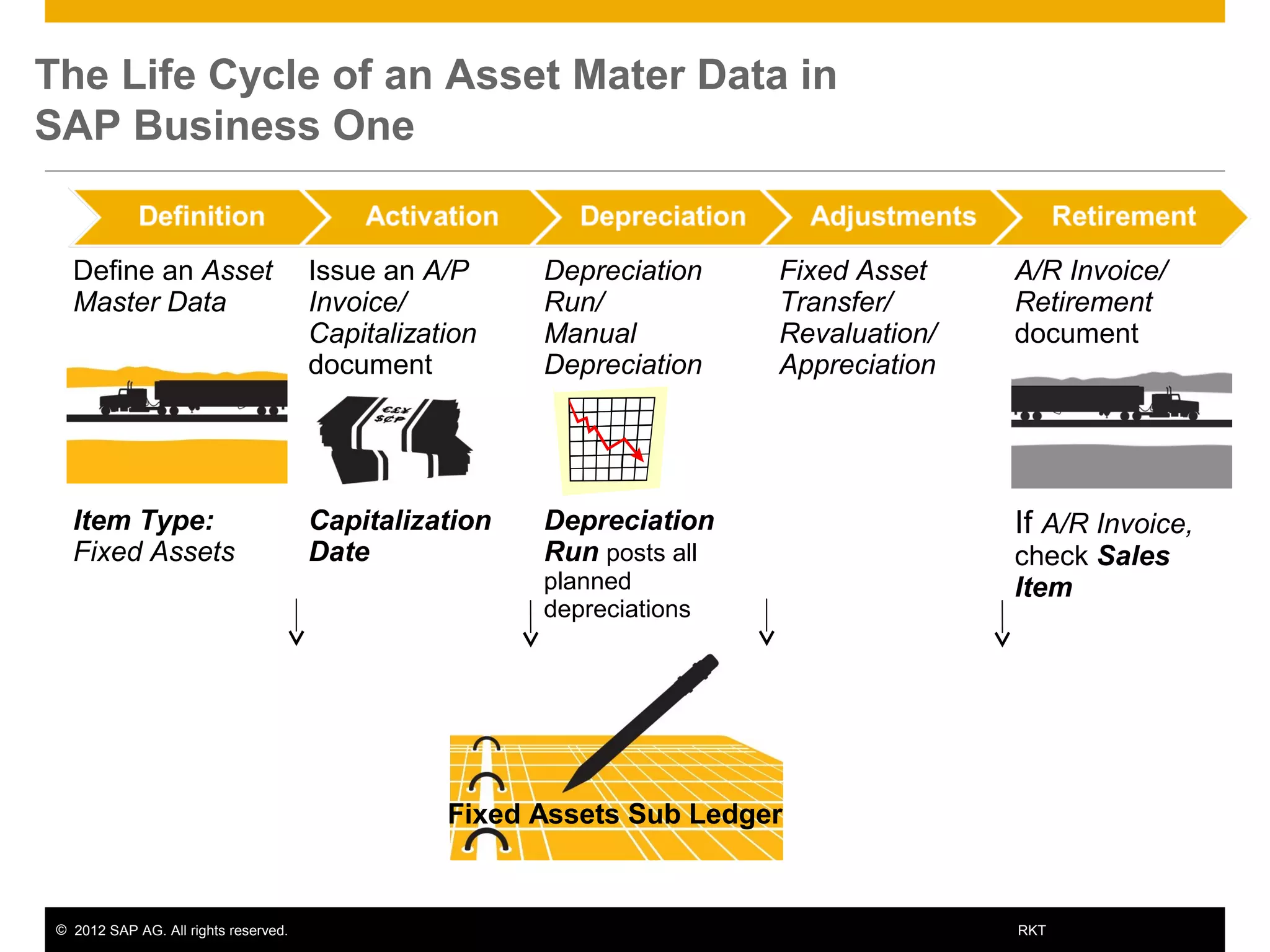

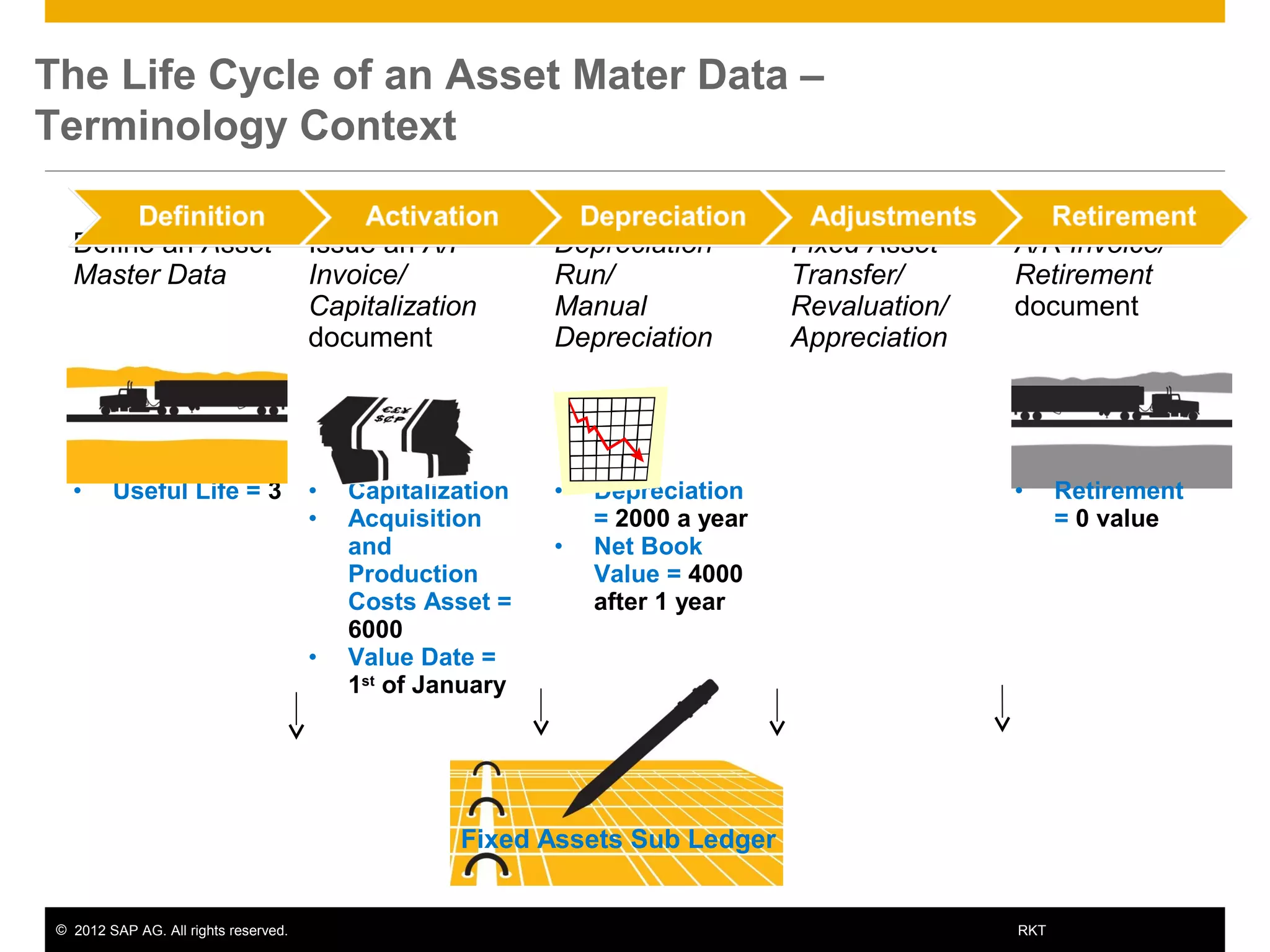

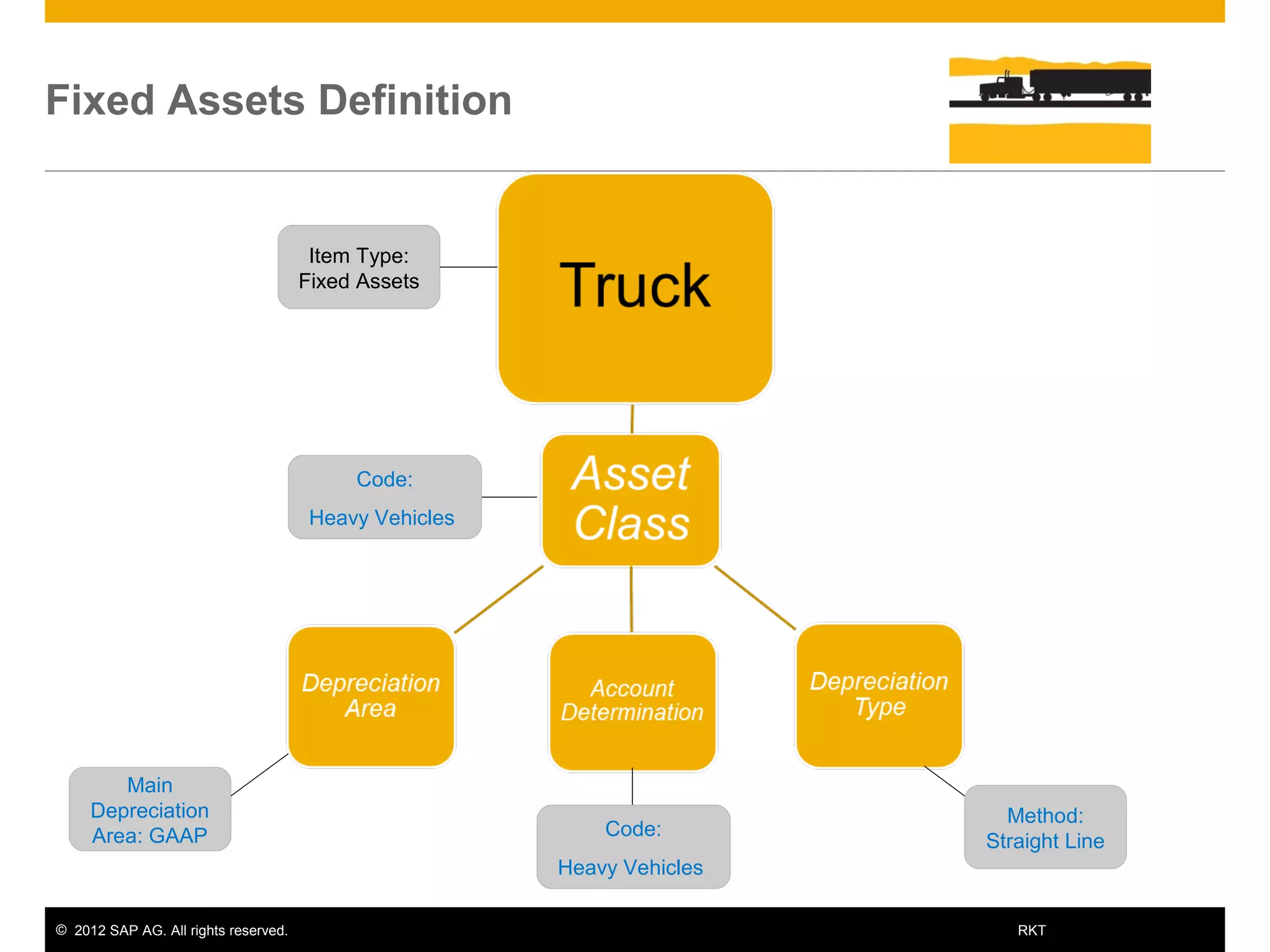

