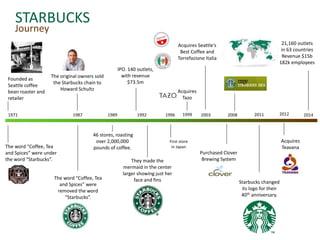

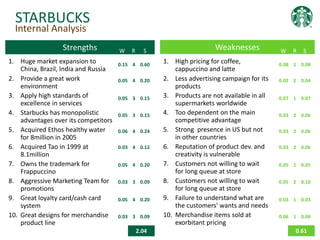

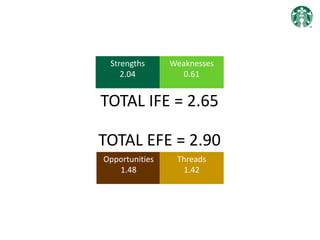

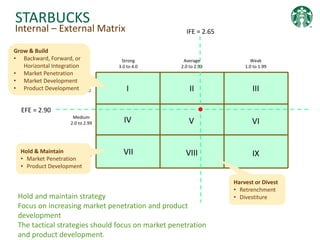

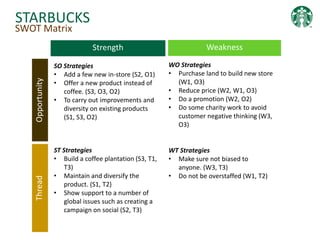

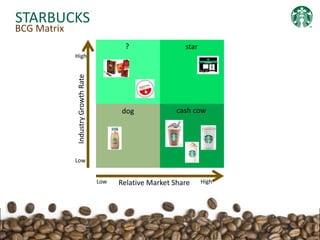

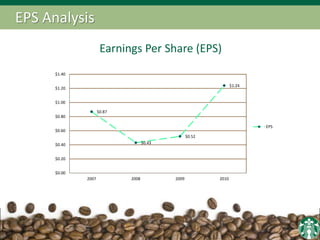

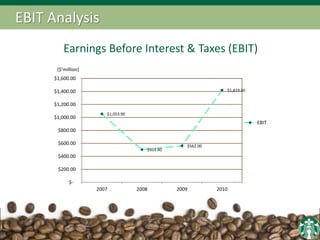

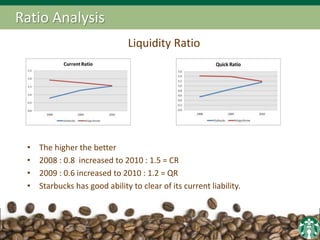

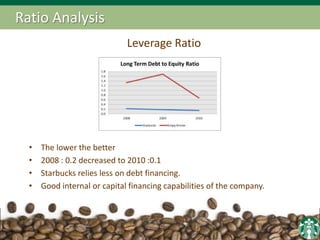

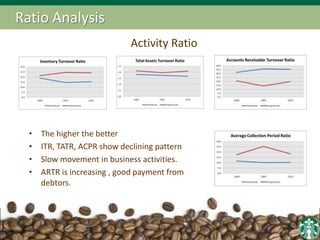

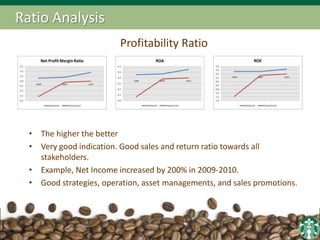

Starbucks has grown from a single coffee shop in 1971 to over 21,000 stores globally. The case study analyzes Starbucks' strategy and performance. It finds that Starbucks has strong brand image and market share but also faces threats from increasing competition and rising costs. The recommendation is for Starbucks to reduce prices through cheaper coffee beans and special promotions to boost sales while pursuing a focus-based strategy with advertising on the internet and events. Financial analysis shows growing earnings per share and operating income from 2007-2010, with good liquidity and profitability ratios, though activity ratios indicate slowing business activities.