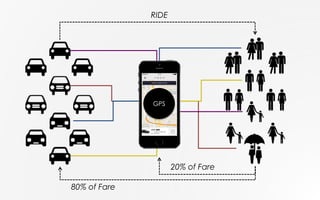

Uber is a ride-hailing platform that connects passengers with drivers, allowing individuals to earn money through driving without the need for a taxi license. The company operates in over 50 countries and has a strong brand identity, but faces challenges from regulations, competitors, and emerging technologies. To address these challenges, suggestions include improving government relationships, enhancing driver safety, and leveraging partnerships with tech companies.

![[Personal Transportation Industry - TAXI]

License Fare

Taxi supply Regulations

Protective! Costly! No invest!

Gov. Taxi Firm

Low customer satisfaction](https://image.slidesharecdn.com/uberfinalcenturygothicfont-150323091517-conversion-gate01/85/UBER-Strategy-7-320.jpg)

![• Easy to start

(no license)

• Individual business

(have full control)

• Earn more than taxi

(simple cost structure)

[Incentive to join the network]

Dynamic Pricing Model

(stably balancing quantity of

demand & supply)

• Easy to use

(thru smartphone app)

• Reliable

(arrival time & Fare)

• Cheaper than taxi

(simple cost structure)

• Better quality

(ratings & feedback)](https://image.slidesharecdn.com/uberfinalcenturygothicfont-150323091517-conversion-gate01/85/UBER-Strategy-10-320.jpg)

![Generalist Niche

ValueNetwork Effects

UBER X

UBER Black

[UBER focuses on Generalist strategy in network effects industry]](https://image.slidesharecdn.com/uberfinalcenturygothicfont-150323091517-conversion-gate01/85/UBER-Strategy-11-320.jpg)

![Threat of new entrants

Threat of substitutes

Suppliers’ power Buyers’ power

Intensity of rivalry

BARRIERS TO ENTRY: MEDIUM-HIGH

Government policy

UBER’s strong brand identity

UBER first mover advantage

RIVALRY DETERMINANTS:HIGH

Large number of firms

Fast market growth

(industry in apps segment)

Similar cost structure

Low switching cost

Low diversity within rivals

DETERMINANTS OF BUYER POWER: HIGH

Many substitute available

Switching cost is cheap

DETERMINANTS OF SUBSTITUTES THREAT : HIGH

High buyer inclination to substitute

(Strong public transportation system/taxi/car-sharing…)

Price elasticity is high

[DRIVER] DETERMINANTS of SUPPLIER POWER: LOW

Many competitive suppliers

Low bargaining power

Low impact of input on cost

[Others] DETERMINANTS of SUPPLIER POWER: MED

Navigation or Background check companies

[Porter’s five forces analysis]](https://image.slidesharecdn.com/uberfinalcenturygothicfont-150323091517-conversion-gate01/85/UBER-Strategy-15-320.jpg)

![[Three big challenges & Group suggestions]

Regulations1 Imitators2 New Technology3

Challenges

• Current law systems says

UBER is illegal in most

cities (No licensed drivers)

• Total or partial prohibition

of the services and

advertising, fines,

confiscations of cars and

other penalties

• Basically anyone with a

car and a driver’s license

could be a competitor

• There are many

companies operating in

very similar ways as UBER

(e.g. LYFT and Sidecar)

• New disruptive

technology

• New business model

• Driverless cars

Suggestions

• Establishing better and

earlier relationships with

government

• Pushing drivers to obtain

such permits by

themselves

• “Too big to fail” strategy

• Reinforce safety system

& Improve PR

• Lock-in strategy through

Google synergy (e.g.

maps)

& UBER brand synergy

• Retain critical mass and

achieve economy of

scale

• Leverage big data

• Partnership/Acquisition

of technology

companies

(Leverage Google)

• Invest R&D](https://image.slidesharecdn.com/uberfinalcenturygothicfont-150323091517-conversion-gate01/85/UBER-Strategy-17-320.jpg)