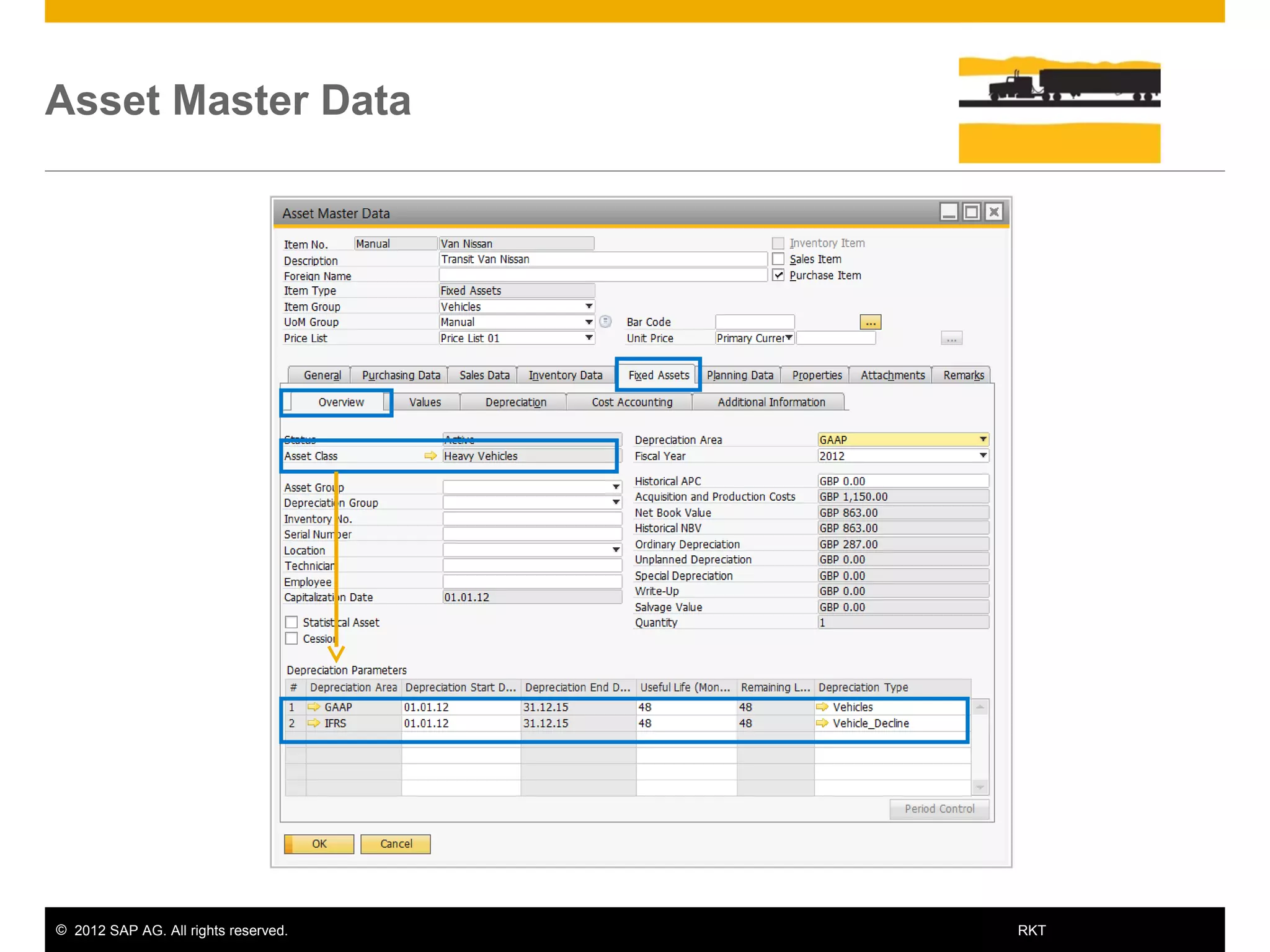

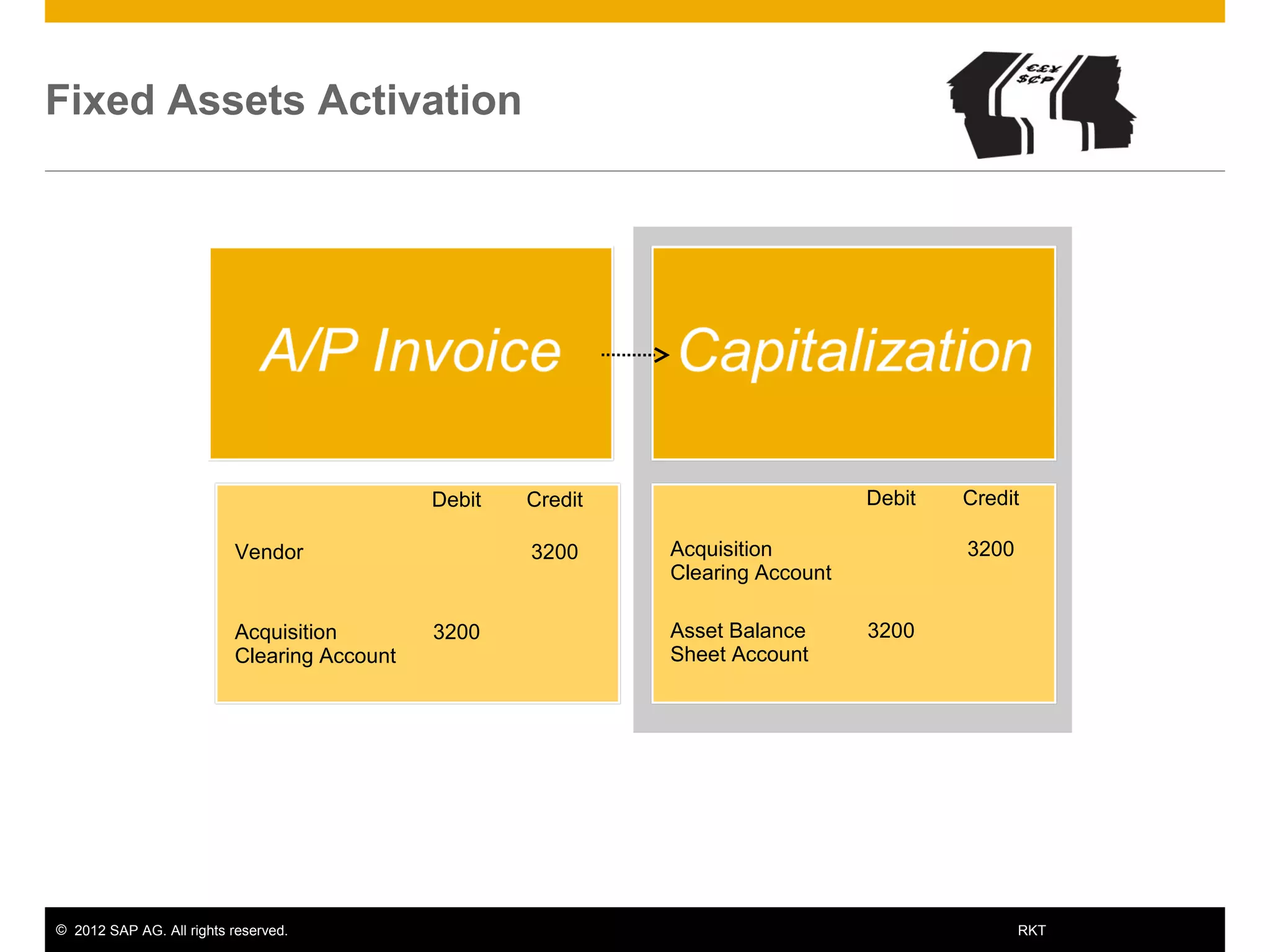

