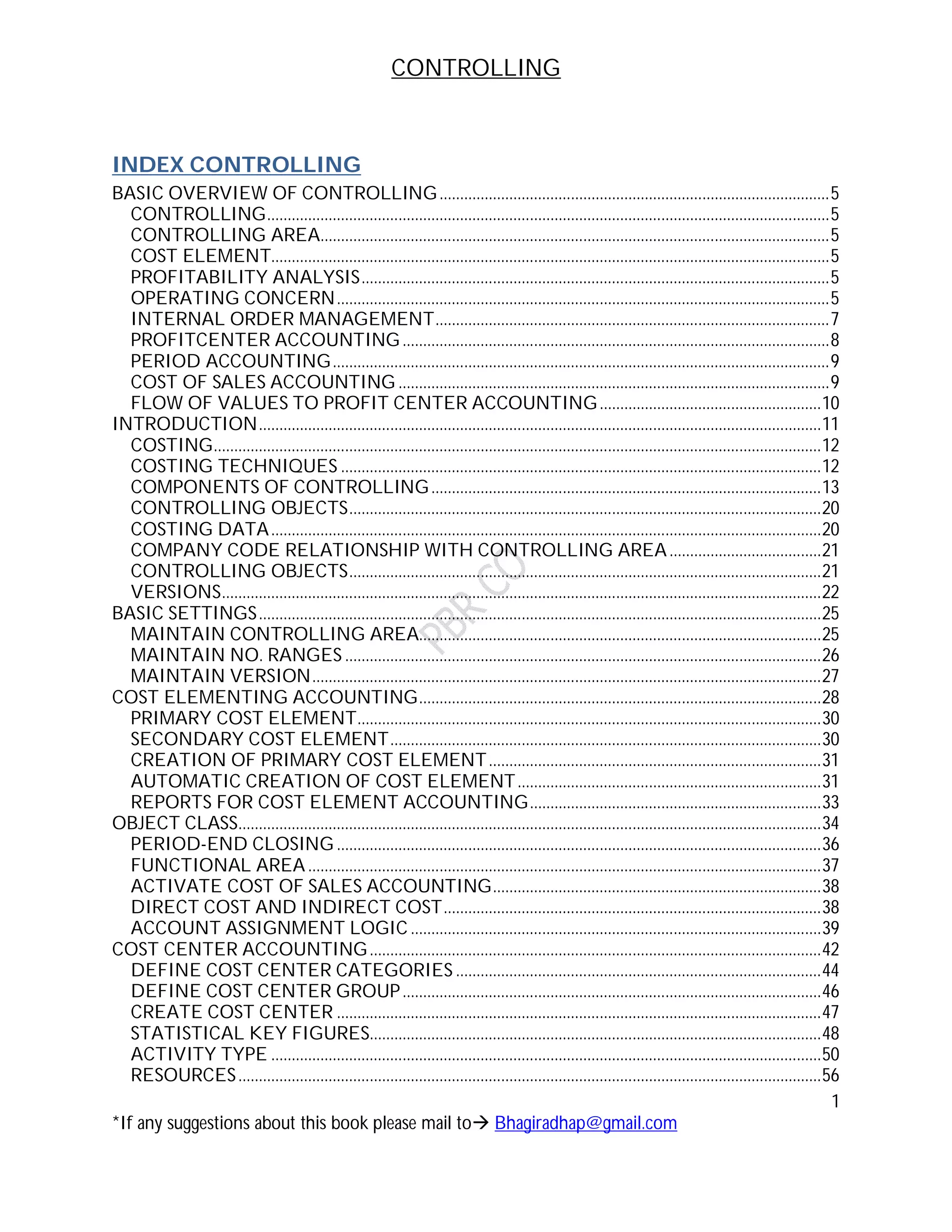

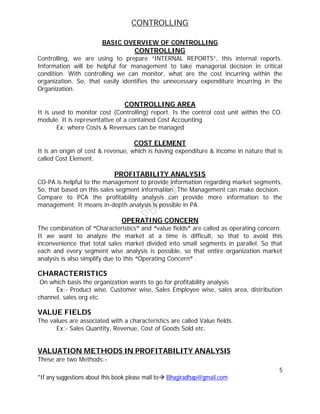

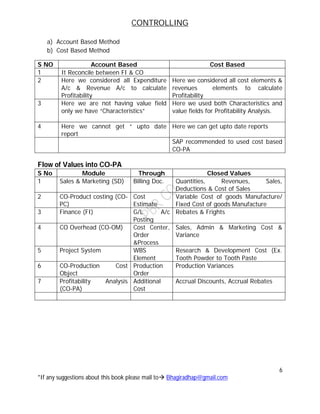

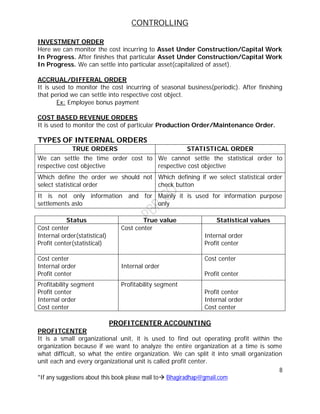

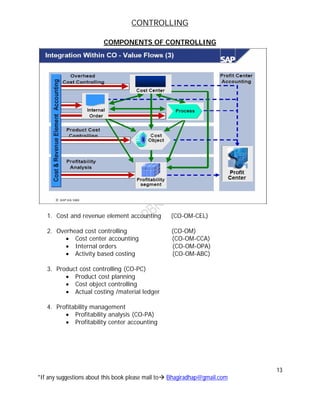

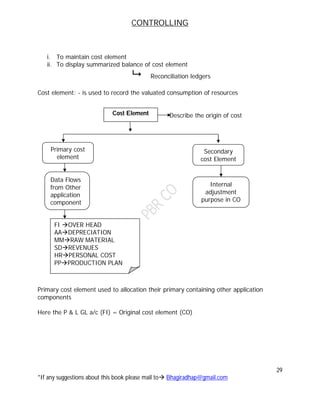

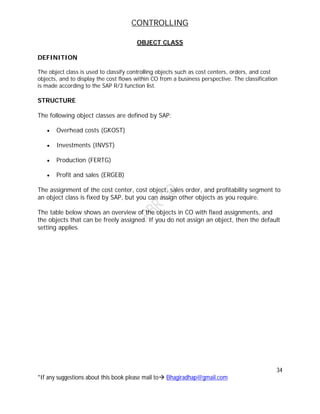

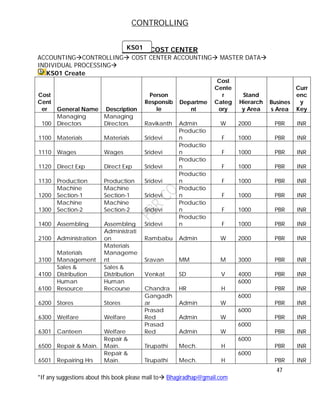

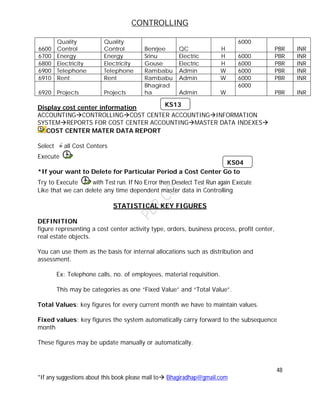

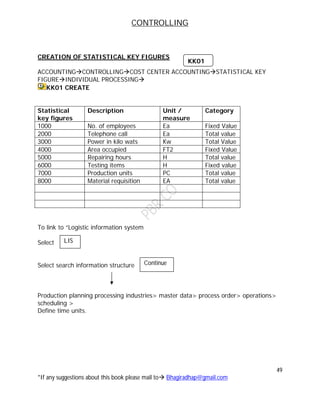

