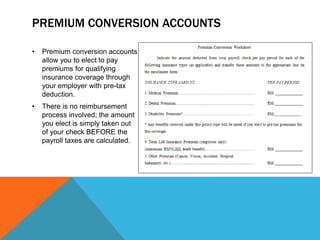

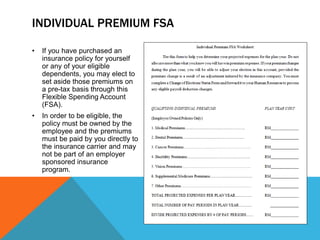

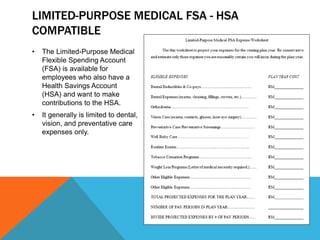

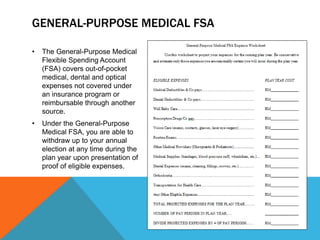

The document discusses flexible benefits plans including premium conversion accounts, individual premium FSAs, limited-purpose medical FSAs that are HSA compatible, and general-purpose medical FSAs. It provides details on how much money will come out of paychecks for participating, when elections must be made, who is covered, account changes, reimbursements, and compatible tax credits. Flexible benefit plans allow pre-tax payroll deductions for insurance and medical expenses to increase spendable income while reducing taxes.