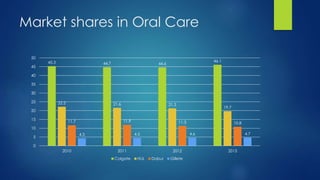

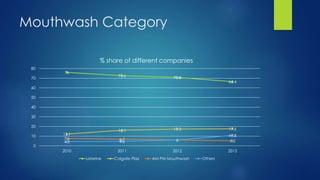

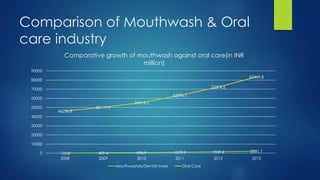

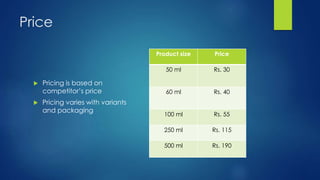

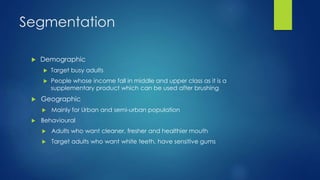

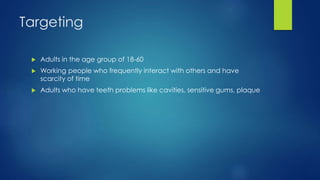

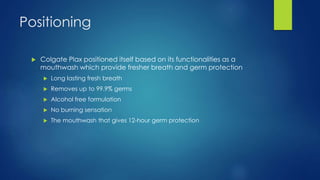

This document analyzes Colgate Plax mouthwash in India. It summarizes Colgate's market position in oral care, the growth of the mouthwash category, and key details about Colgate Plax such as variants, pricing, distribution, promotion strategies, segmentation, targeting, positioning, and competitors. Colgate Plax is positioned as a mouthwash that provides long-lasting fresh breath and protects against 99.9% of germs for 12 hours with an alcohol-free formulation. It targets busy urban adults seeking fresher breath and oral health benefits.