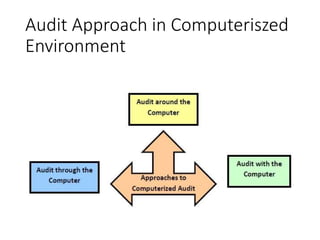

This document discusses auditing in a computerized environment. It outlines three approaches to auditing in this context: auditing around the computer, auditing through the computer, and auditing with the computer. It also describes the five major steps in the audit process for a computerized accounting system: conducting a preliminary survey, reviewing and assessing internal controls, compliance testing, substantive testing, and audit reporting. The key points are that auditors must understand how the computerized system works and evaluate internal controls, then perform compliance and substantive testing before reporting their findings.