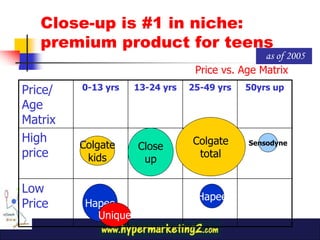

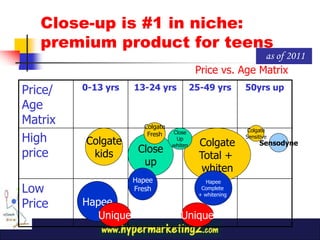

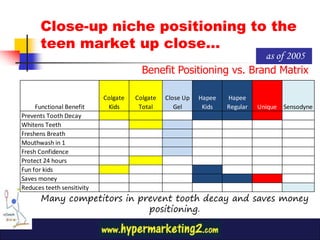

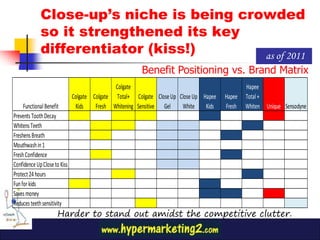

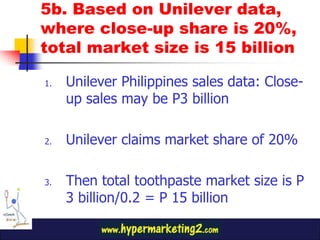

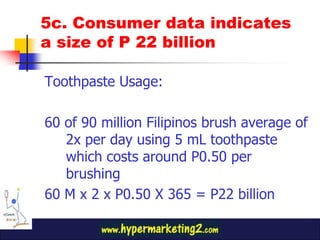

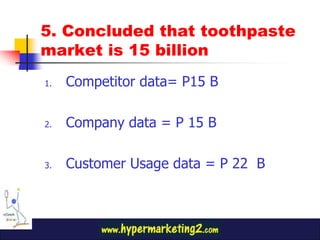

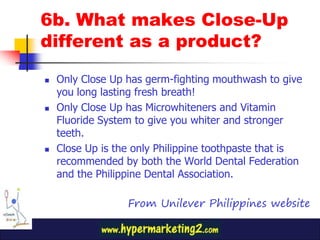

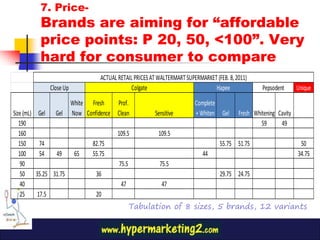

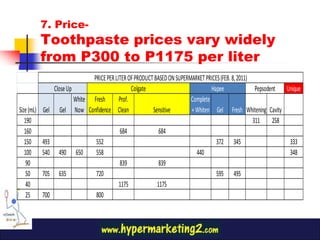

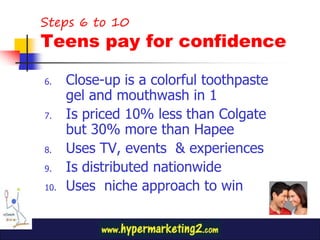

The document outlines a 10-step marketing plan for Close-Up toothpaste targeting teens aged 13-24 who seek confidence in personal interactions. It analyzes the competitive landscape, emphasizing Close-Up's unique positioning as a premium product catering to the desires of its target market for fresh breath and white teeth. The marketing strategy includes event promotions, effective pricing strategies, and leveraging Unilever's distribution network to maintain a strong presence in the Philippine toothpaste market.