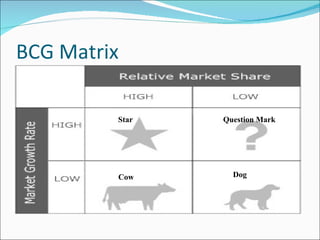

The document presents a BCG matrix analysis of the strategic business units of Bharti Airtel Limited, a leading telecom company in India and Africa. It analyzes four SBUs - Mobile Services, Telemedia Services, Enterprise Services, and Passive Infrastructure. It identifies Mobile Services as a cash cow with high market share and low growth. Telemedia Services is identified as a dog with low market share and low growth. Enterprise Services is identified as a star with high growth potential but low current market share. Passive Infrastructure is identified as a question mark with high growth potential but low current market share requiring significant investment to increase its market share.