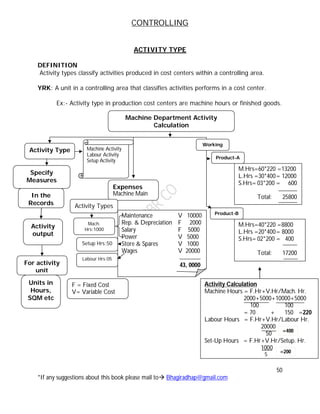

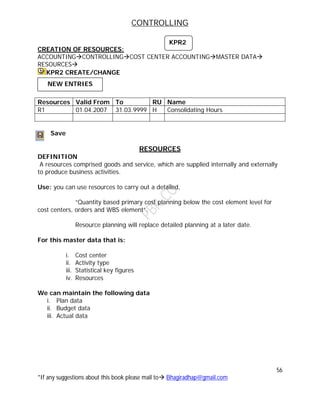

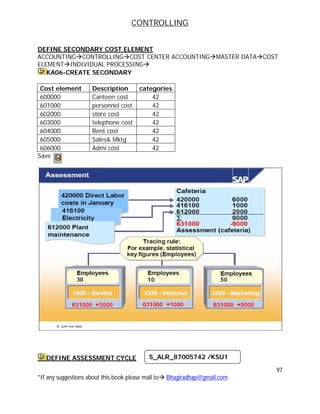

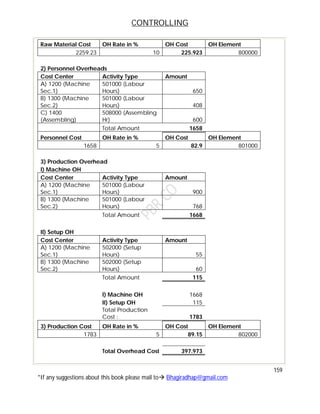

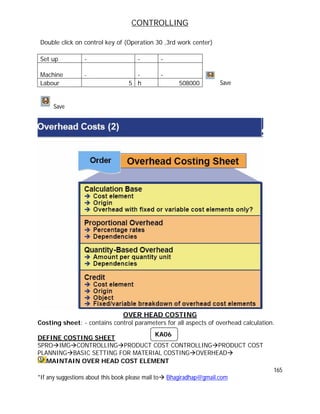

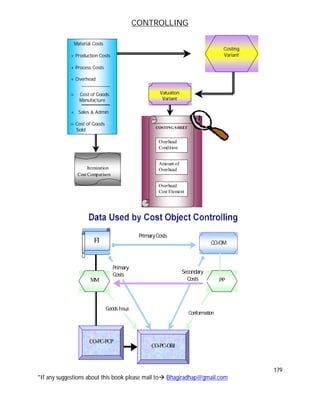

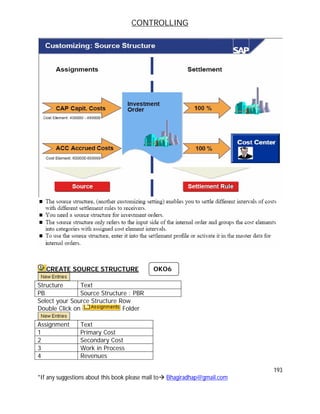

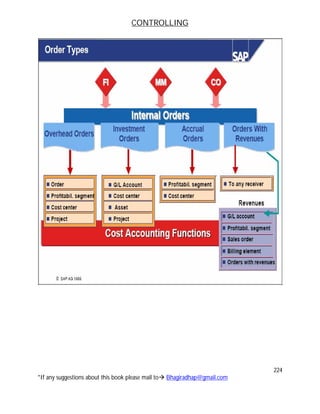

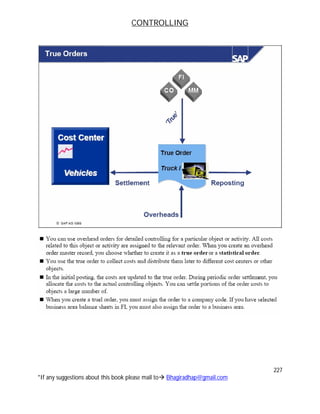

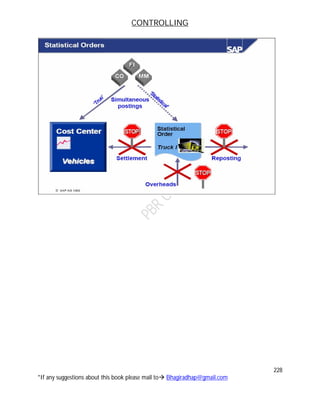

