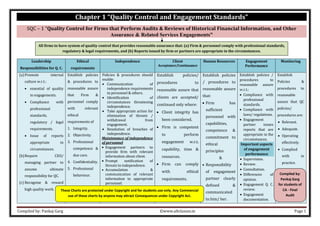

- The document discusses standards for quality control (SQC-1), overall audit objectives (SA 200), agreeing audit terms of engagement (SA 210), quality control for audit (SA 220), audit documentation (SA 230), and responsibilities relating to fraud (SA 240).

- It outlines responsibilities for quality control policies and procedures at audit firms. The objectives of an audit are to obtain reasonable assurance that financial statements are free of material misstatement and to report findings. The auditor must agree the terms and scope of the audit engagement with the client.

- Quality control includes leadership, ethics, independence, client/engagement acceptance, assignment of qualified engagement teams, performance of the audit with proper supervision/review, and monitoring

![Compiled by: Pankaj Garg ©www.altclasses.in Page 31

SA 700 (Revised) – Forming an Opinion and reporting on Financial Statements (w.e.f. 01.04.2018)

Meaning & Types of Audit Reports Elements of an Unmodified Audit Report

1 Title “Independent Auditor’s Report” – so as to distinguish from reports

issued by others.

2 Addressee Auditor’s Report shall be addressed as appropriate. Generally, it is

addressed to those for whom it is prepared.

3 Opinion Section Fair

Presentation

Framework

In our opinion, the F.S. present fairly in all material

respects in accordance with [applicable FRF]; Or

In our opinion, the F.S. gives a true and fair view of

______________ in accordance with [applicable FRF]

Compliance

Framework

In our opinion, the F.S. present, in all material

respect in accordance with [applicable FRF]

Opinion Para shall also cover the following:

• Identify the Entity.

• Identify the title of each financial statement.

• Specify the period/date covered by each F.S.

• State that F.S. have been audited.

4 Basis for

Opinion

• States that audit was conducted in accordance with SAs.

• Refer to Section of Auditor’s report that describes the auditor’s

responsibilities.

• Compliance of Ethical requirements including independence.

• Auditor’s believing that they had obtained sufficient and appropriate

audit evidence to provide a basis for the opinion.

5 Going Concern Where applicable, auditor shall report in accordance with SA 570.

6 Key Audit

Matter

In case of Listed Entity, auditor shall communicate Key Audit Matters in

Auditor’s Report in accordance with SA 701.

7 Management

Responsibilities

for the F.S.

• To prepare F.S. in accordance with applicable FRF.

• Maintenance of adequate records for safeguarding of assets and

prevention and detection of fraud.

• Making reasonable and prudent judgments and estimates.

• Design, Implementation and maintenance of Internal Control.

• Assessing the appropriateness of Going Concern basis of accounting.

• Overseeing the financial reporting process.

8 Auditor’s responsibilities for the Audit of F.S.

9 Other

Reporting

responsibilities

• Heading: “Reporting on Other Legal and Regulatory Requirements”.

• Will include reporting of CARO, 2016, reporting u/s 143(3) of

Companies Act, 2013, Rule 11 of CAAR, 2014.

10 Signature In personal name and name of firm, along with the membership number

and firm registration number.

11 Place The city where audit report is signed.

12 Date It should not be earlier than date on which audit evidences are collected.

1. State the objective of auditor to

obtain reasonable assurance that F.S.

as a whole are free from material

misstatements & issue the auditor’s

report that includes an auditor’s

opinion.

2. Explanation w.r.t. reasonable

assurance and application of concept

of materiality.

3. Statement that auditor exercises

professional judgment and maintain

professional skepticism throughout

audit.

4. State auditor’s responsibilities w.r.t.:

• Identifying & assessing the RMM.

• Design & perform audit

procedures responsive to assessed

risks.

• Obtain SAAE.

• Understanding of Internal Control.

• Expressing opinion on adequacy

and operating effectiveness of

Internal Financial Control.

