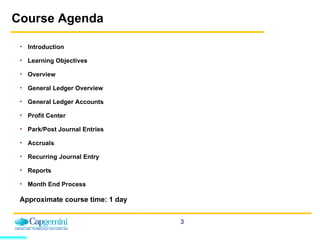

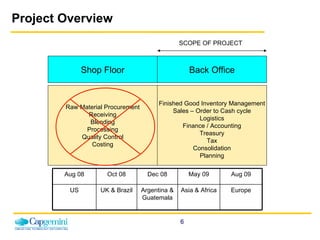

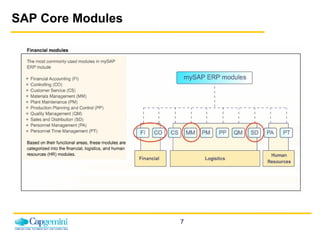

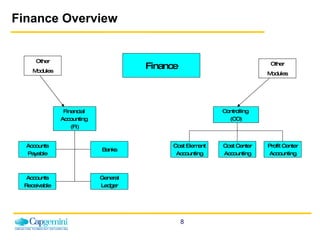

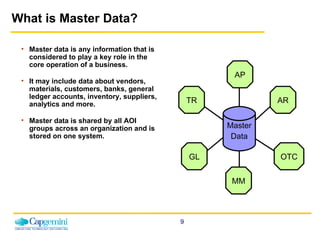

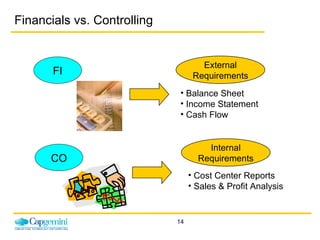

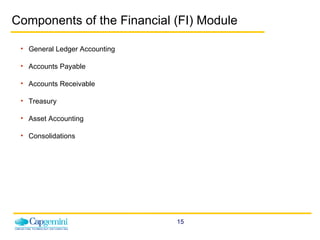

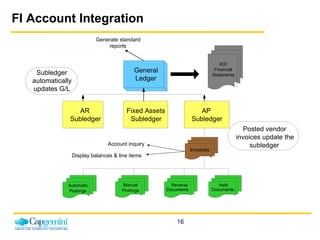

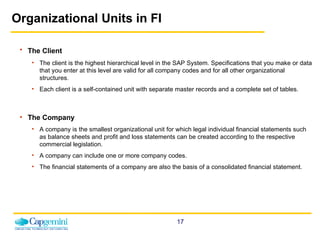

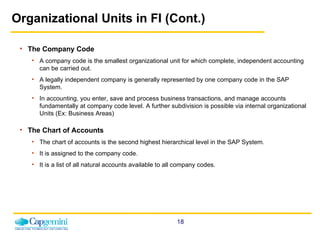

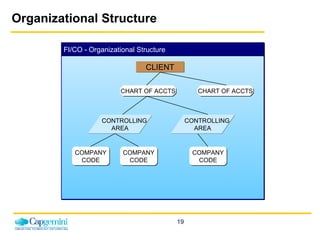

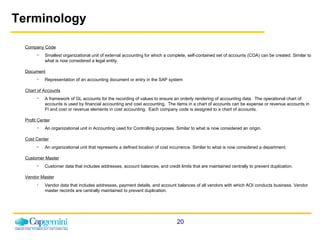

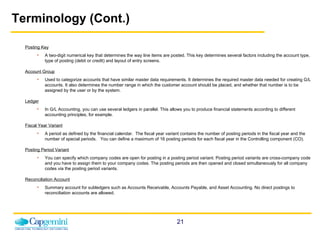

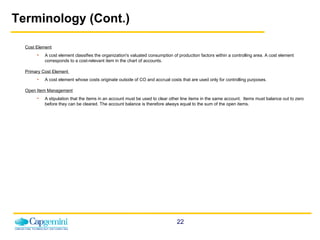

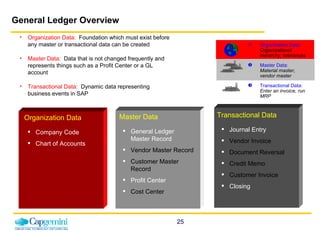

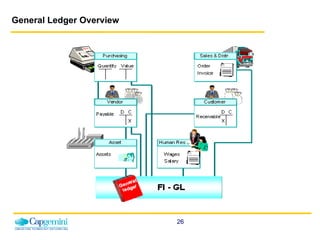

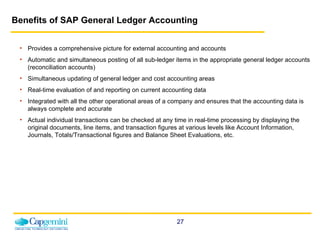

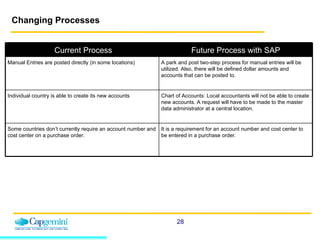

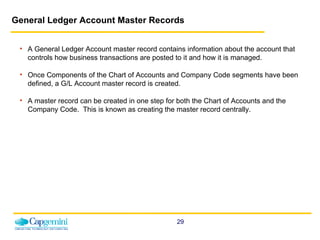

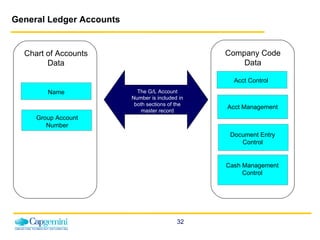

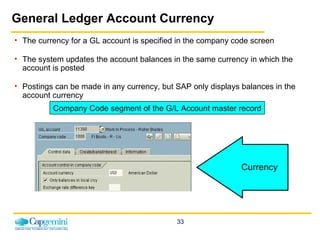

