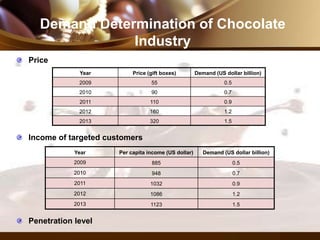

This document provides an overview of the chocolate industry in India. It includes chapters on research methodology, the global and Indian markets, product profiles, demand determinants, distribution channels, trends, PEST analysis, Porter's five forces model, portfolio models including BCG matrix and GE nine cell, financial analysis, opportunities and threats. Key findings are that the Indian chocolate market is growing at 15% annually, milk chocolate dominates sales, and dark chocolate shows potential for growth. The analysis identifies rising incomes, health awareness, and festive gifting traditions as driving demand.