• Evaluation of appropriateness of

Accounting policies &

reasonableness of accounting

estimates.

• Conclude on appropriateness of

management use of Going Concern

basis of accounting.

• Evaluate overall presentation,

structure & content of F.S.

5. State Auditor’s responsibilities w.r.t.:

• Matters communicated to TCWG.

• Providing statement to TCWG on

compliance of Ethical

requirements.

• Determining Key Audit matters out

of matters communicated to

TCWG.

Meaning

Reports in which auditor

expresses his opinion on financial

statements.

• For General purpose F.S. – SA

700, 701, 705 & 706 will

apply.

• For Special Purpose F.S. – SA

800 along with 700, 701, 705

& 706 will apply.

Types

A. Unmodified reports

Reports issued when auditor

concludes that F.S. are prepared

in all material respects in

accordance with applicable FRF.

B. Modified Reports

B.1 – Matters that affect Audit

Opinion.

B.1.1 – Qualified Opinion

B.1.2 – Adverse Opinion

B.1.3 – Disclaimer of Opinion

Details of B.1 is dealt by SA 705.

B.2 – Matters that do not affect

Audit opinion

B.2.1 – With EOM Para

B.2.1 – With OM Para

Details of B.2 is dealt by SA 706.

Compiled by:

Pankaj Garg

for students of

CA - Final

Audit](https://image.slidesharecdn.com/audit-charts-by-pankaj-garg-230420060604-d1bde916/85/audit-charts-by-pankaj-garg-pdf-31-320.jpg)

![Compiled by: Pankaj Garg ©www.altclasses.in Page 33

SA 705 – Modifications to the Opinion in the Independent Auditor’s Report

Types of modified Opinion Considerations while issuing modified Opinion

Opinion Section Basis for Opinion Section Auditor’s Responsibility Section

Use the heading –

• Qualified Opinion

• Adverse Opinion

• Disclaimer of Opinion.

Wordings of Opinion:

Qualified

Except for the effects of

matters prescribed in “Basis

of Qualified Opinion”

section, the F.S. have been

prescribed fairly in all

material respects in

accordance with [applicable

FRF]

Adverse

In auditor’s opinion,

because of significance of

the matters described in

“Basis of Adverse Opinion”

section, the F.S. does not

give a true and fair view of

____________ in accordance

with [applicable FRF].

Disclaimer

Because of significance of

matters described in the

“Basis for Disclaimer of

Opinion” section, the

auditor has not been able to

obtain sufficient

appropriate audit evidence

to provide a basis for audit

opinion on F.S.

Amend the heading – Basis for Qualified Opinion

Basis for Adverse Opinion

Basis for Disclaimer of Opinion.

• Include a description of matter giving rise to

modification.

Cause of

Modification

Description

Material

Misstatement

in Amount

• Description of Misstatement.

• Quantification of financial

effect, if determinable.

• If not determinable, state the

fact.

Material

Misstatement in

Disclosure

Explanation how the

disclosures are misstated.

Material

Misstatement

due to non-

disclosure of

required

information

Describe nature of omitted

information.

And

Include the omitted disclosure

provided it is practicable.

Inability to

obtain SAAE

State the reason for inability.

• Amend the statement w.r.t. auditor believing that

audit evidences are sufficient and appropriate to

provide a basis for “Qualified Opinion” or “Adverse

Opinion”.

• In case of disclaimer, auditor’s report shall not

include the reference to section of auditor’s report

that describes the auditor’s responsibilities and

statement w.r.t. auditor’s believing that sufficient

appropriate audit evidence obtained.

When an auditor disclaims the

opinion, the auditor shall

amend the description of

auditor’s responsibilities to

include only the following:

• Statement that the auditor’s

responsibility is to conduct

an audit in accordance with

Standard on Auditing and to

issue Auditor’s Report.

• Statement that because of

significance of matters

described in basis for

disclaimer of opinion

section, auditor was not able

to obtain SAAE to provide a

basis for an audit opinion.