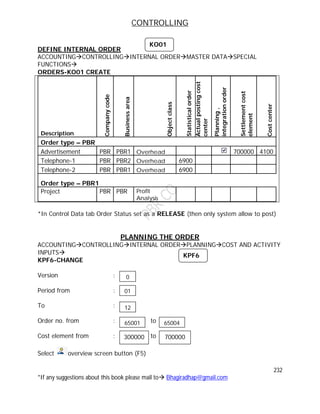

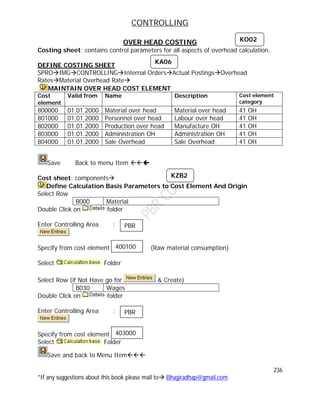

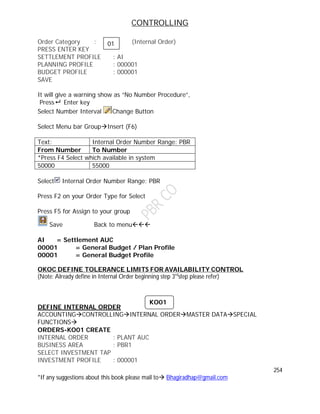

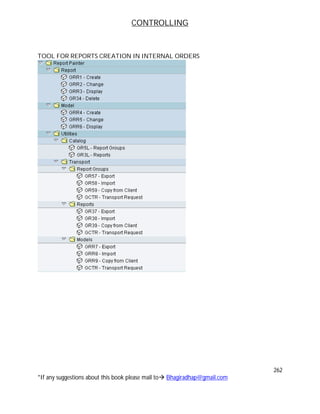

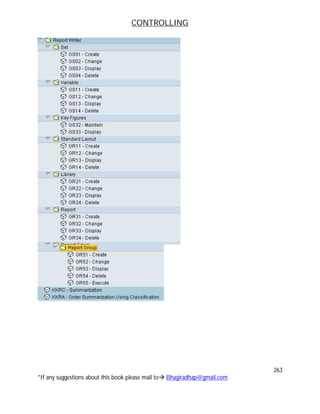

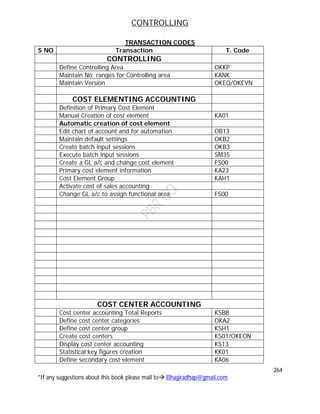

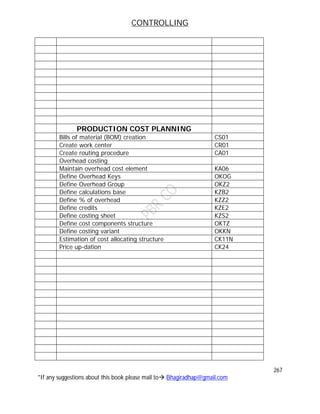

This document provides an overview of controlling and its key components. Controlling is used to prepare internal reports to monitor costs within an organization and identify unnecessary expenditures. The main components discussed include cost and revenue element accounting, overhead cost controlling using cost center accounting, internal orders, and activity based costing. Cost center accounting is used to manage costs and revenues within a contained cost accounting unit. Internal orders are used to monitor costs of short-term jobs and tasks.