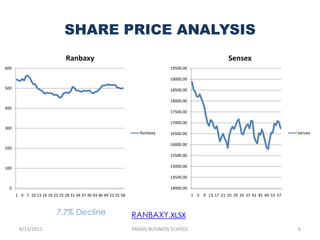

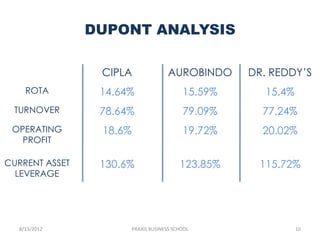

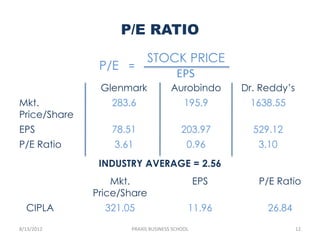

The document discusses the financial accounting analysis of Cipla Ltd, an Indian pharmaceutical company. It includes an overview of Cipla, analysis of its balance sheet, cash flows, profitability ratios, share prices, earnings per share, price-earnings ratio and comparisons to competitors. The board of directors report highlights a 12% growth in domestic sales, 16% growth in exports, a 3% decline in operating margins, investments in new production facilities, a reduction in shareholder funds, 55% of revenues from international markets and contribution of $420 million in foreign exchange earnings.