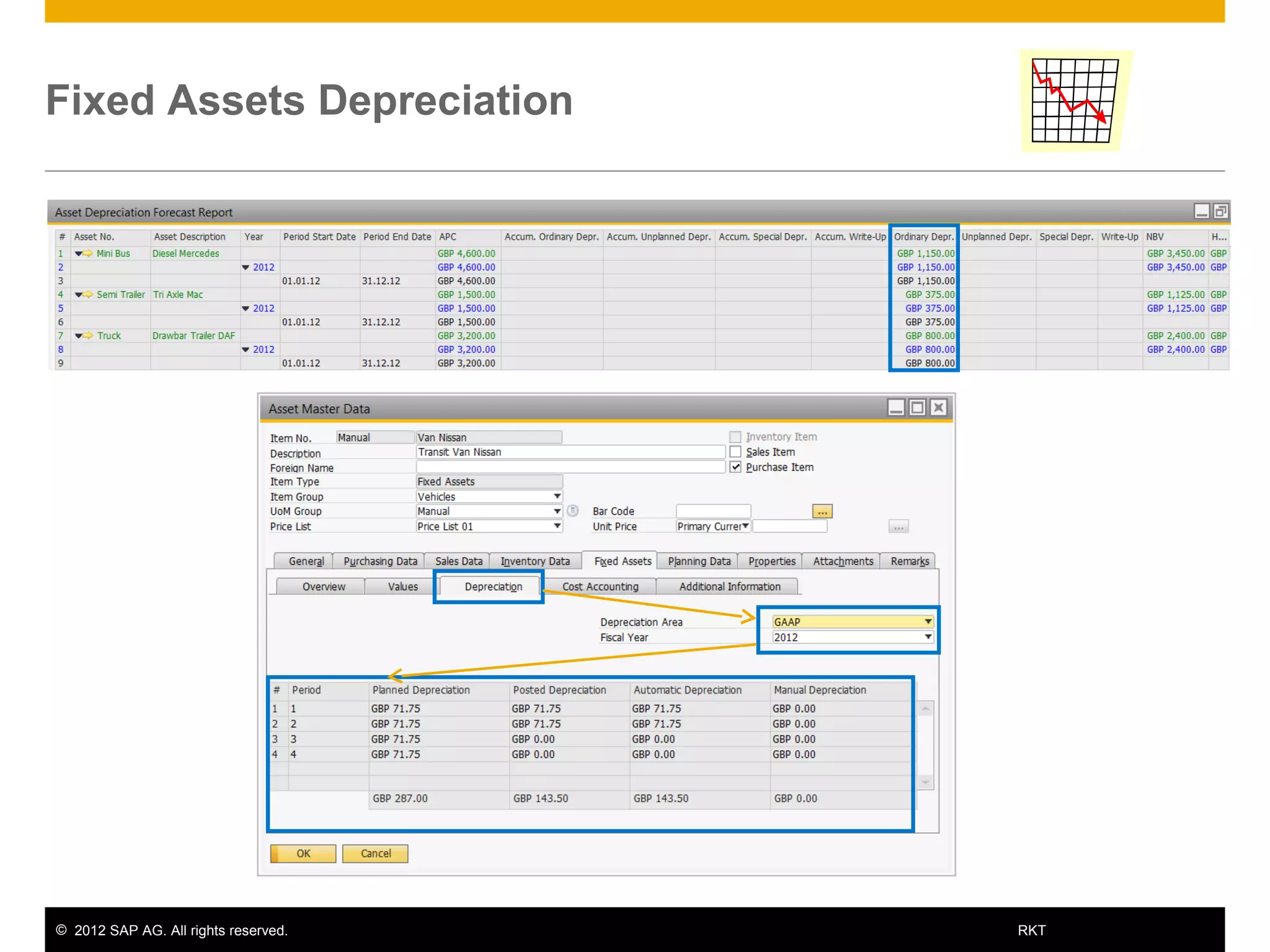

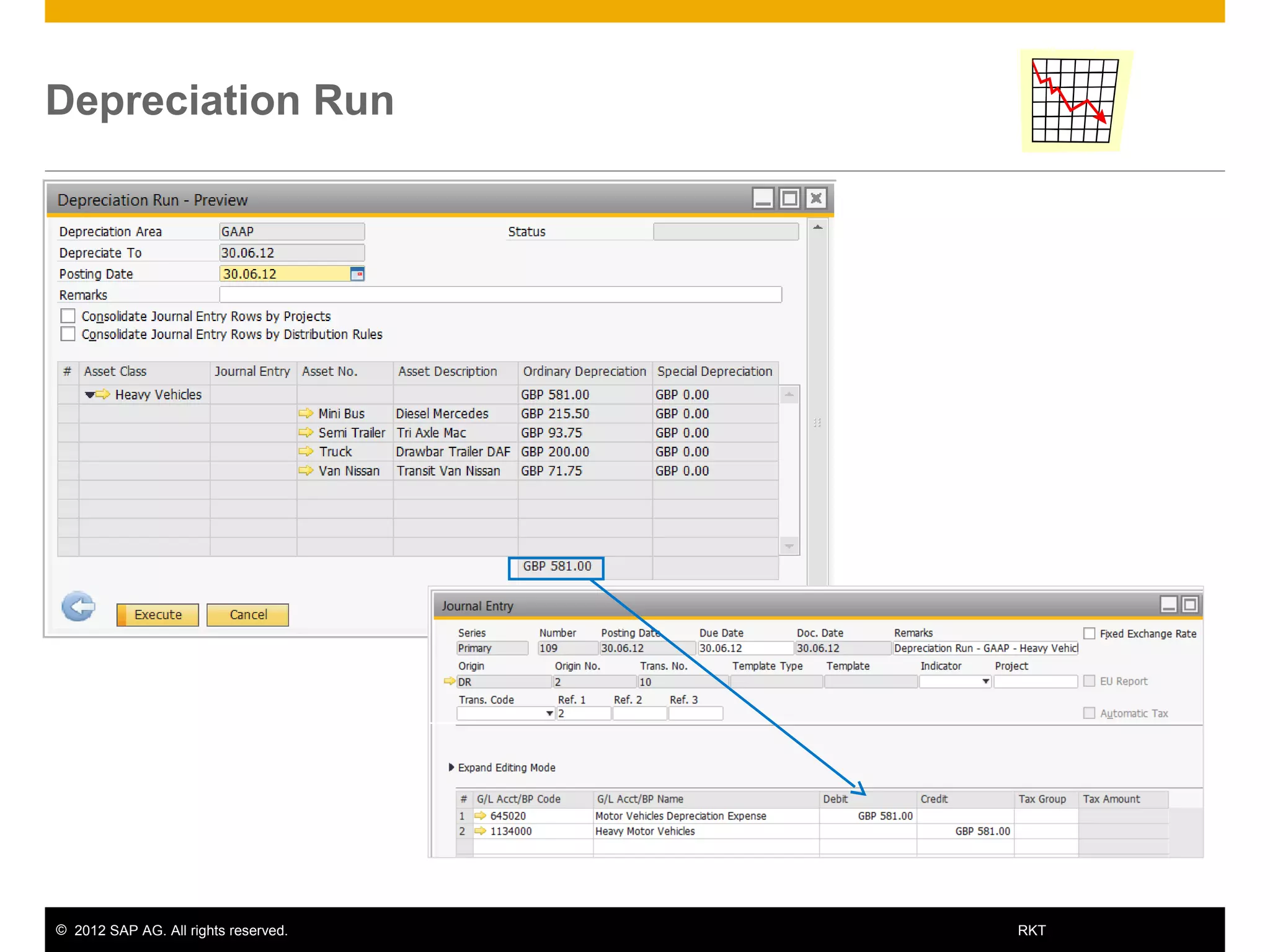

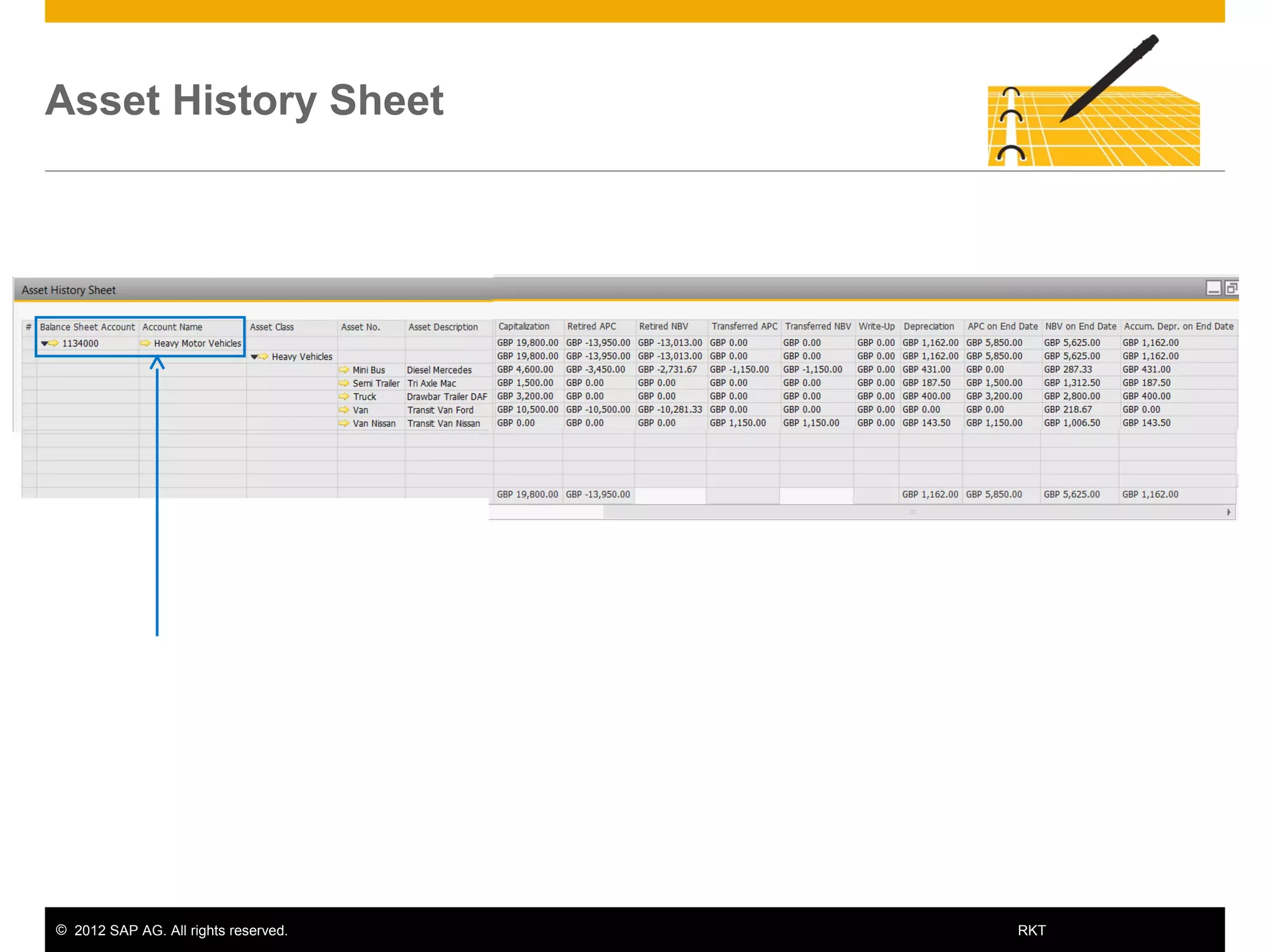

This document provides an introduction to managing fixed assets in SAP Business One version 9.0. It defines key terms related to fixed assets and outlines the new fixed assets sub-menu and windows. It also reviews the life cycle of a fixed asset item from initial capitalization to depreciation and eventual retirement. Sample journal entries are provided for capitalization, depreciation, and retirement. The goal is for users to understand how to manage fixed asset items and utilize the new fixed assets functionality in SAP Business One.