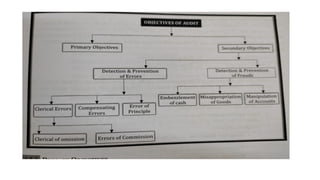

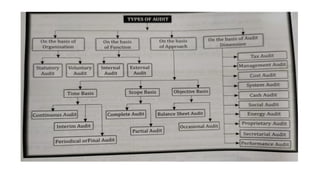

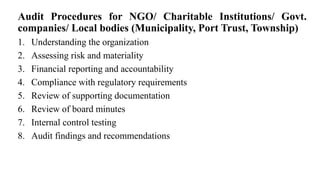

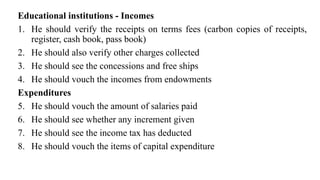

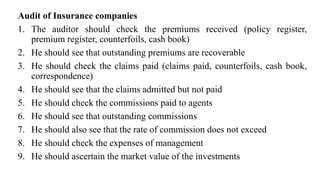

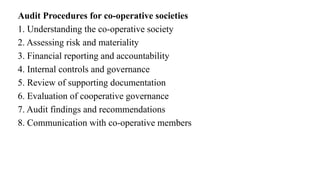

This document provides a comprehensive overview of auditing, covering its definition, advantages, disadvantages, qualities of auditors, and the relationship with various disciplines such as accounting and law. It discusses audit procedures for different types of organizations and emphasizes the importance of risk assessment and professional ethics in auditing. The document also outlines the audit report elements and distinguishes between different types of audit reports.