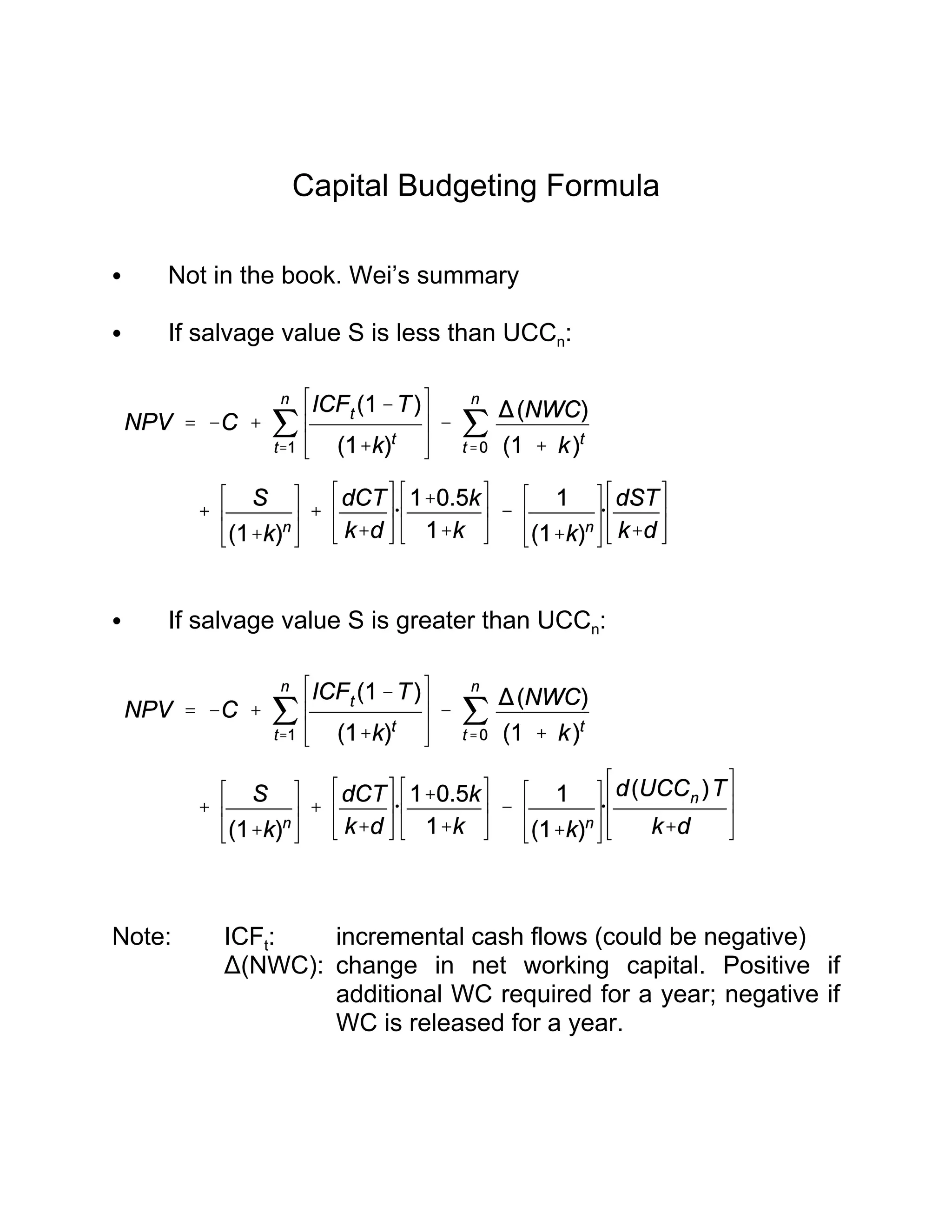

The document explains capital budgeting formulas and provides an example to illustrate how to calculate net present value (NPV). It shows the steps to determine cash flows, tax shields, salvage value, and changes in net working capital in present value terms. The key steps are: 1) determine cash outflows and inflows over the project life, 2) calculate tax shields from capital cost allowance, 3) account for salvage value and changes in working capital. The example is worked through using both a timeline method and formula method to demonstrate the calculations.

![investment. Now, there is a negative sign in front of the who third item. This is to

reflect the fact that a positive NWC represents an investment or a cash outflow. So,

the entire third item is

25,000 + 8,000/(1+0.1) - 33,000/(1+0.1)3

= $7,479

In other words, in PV terms we need to invest $7,470 in NWC (this is the financing

cost).

Since NWC is cash outflow, we have a negative sign in front it.

4) The fourth item is simply the PV of salvage value, which is

35,000/(1+0.1)3

= $26,296

We have a positive sign in front of it, since this is cash inflow.

5) The fifth item is the PV of all the future tax shields from CCA assuming the

equipment will last forever, under the half-year rule. It is

0.3*(200,000)(0.4)/(0.1+0.4)*[(1+0.5*0.1)/(1+0.1)] = $57,273.

We have a positive sign in front of it, since this is tax savings.

6) The last item is the tax shield adjustment. When we calculate item 5, we assume

that the equipment would last forever. But we know that we will lose it after three

years. Therefore, we will not be able to enjoy CCA tax shields after year three. We

must subtract an amount from item 5 to reflect this lost. At the end of year 3, the

UCC is $83,300 and the salvage value is $35,000. If the equipment is not sold and

is held forever, then you would continue to depreciate $83,300 from year 3 on. No

adjustment is needed in this case, since item 5 is the case of equipment lasting

forever. But when you sell it for $35,000, you have recovered $35,000, only the

remaining amount (which is $83,300 - $35,000 = $48,300) will continue to generate

tax shields forever. In other words, you will lose $35,000 (which is salvage value, S)

from the capital base. Since this is lost forever, so the present value of tax shields

from this amount is dST/(k+d) (here we don’t use the half-year formula anymore

since it is year 3 already). What about 1/(1+k)n

? This is simply to bring the PV of tax

shield loss to today. In our case, the entire sixth item is

1/(1+0.1)3

[0.3*35,000*0.4/(0.1+0.3)] = $7,889.

We have a negative sign in front of it, since we lose it.

Put all items together:

NPV = -$200,000 + $109,421 - $7,479 + $26,296 + $57,273 - $7,889

= - $22,378

****************

If we change the example just by one number: make the salvage value to be

$90,000. In this case, since S > UCC3, we will use the second formula. Why? Since

by selling the equipment, you will have recovered all the remaining book value of the

equipment ($83,300). You should not enjoy any CCA tax shields from that point on.

That is why we put the entire UCC in the formula.

Anyway, in this case, we only need to adjust the fourth item (which is now

$90000/(1.1)3

= $67,618) and the last item (which is now 1/(1+0.1)3

[0.3*83,300*0.4/(0.1+0.3)] = $18,775). So the new NPV is

NPV = -$200,000 + $109,421 - $7,479 + $67,618 + $57,273 - $18,775

= $8,058](https://image.slidesharecdn.com/capitalbudget-150217091109-conversion-gate01/85/Capital-budget-3-320.jpg)