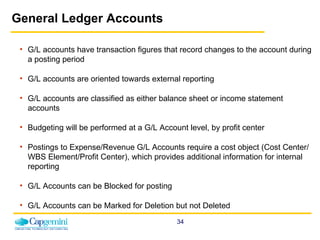

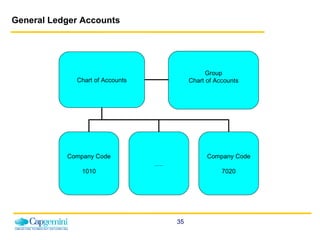

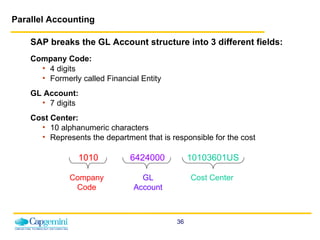

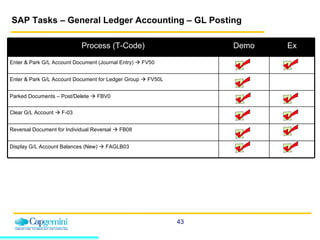

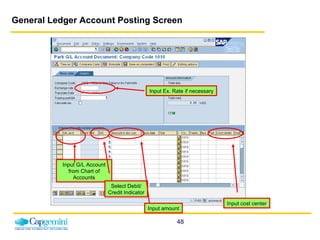

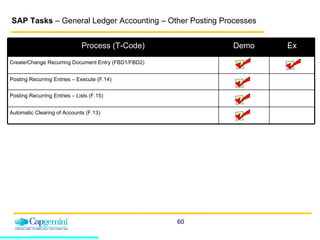

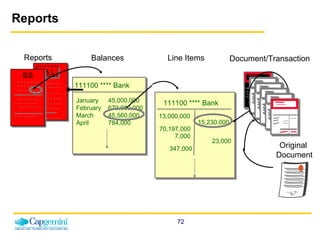

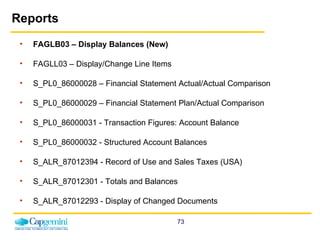

The document outlines the prerequisites and agenda for a General Ledger Accounting SAP end-user training course, highlighting foundational knowledge required and the course objectives such as understanding journal entries, profit centers, and reporting. It details the organizational structure of financial accounting within SAP, including master data management, general ledger functionalities, and the significance of profit and cost centers. The training emphasizes the importance of compliance, data quality, and team engagement during the course sessions.