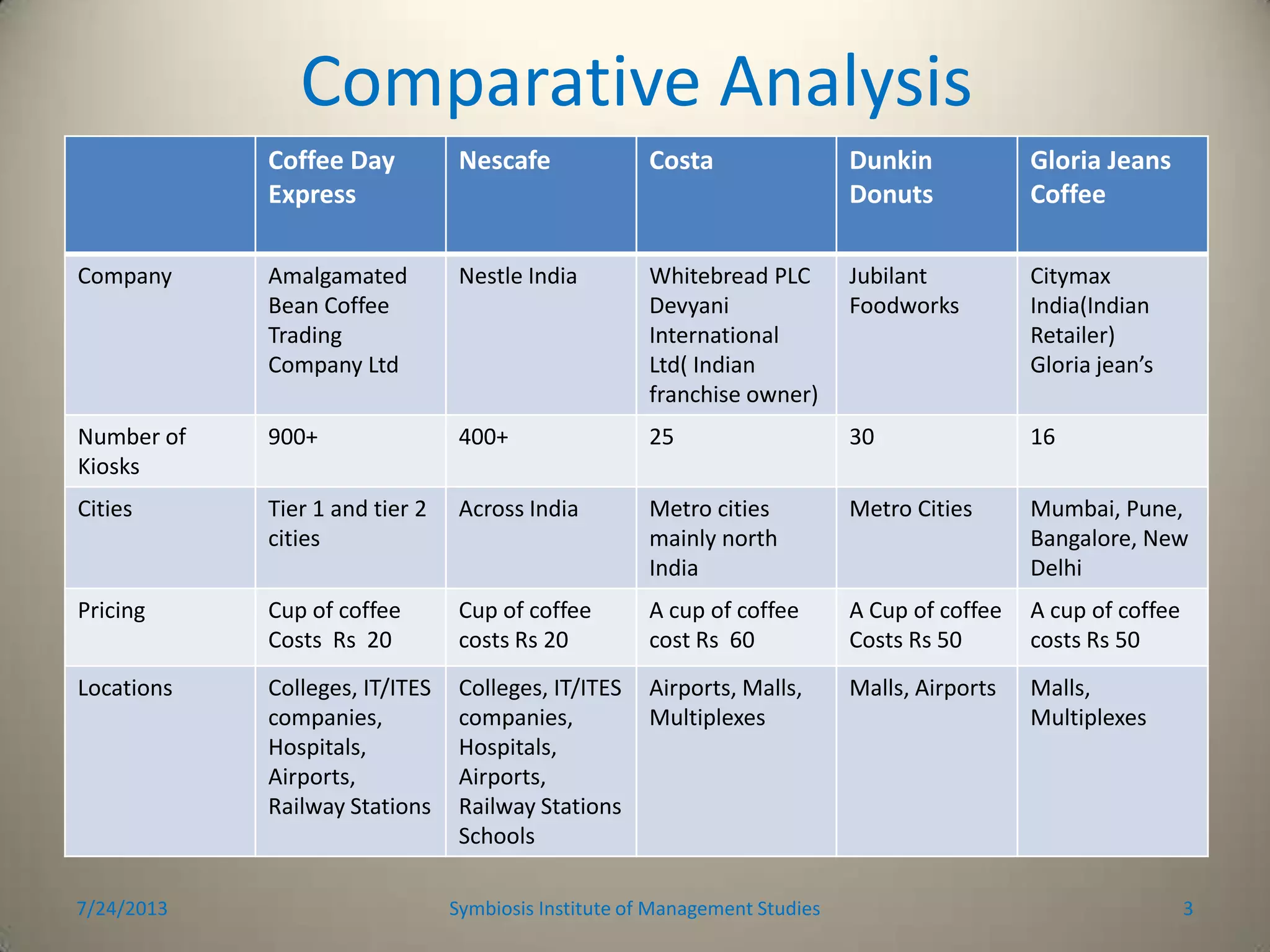

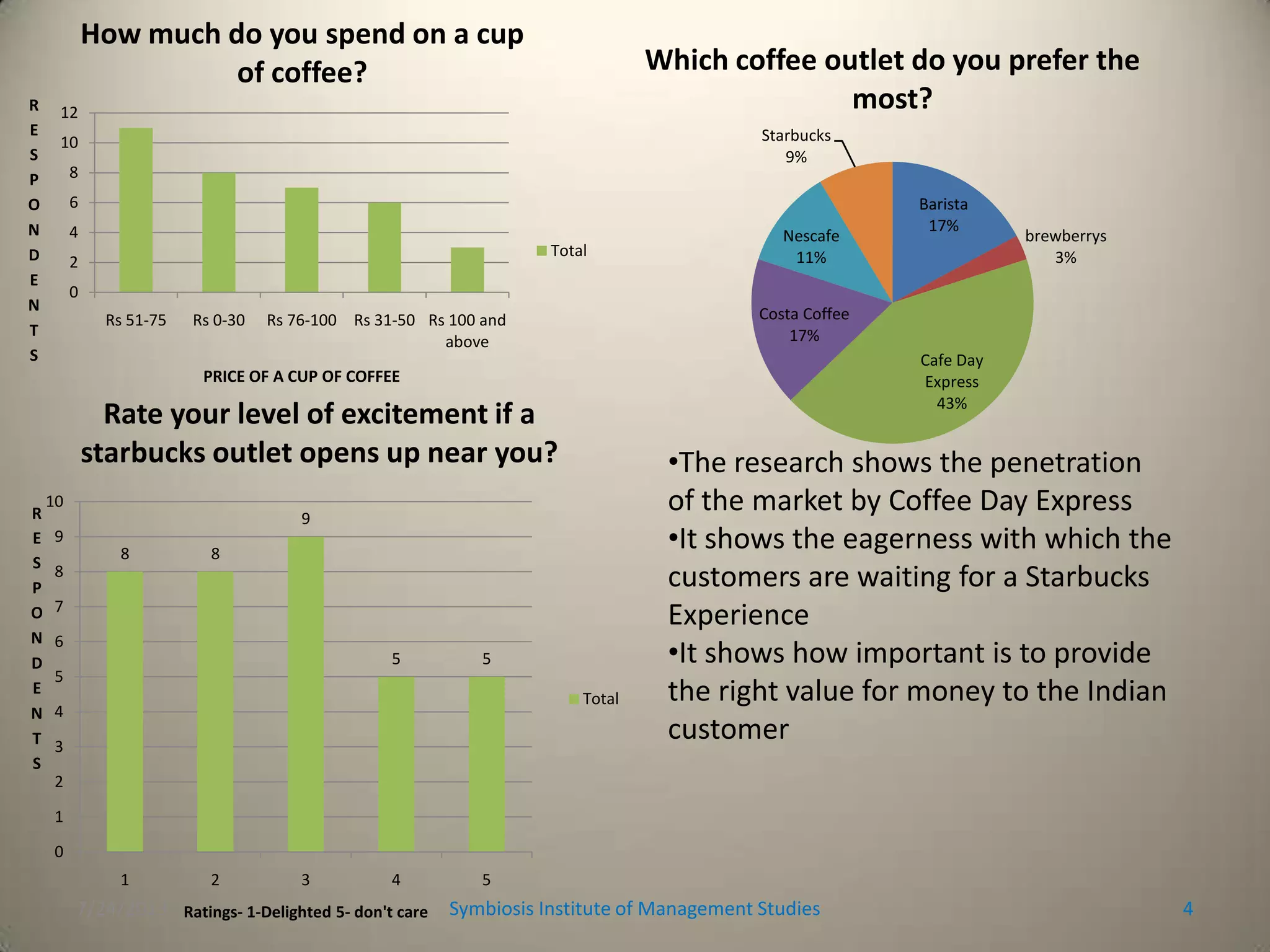

Tata Starbucks wants to open coffee kiosks in India to capitalize on the growing coffee market. Coffee consumption in India is rising as the middle class embraces cafe culture. While Coffee Day Express dominates the market, consumers show strong interest in Starbucks and are waiting for it to open. Starbucks' kiosks will target younger urban professionals and focus on quality, experience, and competitive pricing between Rs 50-75 per cup. Flagship kiosks will be located in high footfall malls in major cities to establish the brand. Starbucks must position itself well and target tier 2 cities to expand its presence beyond competitors in India's growing but tea-focused market.