Embed presentation

Download to read offline

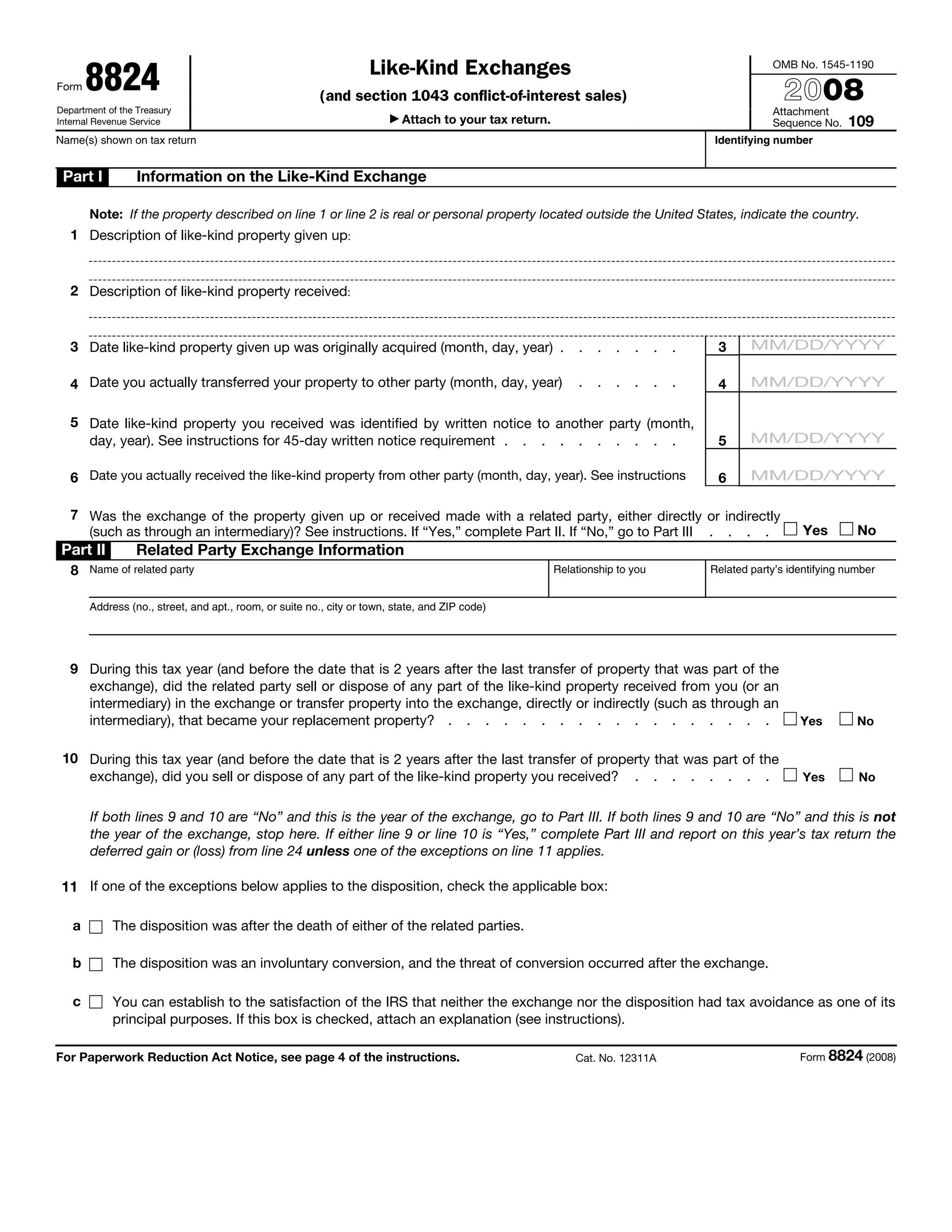

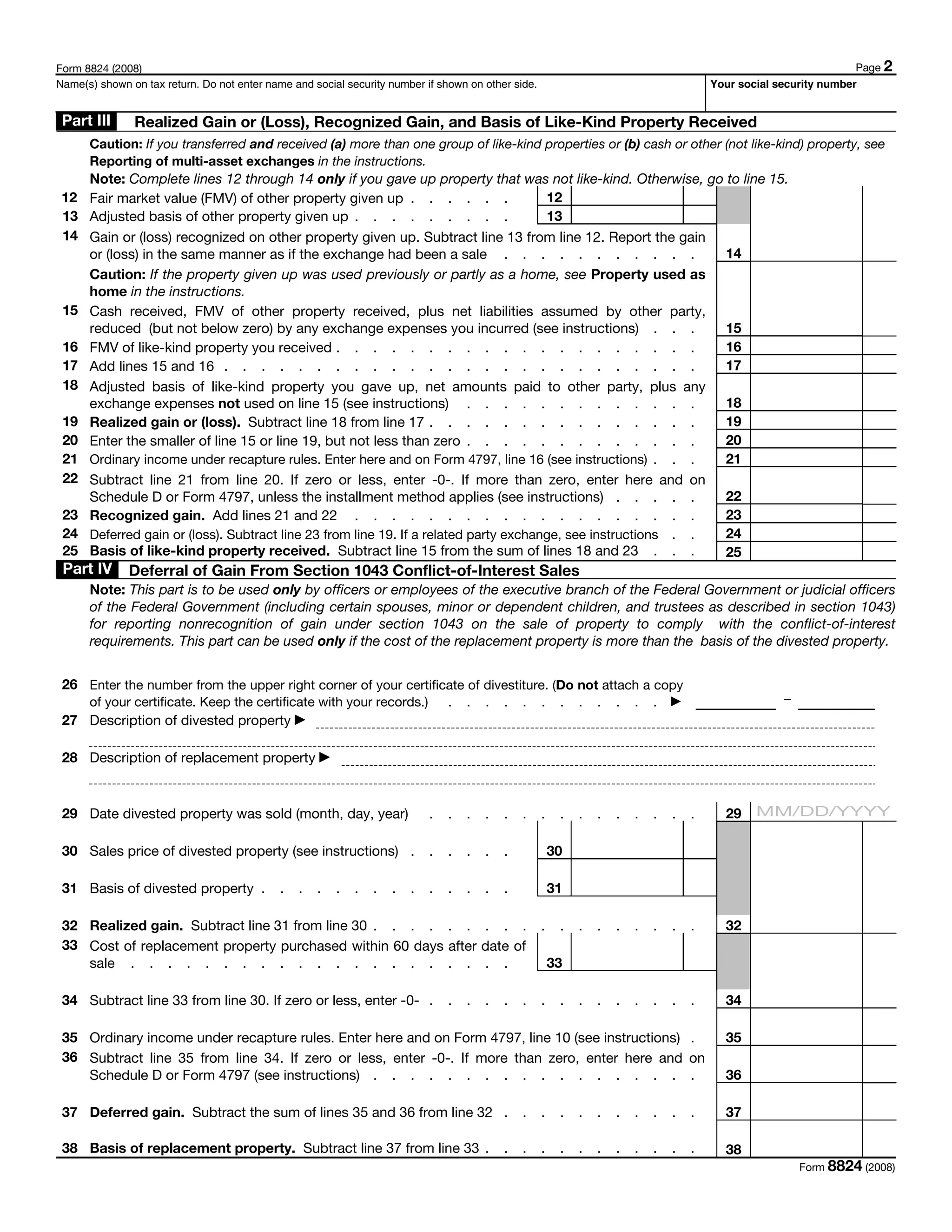

This document is an IRS form for reporting like-kind exchanges and section 1043 conflict-of-interest sales. It contains sections for providing information on the like-kind properties exchanged, related party exchanges, gain/loss calculation, basis of the received property, and deferral of gain from conflict-of-interest sales. The form is to be attached to the filer's tax return and provides details to correctly calculate taxes on like-kind exchanges and property sales due to conflicts of interest.