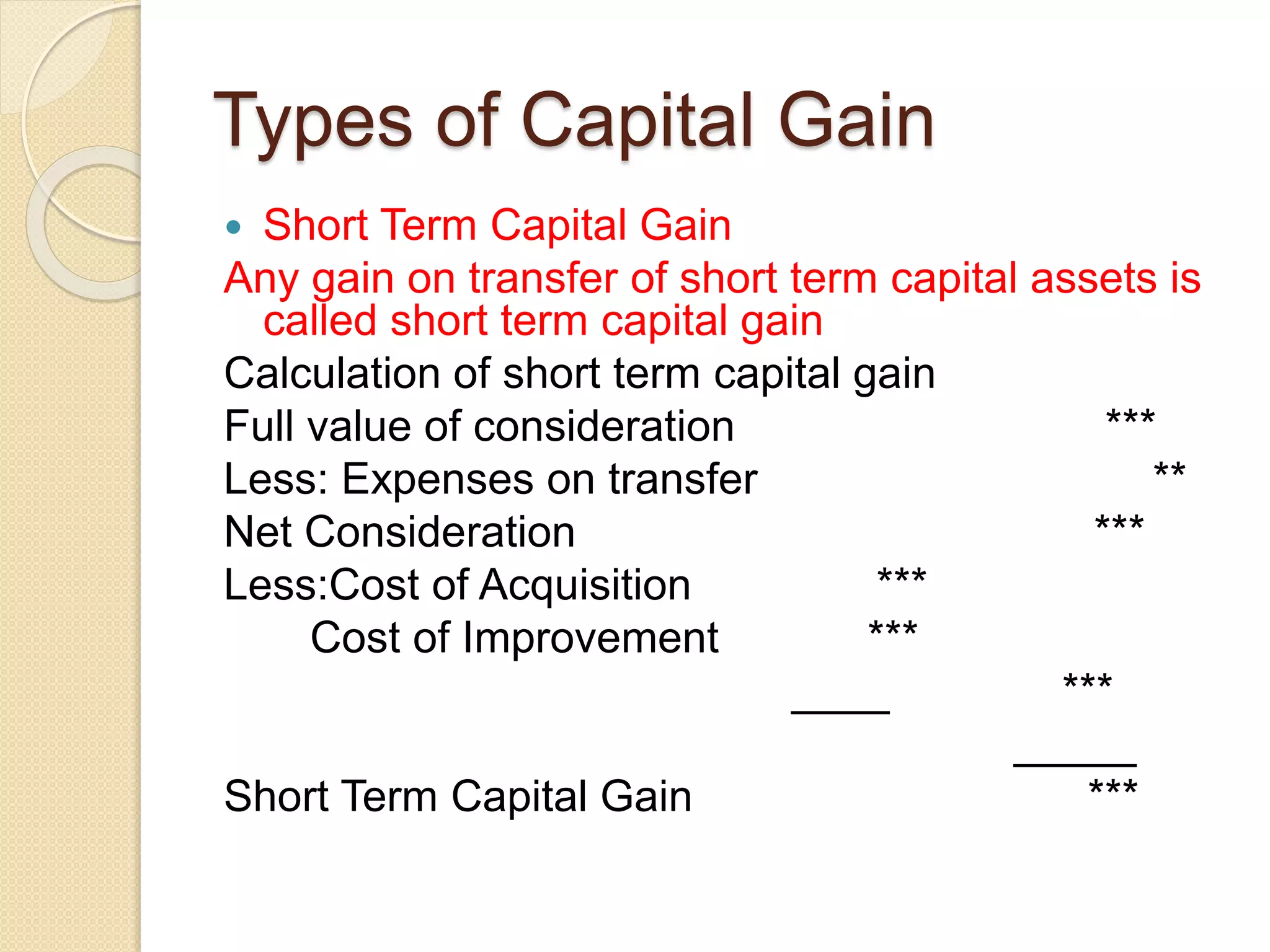

This document discusses capital gains tax in India. It defines capital gains as any profit arising from the transfer of a capital asset. It distinguishes between short-term and long-term capital assets based on the holding period, and discusses the different types of capital gains (short-term, long-term). It also covers topics like calculation of capital gains, indexed cost of acquisition and improvement, exemptions for reinvestment of capital gains in residential houses or specified assets, and the capital gains deposit scheme.