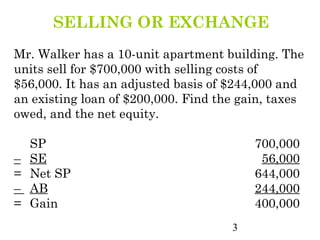

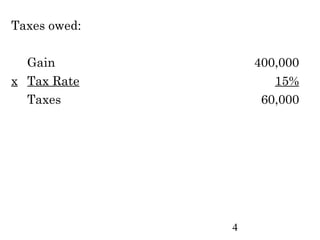

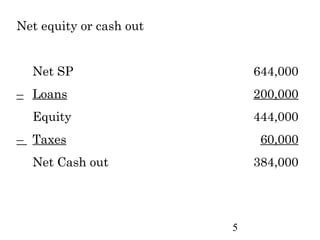

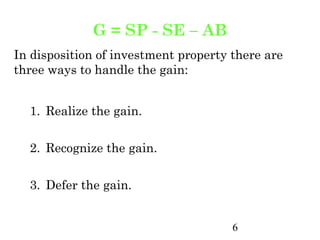

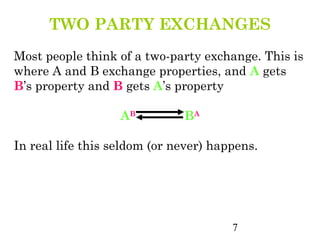

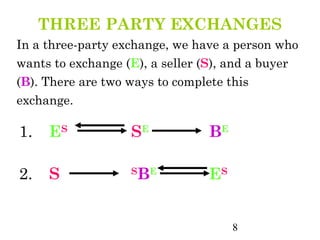

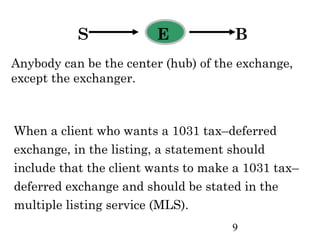

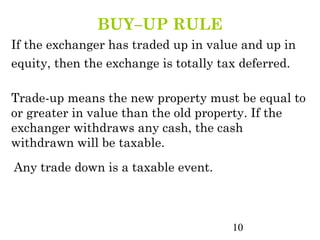

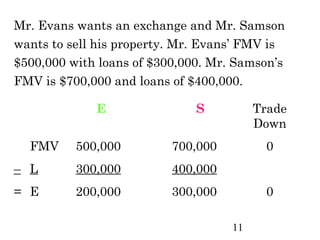

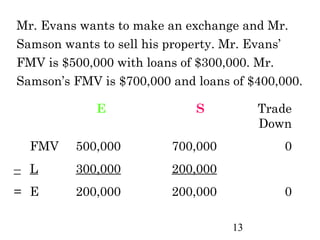

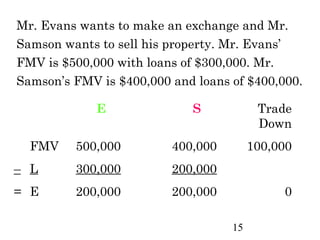

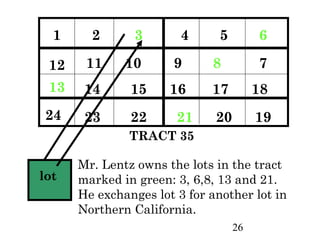

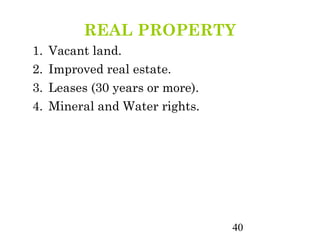

The document discusses various aspects of 1031 exchanges, which allow taxpayers to defer capital gains taxes when exchanging one investment property for another. It explains the rules around like-kind exchanges, including that the properties must be held for investment purposes. It also outlines the guidelines for deferred exchanges, including that any cash or "boot" received in an exchange is taxable and the timelines for identifying and closing on a replacement property.