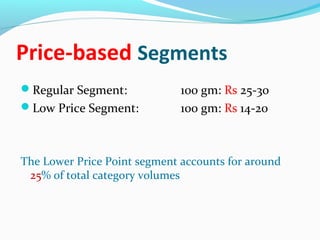

The toothpaste industry in India offers significant growth opportunities as penetration and per capita consumption is still low. While awareness is increasing, the total market is 750 crores with a growth rate of 18.6% annually. However, per capita usage remains just 85gms per person leaving vast potential for expansion. Major players include Colgate Palmolive and Hindustan Unilever who have the highest market shares but many local and regional brands are also available.