INTEREST)*(1

– t)] / Number of shares

Financial leverage is

defined as the % change in

EPS divided by the %

change in EBIT.](https://image.slidesharecdn.com/leverageratios-170530070012/85/Leverage-Ratios-Finance-6-320.jpg)