• Statement about auditor’s

independence and other

ethical requirements.

Qualified

Issued when:

F.S. are misstated having material

but not pervasive effect.

Or

Auditor not been able to collect

sufficient appropriate audit

evidence for transactions that are

having material but not pervasive

effect.

Adverse

Issued when F.S. are misstated

having material and pervasive

effect.

Disclaimer

Issued when auditor not been able

to collect sufficient appropriate

audit evidence for transactions

that are having material and

pervasive effect.

Pervasive Not

Pervasive

Material

Misstatement

ADVERSE QUALIFIED

SAAE not

obtained for

material

Transactions

DISCLAIMER QUALIFIED

Compiled by: Pankaj Garg for

students of CA - Final Audit](https://image.slidesharecdn.com/audit-charts-by-pankaj-garg-230420060604-d1bde916/85/audit-charts-by-pankaj-garg-pdf-33-320.jpg)

![Page 62

Branch Audit [Sec. 143(8) and Rule 12] and Payments controlled by Companies Act, 2013

Branch Audit Payments controlled by Companies Act, 2013

Branch Office –

Sec. 2(14)

Branch office, in relation to a company, means any

establishment described as such by the company.

Persons Eligible

to be appointed

as Branch

Auditor

– Sec. 143(8)

Indian

Branch

Company Auditor

Other person qualified for appointment

as auditor as per Sec. 141.

Foreign

Branch

Company Auditor

Other person qualified for appointment

as auditor as per Sec. 141.

Other person qualified for appointment

as auditor in accordance with the Laws

of that country.

Duties of Branch

Auditor

– Sec. 143(8)

Prepare a report on the accounts of the branch

examined by him

and

send it to the auditor of the company who shall deal

with it in his report in such manner as he considers

necessary.

Duties & powers

of the company’s

auditor with

reference to the

audit of the

branch and the

branch auditor

– Rule 12

(1) The duties and powers of the company’s auditor

with reference to the audit of the branch and the

branch auditor, if any, shall be as contained in sub-

sections (1) to (4) of section 143.

(2) The branch auditor shall submit his report to the

company’s auditor.

(3) The provisions regarding reporting of fraud by the

auditor shall also extend to such branch auditor to

the extent it relates to the concerned branch.

Sec. 181 Contribution to Charitable Funds

BOD can contribute to the bona fide charitable and other funds any

amount in any FY.

If aggregate of such contribution exceeds 5% of average net profits of

3 immediately preceding FY, prior permission of company is required.

Sec. 182 Political Contribution

Government company or any other company which has been in

existence for less than 3 FY cannot contribute any amount directly or

indirectly to any political party.

In other cases, contribution in any FY can be made if a resolution

authorising the making of such contribution is passed at a Board

Meeting.

Every company shall disclose in its P&L A/c total amount contributed

by it under this section during the FY to which the account relates.

Contribution shall not be made except by an A/c payee cheque drawn

on a bank or an A/c payee bank draft or use of electronic clearing

system through a bank account.

Sec. 183 Contribution to National Defence Fund

Section 183 permits the Board or any person or authority exercising

the powers of the Board or company to make contributions to the

National Defence Fund or any other Fund approved by the CG for the

purpose of National Defence to any extent as it thinks fit.

Every company shall disclose in its profit and loss account the total

amount or amounts contributed by it to the National Defence Fund

during the financial year to which the amount relates.](https://image.slidesharecdn.com/audit-charts-by-pankaj-garg-230420060604-d1bde916/85/audit-charts-by-pankaj-garg-pdf-62-320.jpg)

![Page 64

Guidance Note on IFC over Financial Reporting and Guidance Note on reporting of Fraud u/s 143(12)

Guidance Note on IFC over Financial Reporting Guidance Note on Reporting of Fraud u/s 143(12)

1 Meaning of Internal Financial Control – Sec. 134 of Companies Act, 2013

Policies and procedures adopted by the company for ensuring:

Orderly & efficient conduct of its business, including adherence to Company policies,

Safeguarding of its assets,

Prevention and detection of frauds and errors,

Accuracy and completeness of the accounting records, and

Timely preparation of reliable financial information.

