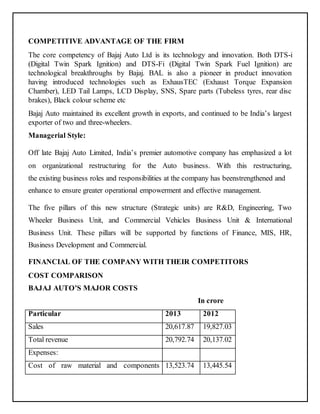

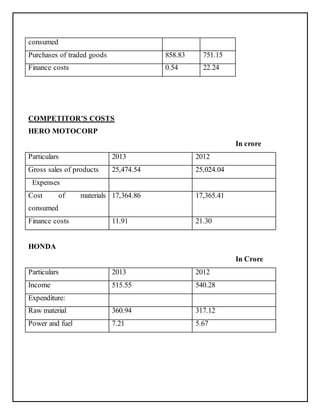

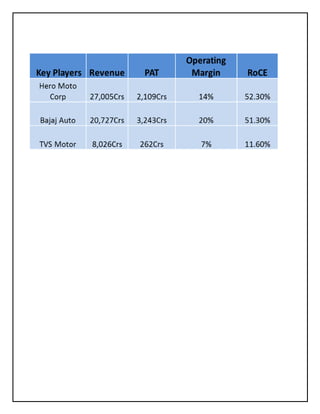

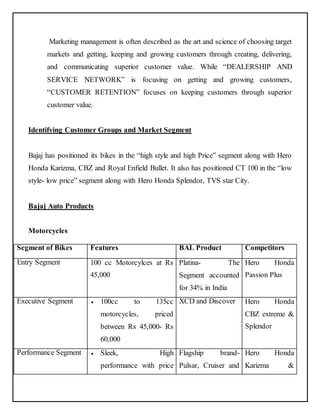

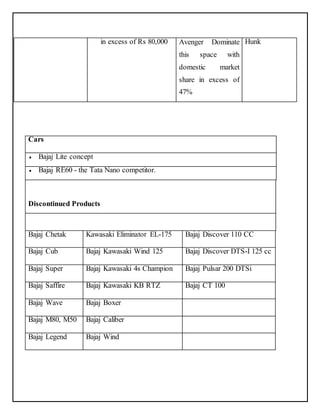

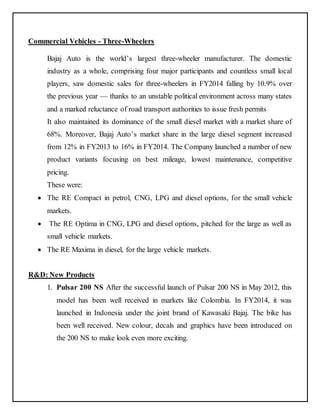

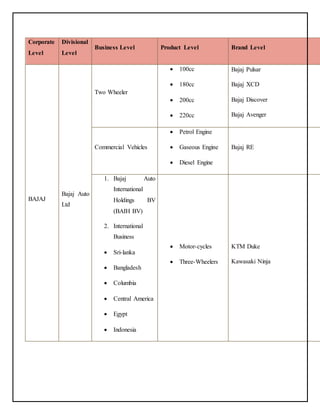

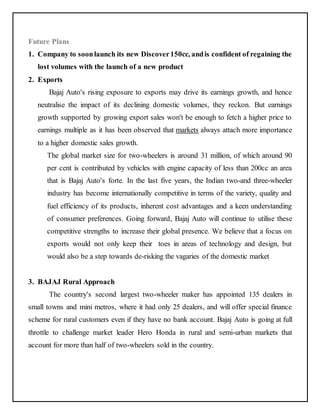

This document provides an overview and analysis of Bajaj Auto Limited (BAL), an Indian motorcycle, scooter, and auto rickshaw manufacturer. It discusses BAL's mission, vision, competitive environment using Porter's Five Forces model, and competitive position through a SWOT analysis. It also analyzes BAL's financial performance, competitors like Hero MotoCorp and Honda Motorcycle and Scooters India using an EFE matrix. Key competitors in the highly competitive two-wheeler industry are discussed.