2 Meaning and concept of Internal Controls over Financial Reporting (ICFR)

A Process designed to provide reasonable assurance regarding the reliability of financial reporting

and the preparation of F.S. for external purposes in accordance with GAAPs.

Company’s IFC over financial reporting includes those policies & procedures which pertain to the

maintenance of the records that, in reasonable detail, accurately and fairly reflect the transactions

and dispositions of the assets.

It provides reasonable assurance that transactions are recorded as necessary to permit

preparation of F.S. in accordance with GAAPs, and receipts and expenditures of the company are

being made only in accordance with authorizations of mngt and director of the company.

It provides reasonable assurance regarding prevention or timely detection of unauthorized

acquisition, use or disposition of the company’s assets that could have a material effect on F.S.

3 Reporting Requirements

Sec. 134 In the case of a listed company, the Directors’ Responsibility states that directors,

have laid down IFC to be followed by the company and that such controls are

adequate and operating effectively.

Sec. 143 The auditor’s report should also state whether the company has adequate IFC

system in place and the operating effectiveness of such controls.

Sec. 177 Audit committee may call for comments of auditors about internal control systems

before their submission to the Board and may also discuss any related issues with

the internal and statutory auditors and the management company.

Sch. IV The independent directors should satisfy themselves on the integrity of financial

information and ensure that financial controls and systems of risk management are

robust and defensible.

Rule 8 of

Companies

(Accounts)

Rules, 2014

The director’s report should contain details in respect of adequacy of internal

financial controls with reference to the financial reporting.

1 Duty to report on frauds – Sec. 143(12)

If auditor in the course of the performance of his duties, has reason to

believe that an offence of fraud involving prescribed amount, is being or

has been committed in company, by its officers or employees, the auditor

shall report the matter to the C.G., within prescribed time and manner.

2 Manner of Reporting - Fraud amounting to ₹1 Cr. or more

If auditor has reason to believe that an offence of fraud, which involves or

is expected to involve individually an amount of ₹1 Cr. or above, is being

or has been committed against company by its officers or employees, the

auditor shall report the matter to the C.G. in following manner:

Report the matter to Board/Audit Committee, immediately but not later

than 2 days of his knowledge of fraud, seeking their reply within 45 days;

on receipt of such reply, the auditor shall forward his report and the reply

of Board/Audit Committee along with his comments to the C.G. within 15

days from date of receipt of such reply;

In case reply not received, auditor shall forward his report to C.G. along

with a note containing details of his report that was forwarded to Board/

Audit Committee for which he has not received reply;

Report shall be sent to the Secretary, MCA in a sealed cover by Regd. Post

with AD or by Speed Post followed by an e-mail in confirmation of the same;

Report shall be on letter-head of the auditor containing postal address, e-

mail address, contact details and be signed by the auditor with his seal and

shall indicate his Membership Number; and

Report shall be in the form of a statement as specified in Form ADT-4.

3 Manner of Reporting - Fraud amounting to less than ₹1 Cr.

Section 143(12) prescribes that in case of a fraud involving lesser than the

specified amount [i.e. less than ₹1 Cr.], the auditor shall report the matter

to the audit committee constituted u/s 177 or to the Board in other cases

within such time and in such manner as may be prescribed.

In this regard, Rule 13(3) of the CAAR, 2014 states that in case of a fraud

involving amount less than ₹1 Cr., the auditor shall report the matter to

Audit Committee constituted u/s 177 or to the Board immediately but not

later than 2 days of his knowledge of the fraud and he shall report the

matter specifying the following:

(a) Nature of Fraud with description;

(b) Approximate amount involved; and

(c) Parties involved.](https://image.slidesharecdn.com/audit-charts-by-pankaj-garg-230420060604-d1bde916/85/audit-charts-by-pankaj-garg-pdf-64-320.jpg)